Updated July 21, 2023

Introduction to Budgeting

The term “budgeting” refers to an organization’s strategic implementation of a scheduled business plan to achieve the desired goal of improving the current operating performance.

It involves forecasting future expenses based on the expected revenue of the company. In other words, budgeting helps in developing a comfortable future financial position by taking care of all the financial expenses.

Some of the major reasons for budgeting are as follows:

- It helps in planning for the crisis scenario such that the organization can take appropriate actions when such a situation arises

- Builds long-term rapport among departments as the process of budgeting requires the help of all the departments

- Provides a ballpark estimation to the management about the organization’s expenses for the entire period under consideration

- Helps all the teams in setting targets and goals for the period

- It can be used to compare the actual expense vis-à-vis the budgeted expense and then draw insights in case of variation

- Helps in evaluating the performance of employees against the set targets

So, now that we understand the importance of budgeting for an organization, let us move to a career in budgeting. Well, it is a fruitful career for candidates with a finance background, and, as such, in this article, we will discuss some of the top budgeting careers in detail.

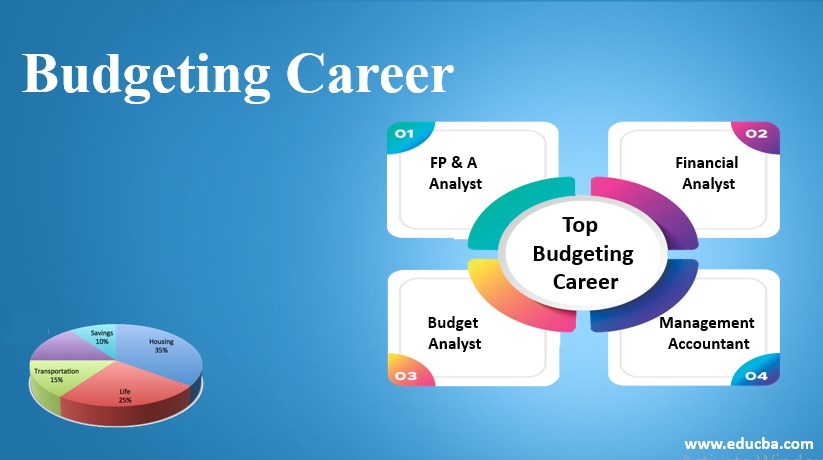

Top Budgeting Career

Some of the top careers are explained below:

1. FP & A Analyst

As an FP&A analyst, you will manage the company’s budget as part of the financial planning department.

Responsibilities:

The major responsibilities of an FP&A analyst include the following:

- Performing quantitative analysis of the financial as well as operational data.

- Building and managing all the business databases by analyzing and organizing large data sets.

- Collecting and analyzing the company’s financial information for preparing reports strictly for internal use only.

- Evaluating the scope of new investment opportunities and projects.

- Assessing the value of a company’s assets based on their existing condition.

- Recommending optimal capital structure (mix of debt and equity) and then determining the cost of capital.

- Building the company’s budgetary forecast.

- Building and maintaining the detailed corporate financial model of the company covering its ongoing operations and upcoming future projects.

Educational and Experience Requirement:

The FP&A analyst should have the following educational and professional background:

- At least a bachelor’s degree in accounting, finance, economics, or a related discipline.

- A Master’s degree, such as an MBA, is preferable.

- Other preferable qualifications include Chartered Financial Analyst (CFA), Certified Financial Planner (CFP), and Certified Public Accountant (CPA) license.

Salary:

The average annual salary of an FP&A analyst at the entry level varies in the range of $50,000 to $80,000, which can go up more than $250,000 at senior management positions such as Director / VP.

Source Link: https://corporatefinanceinstitute.com/resources/careers/map/corporate/fpa-analyst-career/

2. Financial Analyst

As a financial analyst, you will be responsible for analyzing the organization’s financial position.

Responsibilities:

The major responsibilities of a financial analyst include:

- Evaluate the company’s performance by analyzing its financial results and comparing them with the budget to check for variance.

- Creating recommendations for senior management and executives.

- Developing financial models for planning, valuation, or forecasting.

- Providing support to the budgeting team for capital expenditure planning.

- Reconciling all transactions by crosschecking both incoming and outgoing data.

- Conducting various kinds of analysis and market research.

Educational and Experience Requirement:

The financial analyst should have the following educational and professional background:

- At least a bachelor’s degree in accounting, economics, finance, or other related disciplines.

- Around 3 years of relevant experience, while 3 to 5 years of experience is preferred.

- Other preferable qualifications include Financial Modeling & Valuation Analyst (FMVA) certification or MBA.

Salary:

The median annual salary of financial analysts is around $85,000, which can go up more than $167,000.

Source Link: https://www.bls.gov/ooh/business-and-financial/financial-analysts.htm#tab-5

3. Budget Analyst

As a budget analyst, you will advise the organization, preparing their financial budgets and organizing their finances.

Responsibilities:

The major responsibilities of the budget analyst include:

- Helping project managers to develop a company-wide budget.

- Ensuring the company’s budget proposals are complete, accurate, and compliant with laws and regulations.

- Helping consolidate the company-wide budget by coordinating with all the departments.

- Advocating and defending the requests for funds to the organization’s stakeholders.

- Continuously monitor the organizational expenses to ensure it is within the budget plans.

- Updating the status of the availability of funds to all the project managers.

- Forecasting the budget requirements.

Educational and Experience Requirement:

The budget analyst should have the following educational and professional background:

- A bachelor’s in finance, economics, accounting, or statistics.

- Other preferable qualifications include CPA or CFA certification or MBA.

Salary:

The median annual salary of budget analysts is around $76,000, which can go up more than $116,000.

Source Link: https://www.bls.gov/ooh/business-and-financial/budget-analysts.htm#tab-5

4. Management Accountant

As a management accountant, you will work closely with the company’s senior management or the budgeting manager.

Responsibilities:

The major responsibilities of the management accountant include:

- Recognizing the scope of improvement in the existing process.

- Building a pool of personnel and resources for upcoming improvement projects.

- Scrutinizing current operational and financial data for recommending improvements.

- Preparing reports with proposals for setting up new systems and procedures.

- Discussing the implementation of the proposed changes with management.

Educational and Experience Requirement:

The management accountant should have the following educational and professional background:

- A bachelor’s degree in accounting, finance, economics, or a related discipline.

- Other preferable qualifications include Certified Management Consultant (CMC).

Salary:

The median salary for management analysts is around $83,000, which can go up more than $152,000.

Source Link: https://www.bls.gov/ooh/business-and-financial/management-analysts.htm#tab-5

Recommended Articles

This is a guide to Budgeting Career. Here we discuss career paths in the field of budgeting along with responsibilities, educational requirements, and job outlook. You may also look at the following articles to learn more –