Real Examples

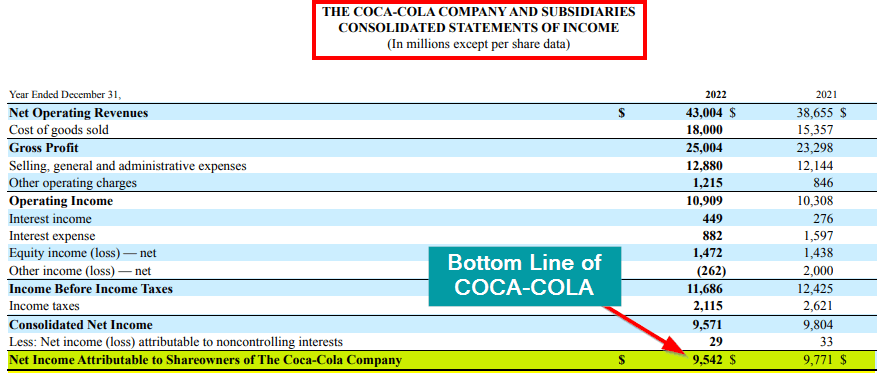

#1: The Coca-Cola Company

Let us take the example of the Coca-Cola Company. On its income statement for FY 2021 and 2022, Coca-Cola’s net income (bottom line) was $9,771 million and $9,542, respectively. It shows a decline of -2.3%, meaning there was a decrease in net income for Coca-Cola.

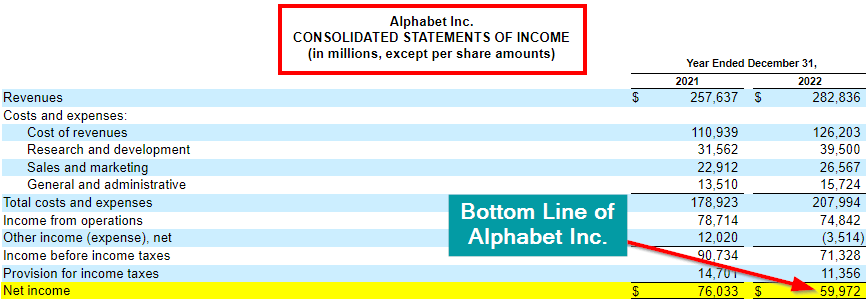

#2: Alphabet Inc.

If we look at the income statement for Alphabet Inc (Google), we can see that the company had a net profit of $59,972 million in 2022. However, it decreased from the previous year’s net income of $76,033 million. It means the bottom line growth for Alphabet Inc. was negative.

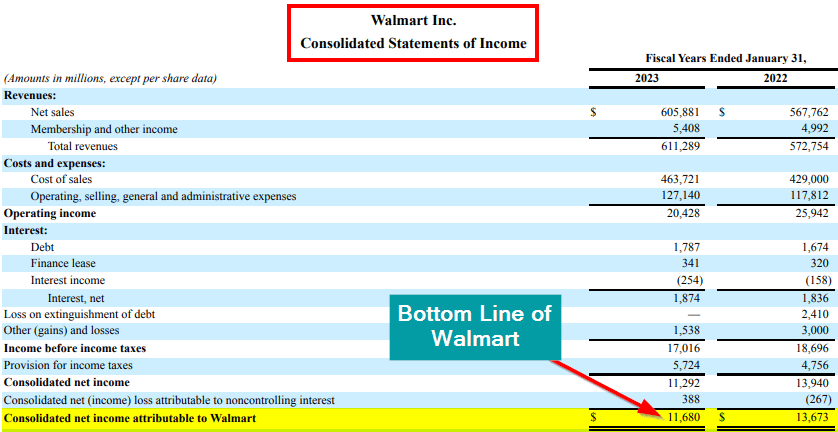

#3: Walmart Inc.

Looking at the image below, we can compare Walmart Inc’s net income for 2022 and 2023 and see that there has been a decline in the value from $13,673 million in 2022 to $11,680 in 2023.

Accounting Examples

Let us see how to calculate the bottom line using simple examples.

Example #1

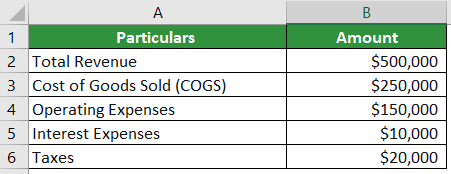

Imagine you are a financial analyst, and you have to evaluate the financial performance of a small retail business. To assess the business’s overall financial health, you must calculate its bottom line. You have the following financial data for the company.

Given:

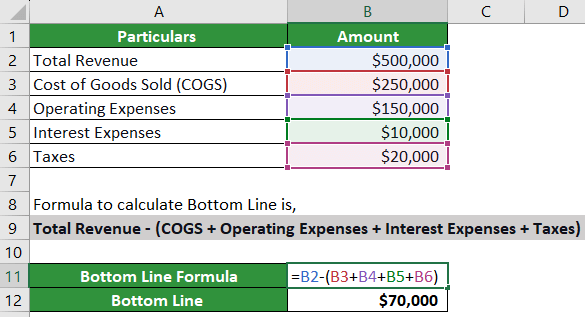

Solution:

To calculate it, you would subtract all expenses and taxes from total revenue.

Bottom Line = Total Revenue – (COGS + Operating Expenses + Interest Expenses + Taxes)

=$500,000 – ($250,000 + $150,000 + $10,000 + $20,000)

=$500,000 – $430,000

= $70,000

So, the company’s net profit is $70,000.

Example #2

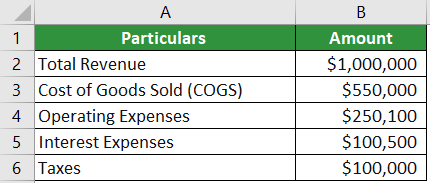

Let’s imagine you are a financial analyst of a Technology Company and asked to evaluate the financial performance of the same. To assess the business’s overall financial health, you need to calculate its bottom line. You have the following financial data for the company:

Let us use the below formula,

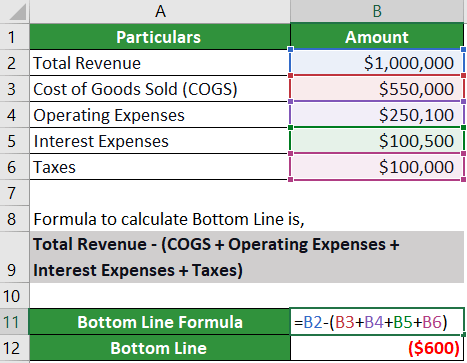

Bottom Line = Total Revenue – (COGS + Operating Expenses + Interest Expenses + Taxes)

= $1,000,000 -($550000+$250100+$100500+100000)

= $1,000,000 – $1,000,600

= -$600

The bottom line for the small retail business is -$600. This means that the business incurred a net loss of $600 during the specified period.

Frequently Asked Questions (FAQs)

Q1. Why is the bottom line important?

Answer: The bottom line is a crucial metric for several reasons, such as financial analysis, decision-making, etc. Investors can analyze a business’s net profit/loss to evaluate its financial position and make investment decisions. On the other hand, businesses can assess their own net income to check their profitability and make better business decisions.

Q2. What are some techniques to improve the bottom line?

Answer: The best way to improve the bottom line of a business is to either increase profits or reduce expenses. The company can use financial management to create robust budgets and identify areas where they can cut expenses. They can also optimize their business processes to eliminate unnecessary costs and increase efficiency. Apart from this, they should also focus on debt management.

Another option is to use pricing strategies and product diversification to improve sales and profits. They can also consider expanding their business operations to other markets.

Q3. Can a company have a positive top line but a negative bottom line?

Answer: Yes, a company can have a positive top line (revenue) but a negative bottom line (net loss). This occurs when a company’s expenses exceed its revenue, resulting in a financial loss.