Updated July 29, 2023

Difference Between C Corp vs S Corp

The following article provides an outline for C Corp vs S Corp. Forming a company structure and getting it registered is a difficult task to deal with. When an individual starts a business, he should register it with the concerned authorities under a corporate or LLC structure. When registering for a company, the founders should also consider whether to get a company registered as a C corporation or an S corporation for income tax purposes, which sometimes becomes critical.

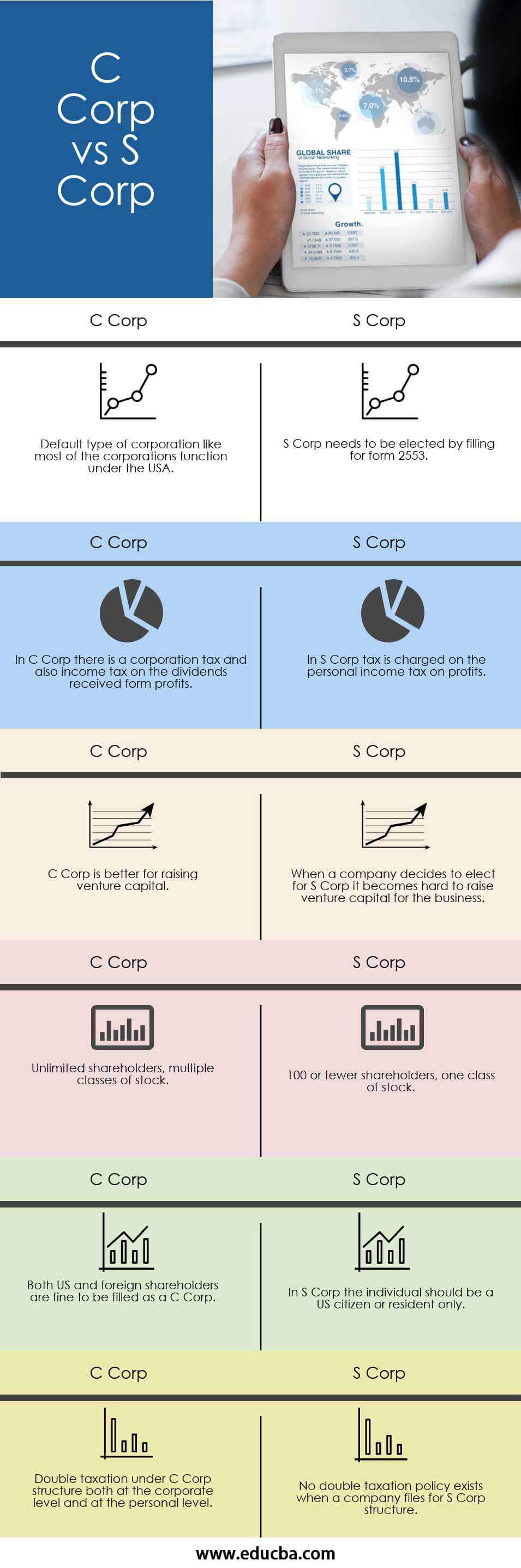

Head To Head Comparison Between C Corp vs S Corp (Infographics)

Below is the top 6 difference between C Corp vs S Corp

Key Differences Between C Corp vs S Corp

Let us discuss some of the major key differences:

- The key difference between S Corp vs C Corp is that the corporation pays the current year’s income tax under C Corp. In S Corp, the individual pays income tax on the percentage of their shareholding in the corporation, and income tax is not charged at the corporation level.

- Under C Corp corporation is treated as a separate legal entity, the income tax is filed under Form 1120, and tax is paid at the corporate level. Although this gives rise to double taxation, if the profits earned by the business are distributed among the partners, they will also have to pay taxes on the profits earned from the corporation. On the other hand, under S Corp, it is treated as a pass-through entity, and income tax is filed under form 1120S, but no income tax is paid at the corporate level.

- The business’s profit and loss under S Corp are pass-through to the partners. Instead, business owners pay these profits and losses individually, but no tax is paid at the corporate level. Whereas Under C Corp, tax is paid by the corporate and again at the individual level on the profit/loss earned by the business.

- Both C Corp and S Corp income tax are due on the salaries drawn by the partners and the dividends received from the corporation.

- Under C Corp, the corporation is treated as a limited liability partnership, which means that the partners are not personally liable for the business’s debts or obligations, hence having limited liability towards the business. On the other hand, in S Corp, the partners can be personally liable for the debts and the business’s obligations. Hence, most companies opt for C Corp for ownership and taxation purposes.

- Under C Corp, it is a default type of Corporation; when a company files articles of incorporation with the secretary of the state, the company becomes a standard C Corp. On the other hand, under S Corp, one must file for IRS Form 2553; after filing the form, the partner will become an S Corp for federal tax purposes.

C Corp vs S Corp Comparison Table

Let’s look at the top 6 Comparison:

|

C Corp |

S Corp |

| Like most corporations, the default type of corporation functions under the USA. | S Corp needs to be elected by filing for Form 2553. |

| C Corp has a corporation tax and income tax on the dividends received from profits. | In S Corp, tax is charged on the personal income tax on profits. |

| C Corp is better for raising venture capital. | When a company decides to elect for S Corp, it becomes hard to raise venture capital for the business. |

| Unlimited shareholders, multiple classes of stock. | 100 or fewer shareholders, one class of stock. |

| US and foreign shareholders are fine to be filled as a C Corp. | In S Corp, the individual should only be a US citizen or resident. |

| Double taxation under the C Corp structure both at the corporate and personal levels. | No double taxation policy exists when a company files for the S Corp structure. |

Conclusion

Selecting between the above methods can impact corporations’ long-term business plans and growth strategies. Looking at the differences and the options, the owners of the business should be clear on whether to file for C Corp or S Corp, which also depends on factors like the stage of the business, long-term plans of the business, and the amount of capital the owners intend to invest in the business. Generally, S Corp is more popular with smaller businesses because of likely tax savings, and C Corp is popular with larger companies because of the greater flexibility to raise capital.

Recommended Articles

This has been a guide to C Corp vs S Corp. Here, we also discuss the C Corp vs S Corp key differences with infographics and a comparison table. You may also have a look at the following articles to learn more.