Bridging Loans for Property Renovation: Overview

When it comes to property development and resale, securing fast financing is crucial to seize profitable opportunities. One of the most effective solutions is bridging loans for property renovation, which provide quick access to funds. These short-term loans enable property developers and investors to purchase and renovate properties without delays, making them an essential tool in competitive real estate markets.

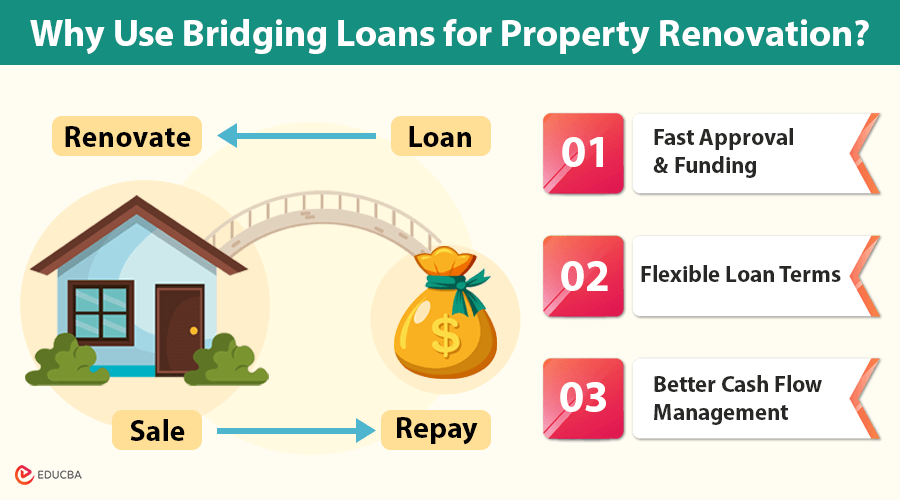

Why Use Bridging Loans for Property Renovation?

Many investors choose bridging loans because they offer:

- Fast Approval & Funding: Traditional loans have lengthy processing times, but bridging loans can be arranged quickly, helping investors secure properties before competitors.

- Flexible Loan Terms: These loans are appropriate for various projects since lenders design them to pay both the purchase price and renovation expenses.

- Better Cash Flow Management: By securing funds upfront, developers can complete renovations efficiently without financial strain.

Strategic Utilization in Property Flipping

For property investors engaged in ‘flipping’—buying, renovating, and selling properties at a profit—bridging loans serve as an invaluable financial tool. Many properties in need of renovations do not qualify for traditional mortgages due to their condition, allowing investors to undertake necessary renovations and position the properties for profitable resale.

Considerations and Risk Management

While bridging loans for property development offer many benefits, it is also essential to consider the risks:

- Higher Interest Rates: Bridging loans usually carry higher interest rates compared to standard mortgages because they are short-term loans.

- Clear Exit Strategy Required: Lenders often require a detailed repayment plan, such as selling the renovated property or refinancing it with a long-term mortgage.

- Financial Analysis is Crucial: Investors must ensure the projected property resale value justifies the loan costs before taking a bridging loan.

Alternative Financing Options

While bridging loans are a great solution for quick capital, developers should also consider alternative financing options:

- HELOCs (Home Equity Loans and Lines of Credit): Homeowners can borrow against their property’s equity, often at lower interest rates. However, approval may take longer, making them less suitable for quick purchases.

- Personal Loans: Unsecured personal loans are available for home improvements and often have faster approval times. However, they usually have higher interest rates and lower borrowing limits than secured loans.

- Cash-Out Refinancing: This involves refinancing an existing mortgage to access additional funds for renovations. While it can provide substantial capital, the process can be time-consuming, and the property must have sufficient equity.

Final Thoughts

For property investors looking to renovate and resell properties, bridging loans for property renovation provide a fast and flexible financing option. They enable quick purchases, cover renovation costs, and support profitable property flips. However, careful financial planning, risk assessment, and a solid exit strategy are essential for successful project completion.

Recommended Articles

We hope this guide on bridging loans for property renovation helps you navigate financing options for your renovation project. Check out these recommended articles for more insights on property investment and financial planning.