Updated July 7, 2023

What is the Budget Deficit?

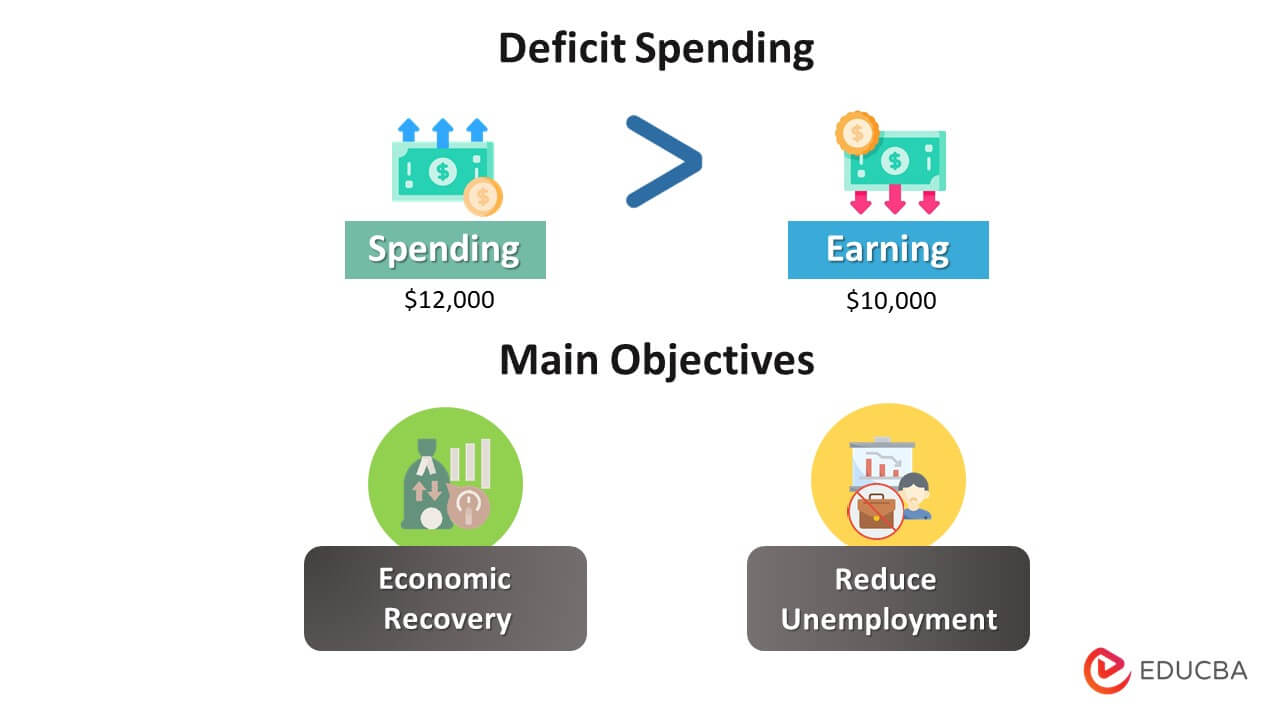

The budget deficit happens when the government expenditure exceeds its generated revenue and collected taxes. In short, revenue generation + taxes < expenditure.

For example, Steve has a departmental store. The monthly sales of the stores are $1000. However, after paying out employees’ salaries, Steve has to pay taxes and purchase raw materials that exceed his monthly income. He is running on a budget deficit, which indicates his financial health.

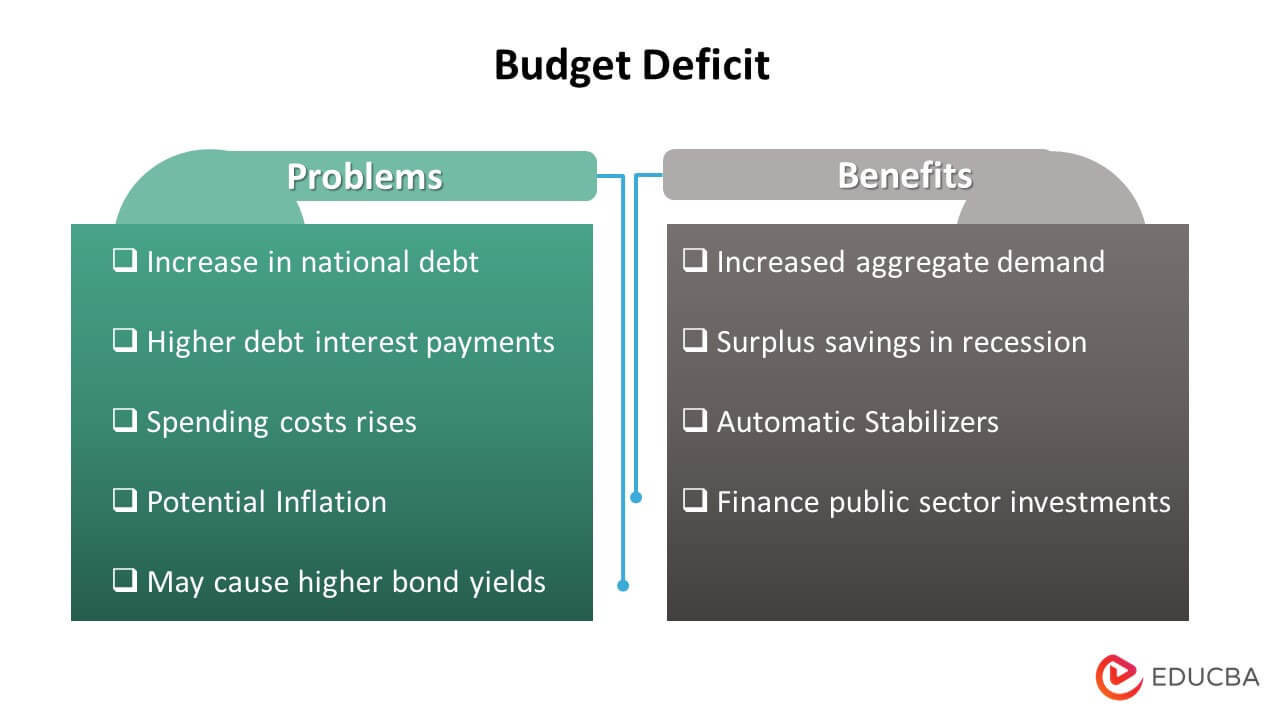

It happens in the public and private sectors but is mostly used for government spending rather than the private landscape. It indicates the health of the economy and has a direct influence on national debts. The national debt is a prime indicator of annual budget deficits and the cumulative total a country owes to creditors.

Key Highlights

- The Budget Deficit occurs when the government spends more than it gets as revenue, including direct or indirect taxes.

- Countries can reduce it by raising taxes and slashing spending.

- The policy changes under the monetary and fiscal policies affect it.

Budget Deficit Formula

The government’s total income consists of company tax, personal taxes, stamp fees, etc.

The total expenditure includes social security, healthcare, energy, research, and defense payments.

Examples of Budget Deficit

Example #1

The US government decided to increase its revenue collections in the year 2019. However, Covid-19 created chaos in the country. A large chunk of the population was out of work. As a result, the US government decided to launch social security schemes for the affected. Through the schemes, the government planned to spend $350 billion on the beneficiary’s scheme. However, the current financial cycle expenditure exceeded the revenue, including collecting taxes. This resulted in a state of Budget Deficit.

Example #2

The national budget of the US government is deemed to be 2 Trillion US dollars. However, New York and California states have come up with new Universities that would need funding. The Department of Education allocated $637.70 billion among its 10 sub-components to fund educational programs in FY 2022. If the government plans to spend more on the educational space, it will create a budget deficit because the expenditure exceeds its revenue potential.

Example #3

John owns and founded a small, newly established company that produces handmade goods. He decided to buy a factory and other essentials to expand his business. In addition, he was responsible for both hiring and paying the workers. The business made a $200,000 budget surplus in the first year. However, the economy entered a recession the next year, which prevented his firm from growing and only allowed him to sell handicrafts worth $400,000 that year. On the other side, the cost increased to $ 900,000. Now, his business had a $500,000 budget deficit ($900,000 – $400,000).

Causes of Budget Deficit

The levels of taxation and the nature of spending are the key variables that impact the budget cycle.

However, there are prime scenarios that can affect it:

- The disparity between the taxpayers belonging to the higher income and lower income potential

- An exponential increase in spending concerning social security, healthcare, and medical Operandi

- Increased government welfare to target the needed industries

- Tax slash decreases government revenue but increases spending in corporations that would need funds as a corporate social responsibility.

- Lower GDP results in lower tax revenues.

How to Reduce Budget Deficits?

- Countries tackle it by boosting economic growth through changing fiscal policies, such as slashing government spending and increasing tax revenues. It also determines a planning strategy concerning the potential spending to cut or to look at potential taxation avenues to increase.

- To pay for the government’s external military operations, the government borrows money by selling bonds. This increases the risk of currency devaluation, which can harm economic health.

- Reduced regulations and lower corporate income taxes improve business confidence, stimulate further employment, and promote economic growth leading to higher taxable profits and an increase in income tax revenue.

Implications of Budget Deficit

- Increased aggregate demand: It implies reduced taxation and increased government spending. It has an impact on the aggregate demand that promotes economic growth.

- Boost the economy during the recession: Following a recession, the economy tends to foster a marginal decrease in investment spending concerning the private sector, coupled with lower aggregate consumption and demand. A government might borrow and run a deficit to combat the situation.

- Increased government spending: The government has responsibilities to take care of. It spends money on infrastructure, health care, policy developments, and social security schemes and focuses on stabilizing market dominance. It spends more than it earns.

- Fiscal Policy: It may finance an expansionary fiscal policy, which involves lowering income and corporate taxes and increasing government spending on infrastructure and investments to attract foreign capital and boost economic growth.

- Higher taxes in return: When the country goes through it, increasing taxation can help it earn more revenues through direct and indirect taxes. The tax slabs are increased to increase investment returns by spotting the market value in general.

- Higher interest rates and bond yields: To borrow large amounts, governments often offer higher interest rates to investors and international banks that lend them money. Increased government borrowing results in higher interest rates and bond yields since investors and banks require compensation for the risk through interest payments.

Budget Deficit V/S Fiscal Deficit

|

Budget Deficit |

Fiscal Deficit |

| It is the gap between the government’s total receipts and expenses in revenue and capital accounts. | It occurs when the overall expenditures of a government surpass the total revenue generated, excluding money borrowed. |

| When a business or government doesn’t make enough money to pay its bills, this situation arises. | It occurs either due to a revenue deficit or a major hike in capital expenditure, including long-term assets such as factories, buildings, and other development. |

| Tax increases for high incomes or big businesses may be implemented to boost revenue, limiting their capacity to invest in new initiatives or recruit new staff. | It is an indication of the total borrowings needed by the government. |

Budget Deficit During a Recession

- If the economy enters a recession, taxes will fall as income and employment fall.

- At the same time, government spending will increase as people are given unemployment compensation and other transfers such as welfare payments.

- Such automatic changes in revenue and expenditures work to increase the deficit.

- They also work to mitigate the decrease in disposable income that households are experiencing. This maintains consumption at a higher level than would otherwise be the case.

Frequently Asked Questions(FAQs)

Q1. What is the difference between Budget Deficit and a Monetary Deficit?

Answer: The Budget Deficit considers the expenditure and spending, including taxes, while the monetary deficit is accessed based on the per-capita income of the population.

Q2. How is the Budget Deficit assessed during recessions?

Answer: If the economy enters a recession, taxes will fall as income and employment fall. At the same time, government spending will increase as people are given unemployment benefits.

Q3. How to reduce Budget Deficits?

Answer: Countries reduce their budget deficits by fostering economic growth by altering their fiscal policies, such as cutting expenditures and raising taxes. Additionally, it establishes a planning framework for any potential budget reductions or increased taxation.

Q4. What is the difference between the Federal Budget Deficit and the Federal Government Debt?

Answer: When government expenditure exceeds its income from taxes, charges, and investments, it results in a federal budget deficit. The national debt, or federal government debt, is increased via deficits. The debt-to-GDP ratio may skyrocket if government debt increases more quickly than the GDP, which could signal an unstable economy.

Recommended Articles

This article is a guide to the budget deficit. We discuss its definition, causes, implications, and more. Read the following articles to learn more,