Updated July 25, 2023

Break-Even Sales Formula (Table of Contents)

What is the Break-Even Sales Formula?

The term “break-even sales” refers to the sales value at which a company earns no profit no loss. In other words, the break-even sales are the dollar amount of revenue that precisely covers the fixed expenses and the variable expenses of a business.

The formula for break-even sales can be derived by dividing a company’s fixed costs by its contribution margin percentage. Mathematically, it is represented as,

The contribution margin percentage can be computed by dividing the difference between the sales and the variable costs by the sales and expressed in percentage. Mathematically it is represented as,

Therefore, the formula for break-even sales can be combined as,

Examples of Break-Even Sales Formula (With Excel Template)

Let’s take an example to understand the calculation of Break-Even Sales in a better manner.

Break-Even Sales Formula – Example #1

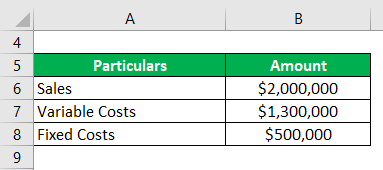

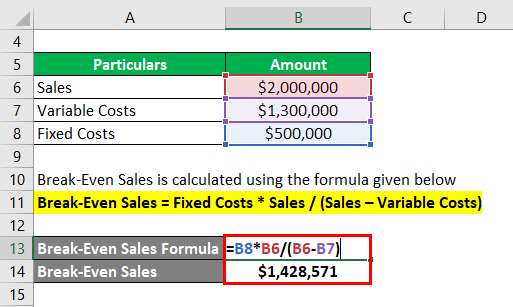

Let us take the example of a company that is engaged in the business of leather shoe manufacturing. According to the cost accountant, last year, the total variable costs incurred added up to $1,300,000 on a sales revenue of $2,000,000. Calculate the break-even sales for the company if the fixed cost incurred during the year stood at $500,000.

Solution:

The calculation of break-even sales is performed using the following formula:

Break-Even Sales = Fixed Costs * Sales / (Sales – Variable Costs)

- Break-Even Sales = $500,000 * $2,000,000 / ($2,000,000 – $1,300,000)

- Break-Even Sales = $1,428,571

Therefore, the company has to achieve minimum sales of $1.43 million to break even at the current mix of fixed and variable costs.

Break-Even Sales Formula – Example #2

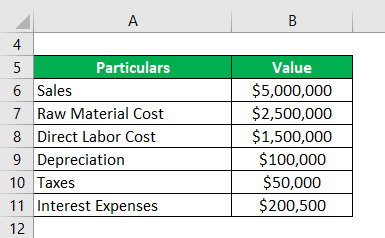

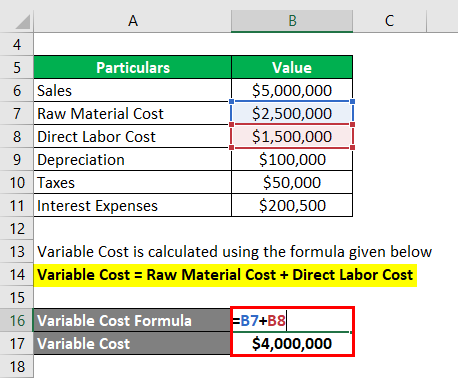

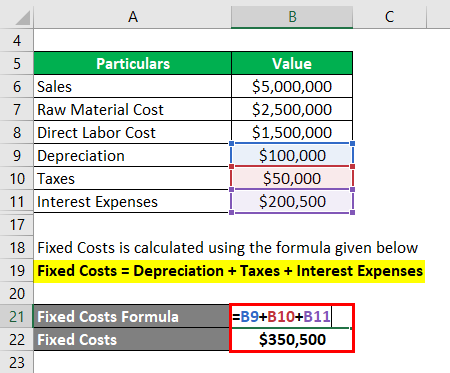

Let us take the example of another company, ASD Ltd. engaged in pizza selling that generated sales of $5,000,000 during the year. The company incurred a raw material cost of $2,500,000 and a direct labor cost of $1,500,000. On the other hand, periodic costs such as depreciation, taxes, and interest expenses stood at $100,000, $50,000, and $200,500, respectively. Calculate the break-even sales of ASD Ltd. based on the given information.

Solution:

The formula used to calculate the variable cost is as follows:

Variable Cost = Raw Material Cost + Direct Labor Cost

- Variable Cost = $2,500,000 + $1,500,000

- Variable Cost = $4,000,000

Fixed Costs are calculated using the formula given below

Fixed Costs = Depreciation + Taxes + Interest Expenses

- Fixed Costs = $100,000 + $50,000 + $200,500

- Fixed Costs = $350,500

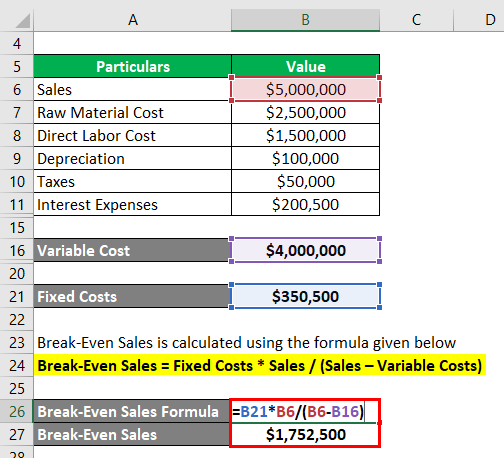

The formula used to calculate break-even sales is as follows:

Break-Even Sales = Fixed Costs * Sales / (Sales – Variable Costs)

- Break-Even Sales = $350,500 * $5,000,000 / ($5,000,000 – $4,000,000)

- Break-Even Sales = $1,752,500

Therefore, to break even, ASD Ltd. has to achieve minimum sales of $1.75 million.

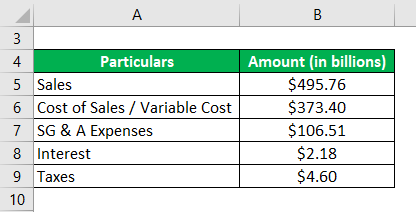

Break-Even Sales Formula – Example #3

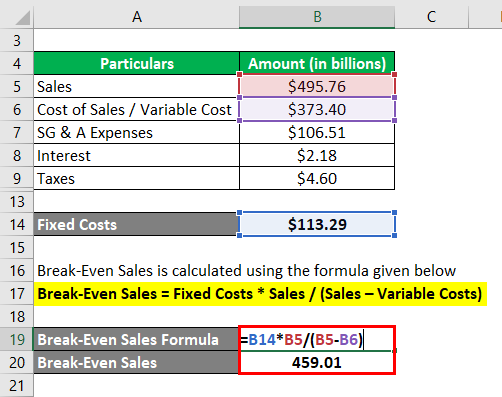

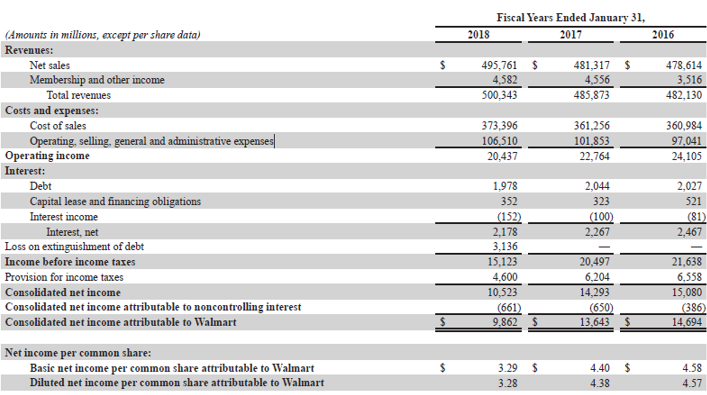

Let us take the example of Walmart’s annual report for the year 2018. According to the annual report, the following information is available, Calculate the break-even sales of Walmart Inc. for the year 2018.

Solution:

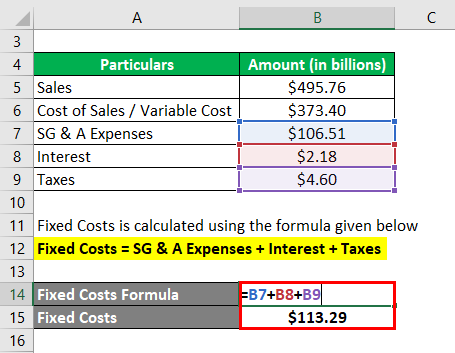

The formula used to calculate fixed costs is as follows:

Fixed Costs = SG & A Expenses + Interest + Taxes

- Fixed Costs = $106.51 Bn + $2.18 Bn + $4.60 Bn

- Fixed Costs = $113.29 Bn

The calculation of Break-Even Sales utilizes the following formula:

Break-Even Sales = Fixed Costs * Sales / (Sales – Variable Costs)

- Break-Even Sales = $113.29 * $495.76 / ($495.76 – $373.40)

- Break-Even Sales = $459.01 Bn

Therefore, Walmart’s break-even sales for the year 2018 are $459.01 billion.

Source: Walmart Annual Reports (Investor Relations)

Explanation

To derive the formula for break-even sales, you can follow these steps:

Step 1: Firstly, determine the subject company’s variable production costs. Typically, variable costs directly vary with the change in production level or sales volume. Examples of variable costs are raw materials, fuel, direct labor, etc.

Step 2: Next, determine the fixed costs of production, which include those types of costs that are periodic in nature and, as such, do not change with the change in the production level. Examples of fixed costs are management salaries, depreciation, interest, taxes, and rental expenses.

Step 3: Next, determine the total sales of the company during a specific period of time, half-yearly or annually, etc.

Step 4: Next, calculate the contribution margin percentage by dividing the difference between the sales (step 3) and the variable costs (step 1) by the sales. Break-even sales express themselves in terms of a percentage.

Contribution Margin Percentage = (Sales – Variable Costs) / Sales * 100%

Step 5: Finally, the formula for break-even sales can be derived by dividing the fixed costs (step 2) of a company by the contribution margin percentage (step 4) as shown below,

Break-Even Sales = Fixed Costs / Contribution Margin Percentage

or

Break-Even Sales = Fixed Costs * Sales / (Sales – Variable Costs)

Relevance and Use of Break-Even Sales Formula

Understanding the concept of break-even sales holds significant importance as it plays a predominant role in determining the minimum sales required to achieve a situation of no profit and no loss. It finds widespread utilization in the early stages of a new business or product line, enabling the formulation of a clear plan and identification of key risks associated with attaining the desired profitability.

Break-Even Sales Formula Calculator

You can use the following Break-Even Sales Formula Calculator

| Fixed Costs | |

| Sales | |

| Variable Costs | |

| Break-Even Sales | |

| Break-Even Sales = |

|

|

Recommended Articles

This is a guide to Break-Even Sales Formula. Here we discuss how to calculate Break-Even Sales along with practical examples. We also provide a Break-Even Sales calculator with a downloadable Excel template. You may also look at the following articles to learn more –