Updated July 14, 2023

Definition of Bullet Bonds

Bullet bonds make a coupon payment on every coupon date, and the entire principal amount is paid back to the bondholder only on maturity. Bullet bond makes periodic interest payments. These bonds are also known as straight bonds because they do not contain any embedded features, such as put or call. The government uses these bonds to meet the expenses of public projects.

Explanation

Bullet bonds are also known as straight bonds. These bonds are issued mostly by the government entity, and the periodic interest payment is there. The principal amount is paid at the end of the maturity date. Bullet bonds have lower coupon rates than any other bonds in the market. Bullet bonds are very commonly available to the public. The bullet bonds do not contain any additional or embedded features, such as the call or put option. The bullet bonds have a very high counterparty risk as the principal payment is made at the end of the maturity date. These bonds are issued to help public sector companies with ongoing projects.

How Does It Work?

A bullet bond is a debt instrument known as a straight bond. These bullet bonds are easily available in the market. The bullet bonds are generally available with government companies/entities. The periodic interest payment is in bullet bonds, and the principal payment is made at maturity. It is a straight bond because it does not have any embedded features. The whole sole bond has a very simple payback system, and the investors easily understand it.

Example

Mr. Joe wants to invest in a bullet bond, so he has invested $1000. The coupon rate of the bond was 10% per annum. The bond will mature at the end of 5 years. Now we have to tell him about the interest he will get and his principal amount payback.

| Years | Cash Flow($) |

| 0 | -1000 |

| 1 | 100 |

| 2 | 100 |

| 3 | 100 |

| 4 | 100 |

| 5 | 1100 |

Therefore, at the end of the maturity date, after 5 years’ time, Mr. Joe will receive $1100 and the periodic interest of $100 every year. So, in this case, he will gain $500 from bullet bonds in 5 years.

Bullet Bonds Strategy

The investor invests in the particular bond, and they get periodic payments, and the entire principal amount is paid back at the end of the maturity date. The strategy of this type of bond is that they create earnings at the maturity date, and all the bonds have the same maturity date, whereas the investment can be at any point in time. The logic behind issuing the bullet bond is that it will create earnings for the government entity if any project is undergoing for the public welfare.

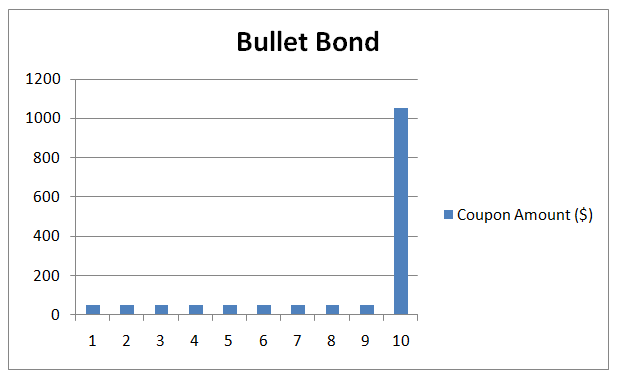

Bullet Bonds Graph

Graph of bullet bond are:

| Face Value ($) | 1000 |

| Coupon Rate | 5.00% |

| Coupon Amount | 50 |

| Coupon frequency | Annual |

| No. of Coupon payments | 10 |

| Maturity in years | 10 |

| Current Yield | 5.50% |

| Years | Coupon Amount ($) |

| 1 | 50 |

| 2 | 50 |

| 3 | 50 |

| 4 | 50 |

| 5 | 50 |

| 6 | 50 |

| 7 | 50 |

| 8 | 50 |

| 9 | 50 |

| 10 | 1050 |

The bullet bond in this graph has a face value of $1000, and the coupon rate is 5%. The interest is paid annually; therefore, the coupon amount is $50, which will pay yearly. At the end of the maturity period, 10 years, the entire amount, including the principal and the interest, will be paid back to the investor. The graph shows the exact picture of the coupon rate and the principal repayment.

Benefits

Some of the benefits of bullet bonds are:

- The concept of bullet bonds is very easy to understand for any type of investor.

- The periodic interest payment method is there in the bullet bond scheme.

- The bullet bonds help the government earn money for public welfare projects.

- The repayment method of this type of bullet bond is very easy. The entire principal amount is repaid to the investor on the maturity date.

- The maturity date of the bonds is the same; therefore, the investor can invest any time to get returns.

- It can help investors to plan their investments accordingly.

- The reinvestment of the principal amount is not possible in this case; therefore, the risk is low compared to other bonds.

Disadvantages

Some of the disadvantages of bullet bonds are:

- The investors will have to bear interest rate risk; therefore, this type of bond can confuse the investors.

- The issuer of these bonds should be careful enough to understand the counterparty risk associated with the investment.

- It has also been seen that bullet bonds give a very low coupon rate compared to the other bonds available.

- It also lacks embedded features. Therefore, investors are sometimes not interested in investing in such bonds.

- Bullet bonds are less flexible; therefore, they are always risky.

- The investors of these bonds need to make some special capital provisions considering the risk associated with them.

Conclusion

The concept of bullet bonds is very old and traditional. Most of the investors are very actively investing their proceeds in these types of bonds. Considering the risk associated with the bonds, the investors must take some necessary steps to safeguard their interests. Government entities very commonly use bonds to finance public welfare projects. The maturity date of these bonds is the same, and therefore, most investors will seek this type of opportunity. It fetches a low coupon rate compared to the other bonds in the market, and therefore, it can create confusion, and the investor’s sentiment can get hurt. Hence, it is advisable to understand the entire repayment policy and the bond’s coupon rate before investing.

Recommended Articles

This is a guide to Bullet Bonds. Here we also discuss the definition and how does it work? Along with benefits and disadvantages. You may also have a look at the following articles to learn more –