Updated July 13, 2023

Definition of Bridge Loan

The term “bridge loan” refers to a form of financing that borrowers use to meet short-term liquidity mismatch before securing a stable form. In other words, it is temporary support when there is an immediate requirement, but a permanent form of funding is not yet available.

Given their inherent nature, bridge loans command relatively higher interest rates and are usually backed by some collateral, such as inventory or real estate. Both individuals and companies can receive a bridge loan, also known as gap financing, interim financing, or swing loan.

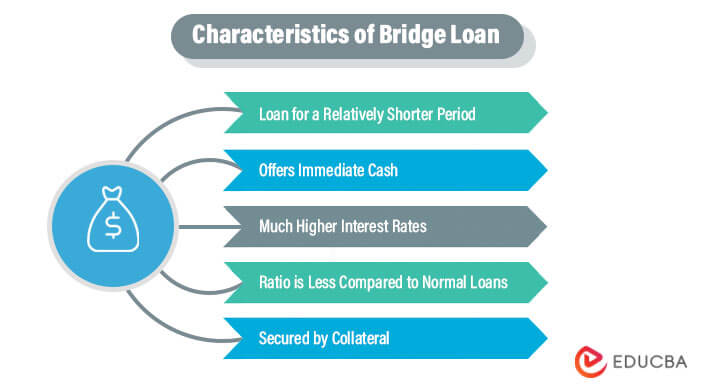

Characteristics of Bridge Loan

The key characteristics of a typical bridge loan are as follows:

- First, it is a loan for a relatively shorter period, which varies from 3 to 12 months.

- Its objective is to offer immediate cash until the borrower secures a permanent form of financing.

- It charges much higher interest rates compared to ordinary loans owing to inherent risks and its short-term nature.

- Its LTV (loan-to-value) ratio is less compared to normal loans. For example, the LTV ratio may go up to 65% for commercial property, while for residential property, it may go up to 80%.

- It is usually secured by collateral, which can be property in the case of individuals and inventory or real estate in the case of companies.

How Does a Bridge Loan Work?

It bridges the funding gap when the permanent funding is yet to kick in, but the financing requirement is immediate. For instance, it can be used by a homeowner buying a new home while he/ she is awaiting cash inflow from the sale of the current home. The homeowner uses the equity in the current home to cover the down payment on the new home purchase. In this way, the homeowner buys himself/ herself some extra time while the sale transaction of the current home gets closed. The lenders usually customize these types of loans per borrowers’ funding requirements.

Examples of Bridge Loan

Below are the different examples with explanations:

Example #1

Let us take the example of David, who plans to purchase a new property by selling his current house. However, it might take him around 6 months to sell the current house. He feels that the deal he is getting for the new home is the best in the current market scenario and hence doesn’t want to let it slip away. The market price of the current house is $1,000,000, and there is no mortgage against it, while the new home’s purchase price is $900,000.

In this case, David can get a bridge loan of $720,000 (= maximum LTV of 80% of $900,000) and purchase the new home. He can later repay the bridge loan and pay the associated interest when selling his current house. In this way, David can use the bridge loan to meet the short-term funding requirement.

Example #2

Take another example of a company named XYZ Inc. planning to set up a new manufacturing plant worth $20,000,000. The company intends to raise funds by issuing corporate bonds, which may take 4-6 months. But it feels that it currently has the best deal for the plant location, and hence it doesn’t want to wait until the issuance of the corporate bonds.

In this case, the company can take a bridge loan of up to $13,000,000 (= maximum LTV of 65% of $20,000,000) and start the construction without delay. It can repay the loan 6 months after raising funds through bond issuance. This is how it works in the case of corporates.

Interest Rate of Bridge Loan

A bridge loan is very costly due to high-interest rates and related fees, such as front-end charges, administration fees, title fees, appraisal fees, valuation payments, lender legal fees, etc. The fees vary depending on the lender, location, and perceived risk. Invariably, the fees for a bridge loan will be more than a standard loan’s.

Benefits

- It provides immediate access to funds, which can help mitigate opportunity costs.

- It plugs in the liquidity gap when it is needed the most.

- It provides flexibility and gives more time for securing permanent funding.

- If repaid on or before time, it can help improve credit ratings.

Disadvantages

- It is very expensive, especially for small businesses and individuals.

- If the associated source of permanent funding fails to materialize due to unexpected events, the bridge loan might end up as a bad loan (default).

- A default on a bridge loan could force the lender to foreclose on a given property, leaving the borrower in even more financial distress.

- The borrower needs a high credit rating to get a bridge loan. The inability to repay the loan on time would adversely affect the credit rating.

Key Takeaways

- It is a form of short-term financing that an individual or a company uses until it secures permanent financing.

- These types of loans are very costly owing to high-interest rates.

- Typically, these loans are used for funding real estate investments.

- It is a source of immediate funds that helps mitigate opportunity costs.

- In the case of a default, the borrower might end up in even more financial distress.

Conclusion

So, it can be seen that a bridge loan can be an excellent funding source funds if things run as planned. However, in case of an unfortunate event, it can easily turn into a poor choice. Hence, the borrower should evaluate all the possible events before entering into a bridge loan.

Recommended Articles

This is a guide to Bridge Loans. Here we also discuss the definitions, working, and examples of Bridge Loans along with the benefits and disadvantages. You may also have a look at the following articles to learn more –