Difference Between Buying and Leasing

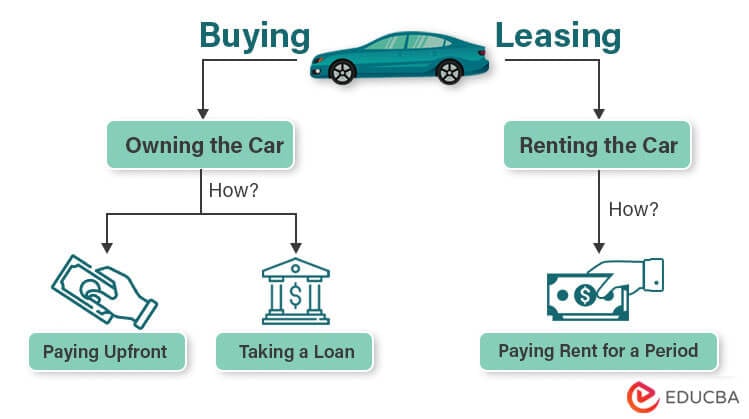

Leasing vs Buying are different in terms of ownership timeline. In leasing, you pay for an item and buy it only for a specific period of time. Whereas, in buying, when you pay for an item, it is yours for your whole lifetime.

In this article, we will explore the key differences between buying and leasing and the factors to consider when deciding which option to choose. We will also provide real-life examples to help you make an informed decision.

What is Buying?

Buying is a common practice for individuals and businesses when they need to acquire an asset. When buying an asset, you pay for the item with cash or financing, gaining full ownership and control. This means you can use the asset as you please and modify it without any restrictions.

For individuals, buying an asset can be a personal investment, such as buying a house or a car. However, individuals are also responsible for all the costs associated with the asset, including maintenance, repairs, and insurance.

For businesses, buying an asset can be a strategic investment that contributes to the company’s long-term growth and success. For example, a construction company may need to purchase heavy equipment like excavators, bulldozers, and loaders. If the business has enough capital, buying the equipment would be the better option. Buying an asset can also provide returns in the future, such as selling the asset for a profit or using it to generate income.

Advantages

- Full ownership and control: Buying an asset gives the owner complete control. They can use it as they please, modify it, and even sell it for a profit.

- No restrictions on use: When you buy an asset, there are no restrictions on its use. You can use it as you please and for as long as you want.

- Investment: Buying an asset can be a good investment. You can use it for your purposes and then sell it for a profit later.

Disadvantages

- High upfront cost: Buying an asset often requires a significant upfront cost. This can be a challenge for individuals or businesses with limited cash flow.

- Maintenance and repair costs: Once you own an asset, you are responsible for its maintenance and repair costs. These costs can add up over time and maybe unexpected.

- Depreciation: Assets often depreciate over time. This means the asset’s value may decrease, making it difficult to recoup your investment.

What is Leasing?

Leasing is a popular alternative to buying for both individuals and businesses. When you lease something, you’re essentially renting it for a set period of time. This could be a car, equipment, or even a property.

For individuals, leasing can be a good option for getting a car. At the end of the lease term, you can return the car and lease a new one or buy it if you want to keep it.

Businesses often use leasing to obtain equipment or office space. Leasing equipment can be a smart option because it allows you to get the necessary equipment without paying for it all at once. You can upgrade to newer equipment when the lease term is up.

There are two main types of leases:

1. Operating Lease

An operating lease is when you rent an asset, like a car or a building, for a short period. The asset owner (the lessor) still owns the asset and is responsible for any associated risks, like damage or loss of value. You, as the lessee, pay to use the asset for a certain amount of time, like a rental agreement. Companies typically use this type of lease for assets with a shorter lifespan.

An operating lease might be like renting a car for a week when you’re on vacation. You pay for using the car during that time and then return it to the rental company.

2. Finance Lease

A finance lease is more like a loan for an asset. You make regular payments to the asset owner (the lessor), similar to loan payments, until the end of the lease term, when you can buy the asset outright. You still use the asset but take on most of the associated risks, like damage or loss of value. Assets that have a longer lifespan use this type of lease.

A finance lease might be like buying a car on a 3-year loan. You make regular payments to the bank or finance company until the end of the loan term, when you can buy the car outright. You’re responsible for maintenance and repairs during that time, just like if you owned the car outright.

Advantages

- Lower upfront cost: Leasing an asset often requires a lower upfront cost than buying it outright. This can be beneficial for businesses or individuals with limited cash flow.

- Lower maintenance and repair costs: When you lease an asset, the lessor is often responsible for its maintenance and repair costs. This can benefit businesses or individuals who want to avoid unexpected expenses.

- Access to newer assets: Leasing an asset allows the lessee to access newer models of an asset without having to pay the full price for it. This can benefit businesses that need to keep up with the latest technology or individuals who want to drive a new car every few years.

Disadvantages

- No ownership: When you lease an asset, you do not own it outright. This means you have limited control over its use and cannot modify it without the lessor’s permission.

- Restrictions on use: When you lease an asset, its use is often restricted. For example, if you lease a car, there may be mileage restrictions or restrictions on modifications.

- Higher overall cost: While leasing an asset may have a lower upfront cost, it can be higher than buying it outright. This is because the lessee is paying for the use of the asset but does not own it outright.

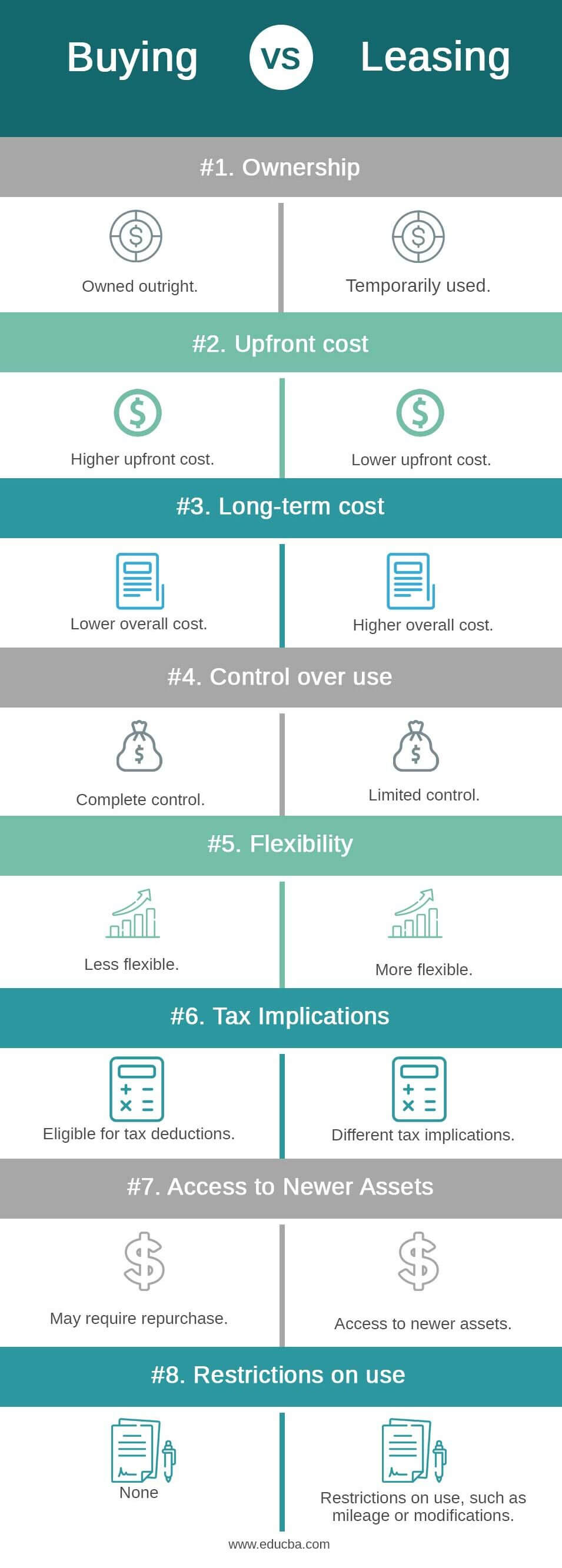

Buying vs Leasing Infographics

Below is the top 8 Difference between Buying and Leasing

Real-Life Examples of Buying vs Leasing

To help illustrate the differences between buying and leasing an asset, here are real-life examples:

Example 1: Buying vs Leasing a Car

Buying a car:

Buying a car can be a good investment if you have the money for a down payment and can afford monthly loan payments. You’ll own the car and can customize it as you wish. However, you’ll also be responsible for maintenance and repair costs, insurance, and depreciation.

Leasing a car:

Leasing a car or taking out a car loan allows you to drive a new car without the upfront costs of buying and lower monthly payments. However, you won’t own the car and may be subject to mileage limits and wear and tear fees.

Example 2: Buying vs Leasing Office Space

Buying office space:

Buying office space allows you to own it outright and use it as you please but requires a high upfront cost and responsibility for maintenance and repair costs.

Leasing office space:

Leasing office space gives you access to the space you need without the high upfront cost, but you don’t own the space outright, and there are restrictions on its use, along with regular monthly payments.

Example 3: Buying vs Leasing a House

Buying a house:

Buying a house can be a good investment if you have the money for a down payment and qualify for a mortgage. You’ll own the property outright and build equity as you make mortgage payments, but you’ll also be responsible for maintenance and repair costs, property taxes, and homeowner’s insurance.

Leasing a house:

Leasing a house, also known as renting, allows you to live in a house without the upfront costs of buying and the responsibility of maintenance and repair costs. However, you won’t build equity in the property and may be subject to rent increases or restrictions on what you can do with the property.

Factors to Consider when Deciding between Buying and Leasing

- Upfront cost: If you have limited cash flow, leasing may be the better option as it often requires a lower upfront cost.

- Long-term cost: If you plan on using the asset for a long time, buying may be the better option as the long-term cost may be lower than leasing.

- Control over use: If you need complete control over the asset, buying may be the better option as you own it outright.

- Need for flexibility: If you need flexibility in using the asset, leasing may be the better option, as you can return it at the end of the lease term or upgrade to a newer model.

- Tax implications: The tax implications of buying or leasing an asset can also be a factor to consider. For example, if you buy an asset, you may be eligible for tax deductions, while leasing may have different tax implications.

Buying Vs Leasing: Comparison Table

|

Buying |

Leasing |

|

| Ownership | Owned outright | Temporarily used |

| Upfront cost | Higher upfront cost | Lower upfront cost |

| Long-term cost | Lower overall cost | Higher overall cost |

| Control over use | Complete control | Limited control |

| Flexibility | Less flexible | More flexible |

| Tax implications | Eligible for tax deductions | Different tax implications |

| Access to newer assets | May require repurchase | Access to newer assets |

| Restrictions on use | None | Restrictions on use, such as mileage or modifications |

Final Thoughts

Whether to buy or lease an asset depends on various factors, including the type of asset, business needs, and financial situation. For assets prone to rapid technological development, leasing may be a better option to mitigate the risk of obsolescence. Therefore, businesses must evaluate their specific situation and requirements before buying or leasing an asset.

Frequently Asked Questions (FAQs)

Q1. Which option is more cost-effective, buying or leasing?

Answer: The answer to this question depends on various factors, such as the type of asset, its intended use, the duration of use, and the available financial resources. In some cases, buying may be more cost-effective, while leasing may be the better option in others. It’s essential to evaluate the costs associated with both options and compare them before deciding.

Q2. Can I customize or modify a leased asset?

Answer: Yes, you can usually customize or modify a leased asset, but you need permission from the lessor first. The lessor may require that the modifications are reversible, and you may be responsible for any associated costs.

Q3. What happens at the end of a lease term? Can I purchase the asset I am leasing?

Answer: At the end of a lease term, you typically have three options: return the asset to the lessor, renew the lease, or purchase the asset. Certain lease agreements may contain an option to purchase the asset at a predetermined price upon completion of the lease term.

Q4. How does the decision between buying vs leasing affect a company’s financial statements?

Answer: Buying vs leasing affects a company’s financial statements differently. Buying results in higher upfront costs, and the asset appears as an asset on the balance sheet, while leasing results in lower upfront costs. However, lease payments appear as an expense on the income statement, not an asset on the balance sheet.

Q5. Can I terminate a lease early?

Answer: Yes, it is possible to terminate a lease early, but penalties or fees may be associated. Reviewing the lease agreement carefully and consulting with the lessor before terminating a lease early is important. The lease agreement should outline the terms for early termination.

Q6. What are the tax implications of buying vs leasing?

Answer: Buying an asset allows you to deduct depreciation and interest expenses from taxable income, while leasing allows you to deduct lease payments as a business expense. However, the tax implications depend on specific circumstances and country tax laws. It’s important to consult a tax professional for guidance.

Recommended Articles

This has been a guide to the top difference between Buying and Leasing. Here, we also discuss the buying vs leasing key differences with infographics and comparison tables. You may also have a look at the following articles –