Budget in Excel (Table of Contents)

Introduction to Budget in Excel

Budget in Excel or budget planning helps you to keep your finances in check, i.e. spending and earnings. The budget planner is essential to track your monthly income and expenses. In addition, it will help you to spend the right expense items at the right ratios when you are in debt-ridden or financial difficulty.

A budget estimates revenue or income and expenditure or expense for a particular set of periods. The budget planner analyzes your spending habits. Many templates are available in Excel, but it is always better to make your own. Also, it is always better to document your expenses; they may be Fixed and Variable Expenses.

- Fixed Expenses: Monthly Loan amounts (car, home, personal) & mortgage remains constant month after month, whereas,

- Variable Expenses: Groceries, Home & utilities, personal, medical expenses & entertainment fluctuate month on month & variation will be based on your spending.

Goal Settings: We can set short or long-term goals with budget planning in Excel.

You can create various types of Budget templates based on the criteria; we can choose any of the below-mentioned budget templates that fit your needs.

- Family & Household Expense Budget

- Project Budget in the organization

- Home Construction Budget when you are building a house of your own

- Wedding Budget Planner

- Academic Club Budget

- College or School Student Budget

- Retirement Budget

- Holiday & Shopping Budget when you are on vacation leave

How to Create a Family Budget Planner in Excel?

Let’s check out some examples of how to create a family budget planner in Excel.

Example of Family Budget Planner

Suppose I want to create a family budget planner. The following criteria are kept in mind while creating a budget; in the below-mentioned categories, I can add to create an Excel template of it.

You Should Know or Be Aware of Your Monthly Income or Earnings

- Your monthly take-home pay (monthly)

- Your partner’s or spouse’s take-home pay (monthly)

- Bonuses/overtime worked & payout from the company (monthly)

- Income from savings and investments made (monthly or annual)

- Family benefit payments you have received prior (monthly or annual)

- Interest Income

- Dividends

- Gifts Received

- Refunds/Reimbursements received

- Child support received

You should know or be aware of your monthly expenses or spending, which are categorized into various sections.

Home & Utilities

- Mortgage & rent

- Furniture & appliances

- House Renovations & maintenance

- Cleaning Services

- Electricity

- Gas

- Water

- Internet

- Cable

- Home phone

- Mobile

- Lawn/Garden maintenance

Insurance & Financial Section

- Car insurance

- Home Insurance

- Personal & life insurance

- Health insurance

- Paying off debt if you have taken from someone

- Savings

- Investments & super contributions (Stock market or mutual funds)

- Charity donations to save tax

- Gifts are given on any wedding or other occasions

Obligations

- Car loan

- Study Loan (Taken during graduation or postgraduation studies)

- Credit Card bills payment

- Alimony/Child Support

- Federal Taxes

- State/Local Taxes

- Legal Fees

Groceries

- Supermarket

- Fruit & veg market (Veg)

- Butcher or Fish shop (Non-veg)

- Bakery products

- Pet food, in case you own a pet

Personal & Medical Expenses

- Cosmetics & toiletries spending

- Hair & beauty products

- Medicines & Pharmacy

- Glasses & eye care

- Dental

- Doctors & medical expense

- Emergency (Any accidents you met with)

- A health club (Annual or monthly memberships & spending)

- Clothing & shoes

- Jewelry & accessories

- Computers & Gadgets

- Sports & gym

- Education

- Online or offline course fees

- Pet care & veterinary expense

Entertainment & Dine Out

- Coffee & tea

- Lunch

- Takeaway & snacks

- Cigarettes

- Drinks & Alcohol

- Bars & clubs

- Restaurants

- Books

- Newspapers & magazines

- Theater or Movies & Music

- Concerts/Plays

- Film/Photos

- Sports

- Outdoor Recreation

- Celebrations & gifts

- Club Memberships

- Videos/DVDs taken on rent or purchased

- Music

- Games

- Toys/Gadgets

Transportation Fares

- Bus & train fare

- Taxi fare

- Airfares

- Petrol

- Road tolls & parking

- Registration & license

- Vehicle Repairs & maintenance

- Fines Paid

Child Care

- Baby products

- Toys

- Play home or babysitting fare

- Childcare

- Sports & other activities

- School tuition fees

- Excursions

- School uniforms

- Other school needs

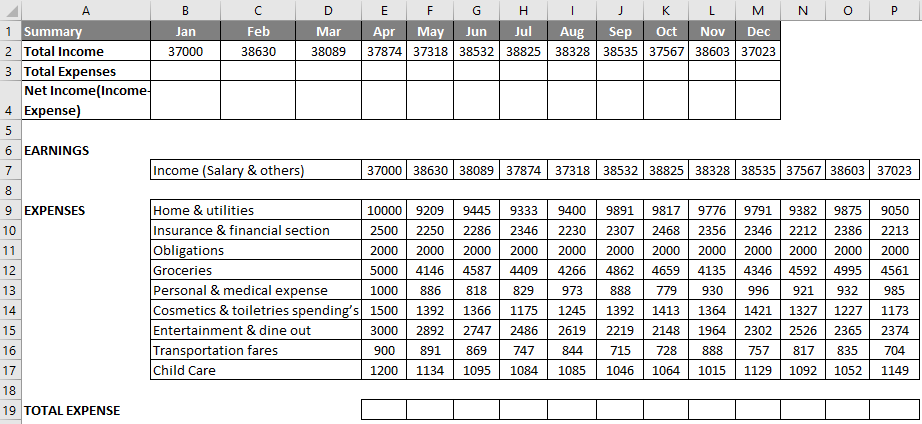

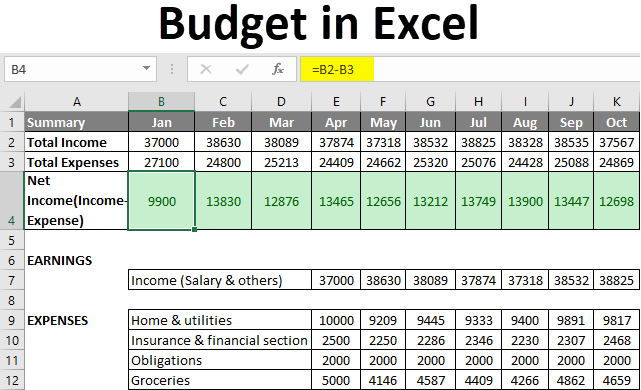

We can all add these categories in Excel; you can enter the different income and expenses categories in column B. Enter the months, i.e., Jan, into cell B1. Then, select cell B1, click the cell’s lower right corner, and drag it across to cell M1. Excel automatically adds the other months.

Simultaneously add total income and expense in cells A2 & A3 and net income OR savings in column A4. Now, enter all the income & expense data in the respective cells.

Addition of Expenses by using the Sum Function

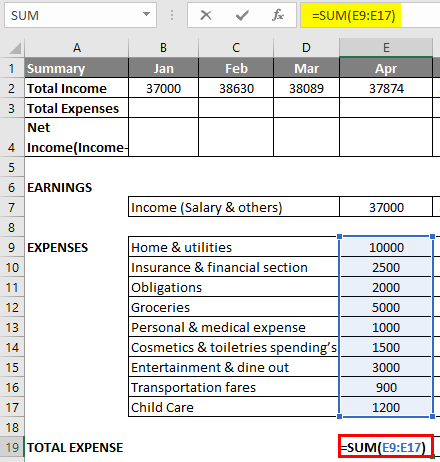

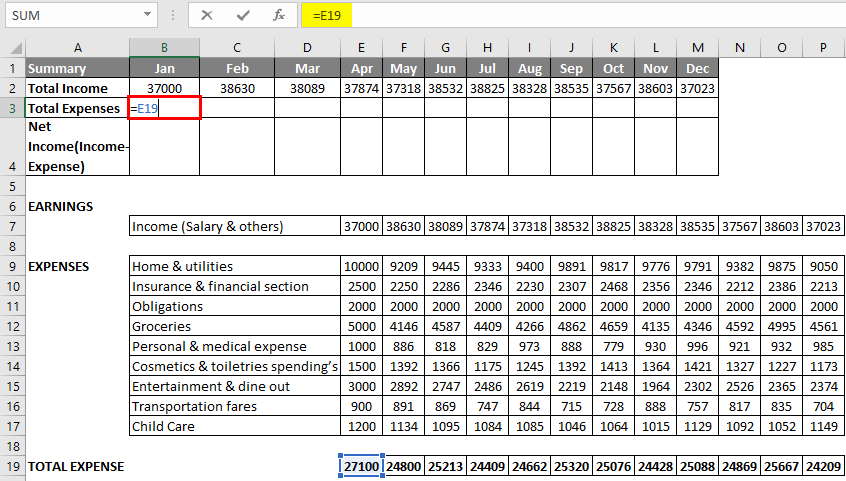

Enter the SUM function into cell E19, select cell E19, type an equal sign (=), and enter SUM (select the expense range for the month of Jan, i.e., E9: E17, close with a”)

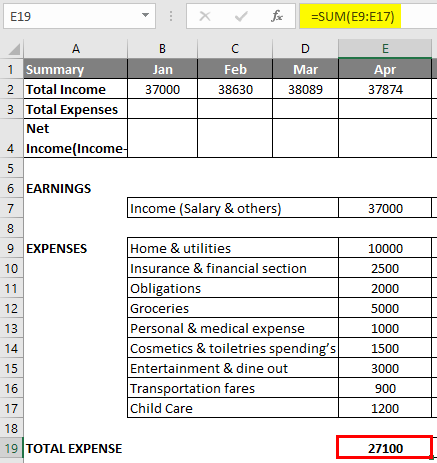

Press Enter so that it will result or gives you a total expense for that month.

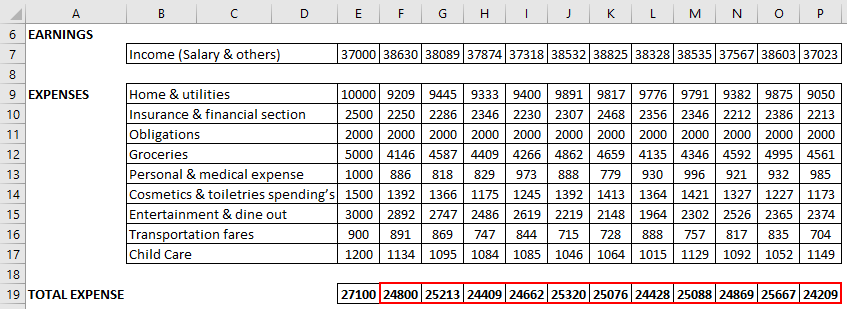

Now, simultaneously apply for other months, i.e., select cell E19, click the cell’s lower right corner, and drag it across to cell P19. Excel copies the function and border to the other cells.

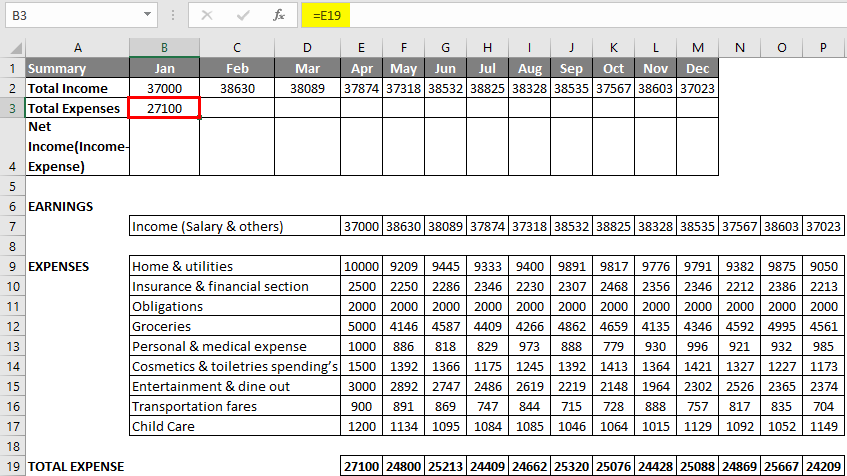

Select cell B3 and enter “=E19” as a cell reference.

Press Enter, so the result will be as shown below.

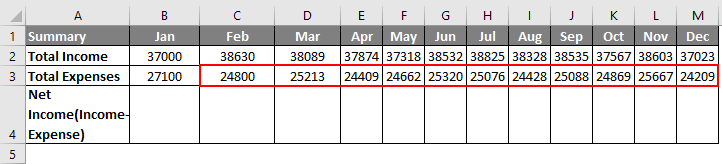

Drag it across to cell M3. Excel copies the function and border to the other cells so that you can see all the month’s total expenses.

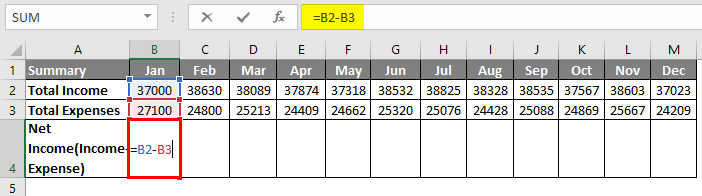

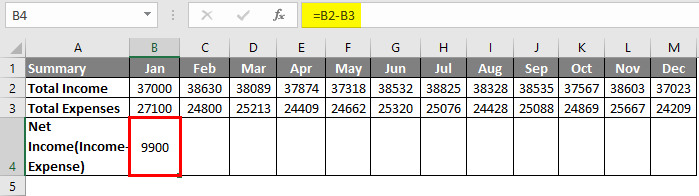

In the cell “B4”, enter the formula =B2-B3, which is Total Income – Total Expenses, which gives you net income or savings value.

Press Enter, so the result will be as shown below.

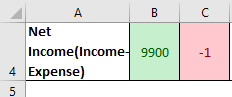

Sometimes, if an expense is more than earnings or income, the negative value appears in the net income row; therefore, we should apply conditional formatting to appear green in color, and negative values cells appear in red.

I created two conditional formatting rules to highlight cells lower than 0 and greater than 0, i.e., a complete net income row.

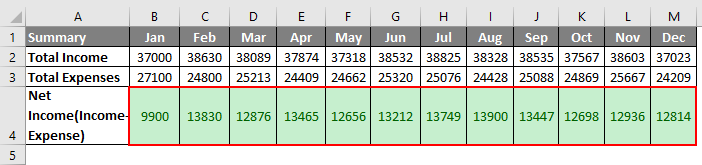

So the result will be as shown below.

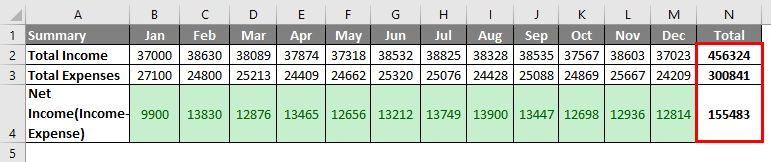

At last, you can calculate yearly income, expenses & total money saved in that year with the help of the SUM function.

Things to Remember about Budget in Excel

In any organization or company, you can create the below-mentioned type of budget planner based on different criteria, which will give a complete picture of its financial activity and health.

- Operating Budget

- Financial Budget

- Cash Flow Budget

- Static Budget

Recommended Articles

This is a guide to Budget in Excel. Here we discuss creating a Family Budget Planner in Excel, an example, and a downloadable Excel template. You may also look at the following articles to learn more –