What is Business Cash Flow Management?

Business cash flow management involves tracking where your money is going, monitoring incoming revenue and outgoing expenses, and ensuring positive cash flow.

A study from Intuit found that 61% of small businesses worldwide grapple with cash flow problems. This highlights the importance of business cash flow management. So, how can business owners stop this cycle? Instead of guessing and hoping, let us implement a predictable system for handling incoming and outgoing cash. Understanding net cash flow is a vital component of financial health. This knowledge helps forecast future cash flow needs and informs smart strategies for payment terms. Effective cash management enables businesses not only to survive but to thrive.

Importance of Cash Flow Management in Business

Cash flow is the lifeblood of your business. The primary reason businesses fail is poor cash flow management. If a business cannot maintain positive cash flow, paying bills and vendors becomes impossible. It is not merely about survival; healthy cash flow plays a key role in growth and financial stability. Monitoring cash flow and establishing sound management strategies are crucial for long-term success.

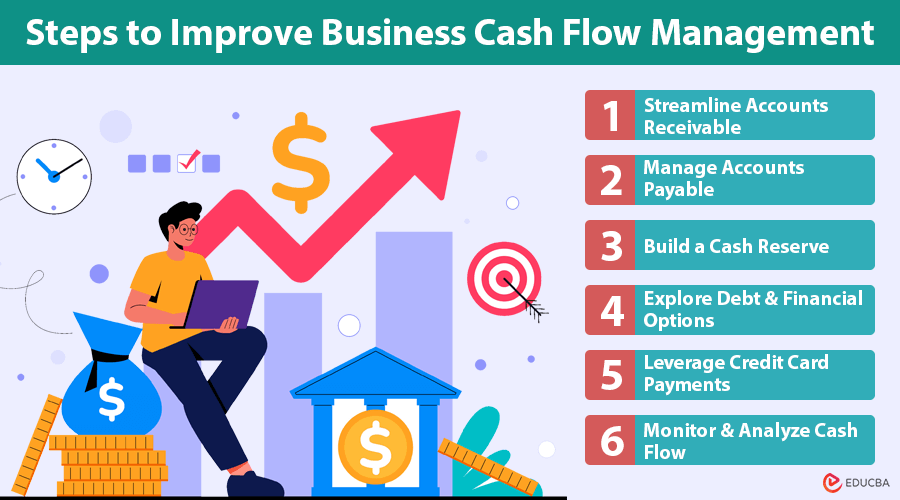

Steps to Improve Business Cash Flow Management

Studies reveal that small businesses’ unpaid invoices amount to over $825 billion. Receiving payment is not as simple as sending an invoice. Let us explore practical steps to improve your business’ free cash flow.

#1. Streamline Accounts Receivable

Accounts receivable (AR) refers to the money clients owe your business. Improving the efficiency of AR collections can significantly boost cash flow.

- Action: Implement electronic invoicing to ensure invoices are sent promptly and tracked efficiently.

- Benefit: Faster invoicing improves the chances of timely payments.

- Tip: Include automatic payment options directly on invoices to encourage early payments.

- Further Action: Perform credit assessments for new clients to evaluate the risk of late payments.

#2. Manage Accounts Payable

Accounts payable (AP) are the sums that your company owes suppliers for goods and services received. Properly managing AP helps ensure you maintain a positive cash flow.

- Action: Use business credit cards for short-term purchases and take advantage of cash-back programs and partner discounts.

- Benefit: Efficient AP management prevents overdue bills and late fees.

- Tip: Automate AP processes where possible to reduce delays and administrative work.

- Further Action: Negotiate slightly extended payment terms with suppliers to improve cash flow while maintaining good relationships.

#3. Build a Cash Reserve

A cash reserve is essential for covering unexpected expenses or emergencies without disrupting daily operations.

- Action: Set up a dedicated savings account specifically for your business reserve.

- Benefit: Helps you prepare for unforeseen cash flow gaps and unexpected expenses.

- Tip: Treat building your cash reserve as a recurring expense by contributing regularly.

- Further Action: Aim for a reserve that covers at least three months’ worth of business expenses for financial security.

#4. Explore Debt and Financial Options

Unexpected cash flow gaps may require you to explore debt and financing solutions.

- Action: Research and evaluate personal loans, lines of credit, or other financing options for addressing short-term cash flow needs.

- Benefit: It provides the liquidity necessary to cover costs without impacting operations.

- Tip: Pay attention to terms and interest rates to ensure you select the most affordable choice.

- Further Action: Use financing judiciously and focus on solutions that prevent long-term debt accumulation.

#5. Leverage Credit Card Payments

Credit cards can be useful in managing cash flow by offering extended payment terms and rewards.

- Action: Use business credit cards strategically for business-related expenses.

- Benefit: Many credit cards offer up to 50+ days of interest-free credit, improving cash flow flexibility.

- Tip: RewardPay allows you to earn up to 2 reward points for every dollar when paired with a high-earning American Express card.

- Further Action: Consider Payment platforms like RewardPay.co.nz to make payments to vendors who do not accept your preferred credit card, maximizing your rewards.

#6. Monitor and Analyze Cash Flow

Monitoring and analyzing your cash flow management in business is key to spotting trends and ensuring stability.

- Action: Generate weekly financial statements to keep track of incoming and outgoing funds.

- Benefit: Helps identify potential problems early, allowing you to take corrective action before they grow into larger issues.

- Tip: Stay proactive by regularly reviewing financial statements and adjusting strategies as needed.

- Further Action: Use analytics tools to gain deeper insights into your cash flow patterns for improved decision-making.

Final Thoughts

Business cash flow management is not just about keeping your business afloat but about ensuring financial stability and paving the way for growth. You can transform your financial management by streamlining your accounts receivable and payable processes, building a cash reserve, and leveraging strategic financing options. Start implementing even one of these strategies, and you will soon notice a smoother, more predictable cash flow process. You can achieve greater financial stability, leading to long-term business success.

Recommended Articles

We hope this guide to business cash flow management helps you streamline your finances and maintain healthy operations. Check out these recommended articles for more strategies to optimize cash flow and strengthen your business’s financial stability.