Updated July 24, 2023

Difference Between CA vs CS

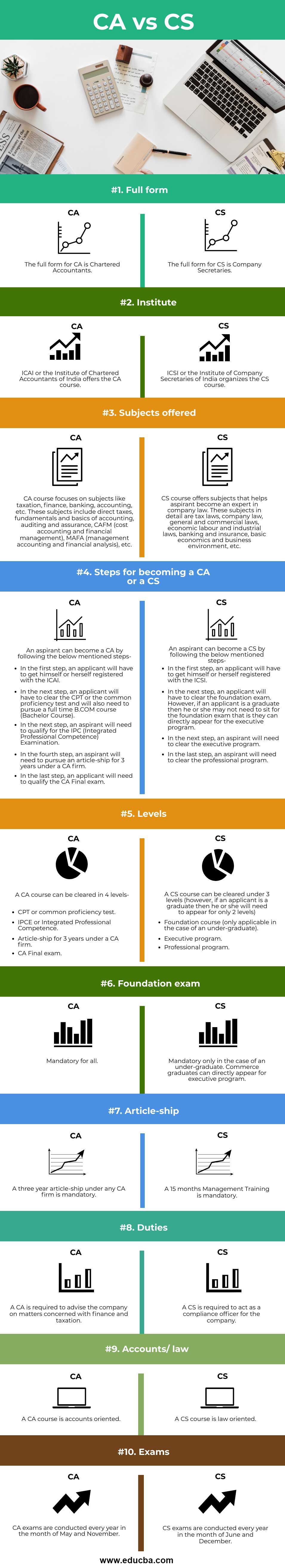

The full form of a CA is a Chartered Accountant. In contrast, the full form of a CS is Company Secretary. CA is the course organized by the Institute of Chartered Accountants of India or ICAI. In contrast, CS is the course organized by the Institute of Company Secretaries of India. CA vs CS in this a Chartered Accountant can choose to work as an internal auditor or the statutory auditor of the company, whereas a Company Secretary works as a compliance officer of the company. The roles and responsibilities of a Chartered Accountant include advising the company on matters related to finance and taxation solely for the purpose of minimizing the tax burden of the company.

In other words, a Chartered Accountant works as an auditor for the company. On the other hand, a company secretary’s roles and responsibilities include ensuring that the company has complied with all the necessary laws such as the Companies Act, 2013, FEMA Act, and such other independent statutory requirements. A Company Secretary is also required to advise the company’s Board of Directors on matters pertaining to compliance with statutory requirements.

Head To Head Comparison Between CA vs CS

Below are the Top 10 Differences CA vs CS:

Key Differences Between CA vs CS

The key difference between a CA and a CS are:

- A CA can apply for jobs in the fields of auditing, accounting, taxation, consultancy, and management accounting, whereas a CS can apply for jobs as legal experts, strategic managers, corporate planners, executive secretaries, and chief advisors.

- A CA course may take an average of 4 to 5 years to complete, whereas a CA course might take an average of 2 to 3 years to complete.

- An applicant will not need to appear for the CS Foundation exam if he or she is already a commerce graduate, whereas such exclusion is not provided in the CA course.

- CA exams happen in the month of May and November every year, whereas CS exams are conducted in the month of June and December each year.

- CA course focuses on subjects like direct taxes, fundamentals, and basics of accounting, auditing, and assurance, CAFM (cost accounting and financial management), MAFA (management accounting and financial analysis), etc. whereas CS course focuses on subjects like tax laws, company law, general and commercial laws, economic labor and industrial laws, banking and insurance, basic economics, and business environment, etc.

CA vs CS Comparison Table

Let’s discuss the top comparison between CA vs CS:

| Basis of comparison |

CA |

CS |

| Full form | The full form for CA is Chartered Accountants. | The full form for CS is Company Secretaries. |

| Institute | ICAI or the Institute of Chartered Accountants of India offers the CA course. | ICSI or the Institute of Company Secretaries of India organizes the CS course. |

| Subjects Offered | CA course focuses on subjects like taxation, finance, banking, accounting, etc. These subjects include direct taxes, fundamentals, and basics of accounting, auditing and assurance, CAFM (cost accounting and financial management), MAFA (management accounting and financial analysis), etc. | CS course offers subjects that help aspirant become an expert in company law. These subjects in detail are tax laws, company law, general and commercial laws, economic labor and industrial laws, banking and insurance, basic economics, and business environment, etc. |

| Steps for becoming a CA or a CS | An aspirant can become a CA by following the below-mentioned steps-

|

An aspirant can become a CS by following the below-mentioned steps-

|

| Levels | A CA course can be cleared in 4 levels-

|

A CS course can be cleared under 3 levels (however, if an applicant is a graduate, then he or she will need to appear for only 2 levels)

|

| Foundation Exam | Mandatory for all | Mandatory only in the case of an undergraduate. Commerce graduates can directly appear for the executive program. |

| Article-ship | A three-year article-ship under any CA firm is mandatory. | 15 months of Management Training is mandatory. |

| Duties | A CA is required to advise the company on matters concerned with finance and taxation. | CS is required to act as a compliance officer for the company. |

| Accounts/ Law | A CA course is accounts-oriented. | A CS course is law-oriented. |

| Exams | CA exams are conducted every year in the month of May and November. | CS exams are conducted every year in the month of June and December. |

Conclusion

CA exams are conducted in the month of January every year, whereas CS exams are conducted in the month of June and December every year. A CA can apply for jobs as an accountant, auditor, management accountant, and so on, whereas a CS can apply for jobs as a legal expert, strategic manager, corporate planner, chief advisor, and executive secretary. CA course takes a longer time to complete as compared to the CS course. A CA course is more accounts oriented whereas a CS course is totally law-oriented. ICAI organizes the CA course, whereas ICSI organizes CS courses.

Recommended Articles

This is a guide to CA vs CS. Here we discuss the CA vs CS key differences with infographics and a comparison table. You can also go through our other suggested articles to learn more –