Difference Between CA vs MBA

This article compares CA (Chartered Accountant) and MBA (Masters of Business Administration). CA professionals work in finance, taxation, auditing, and management in the public and private sectors. ICAI offers CA courses that can be pursued after high school. It takes around 5 years to complete, with four exam levels and mandatory 3 years of article-ship. Failing to complete the article-ship disqualifies aspirants from obtaining the CA degree.

On the other hand, an MBA is a post-graduate program in India and abroad. It is a two-year program, and an aspirant can enroll for the same once he or she graduates. Aspirants can pursue an MBA through online, part-time, and distance education programs.

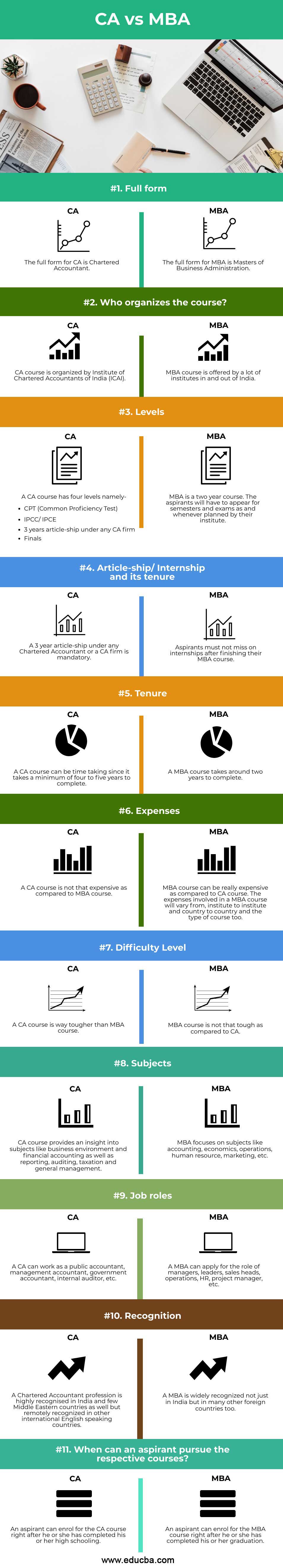

Head To Head Comparisons Between CA vs MBA (Infographics)

Below are the top 11 comparisons between CA vs MBA:

Key Differences Between CA vs MBA

Let us discuss some of the major key differences between a CA vs MBA:

- The CA course averages four to five years, whereas the online MBA course in India typically takes around two years

- Other foreign countries do not widely recognize CA in India and some Middle Eastern countries, while they recognize MBA worldwide.

- Only the ICAI or the Institute of Chartered Accountants of India offers a CA course, whereas multiple universities worldwide offer an MBA course.

- MBA courses can be pursued through regular, offline, part-time, or distance education, whereas the same thing does not apply to a CA course.

- CA course may take a long time to complete, but it is not as expensive as a regular MBA course. A regular MBA course from a reputed university can be at least ten times more expensive than the expenses incurred in pursuing a CA course.

- CA course is much harder as compared to the MBA course.

- After clearing all four levels, which include the Common Proficiency Test (CPT), IPCC/IPCE (Intermediary exams), three years of mandatory Article-ship under a CA firm, and the Finals exam, one can complete a CA course. On the other hand, an aspirant can complete an MBA course by clearing all the semesters and exams.

- A CA course can be pursued right after class 12 exams, whereas the MBA course is a post-graduate program that graduates can only pursue.

- A three-year article ship under a CA firm is mandatory in a CA course, whereas internships are mandatory in an MBA course.

CA vs MBA Comparison Table

Let’s look at the top comparisons between CA vs MBA:

| Basis of Comparison | CA | MBA |

| Full-Form | The full form for CA is Chartered Accountant. | The full form for MBA is a Master of Business Administration. |

| Who Organizes the Course? | CA course is organized by the Institute of Chartered Accountants of India (ICAI). | Many institutes offer MBA courses in and out of India. |

| Levels | A CA course has four levels, namely –

|

MBA is a two-year course. The aspirants will have to appear for semesters and exams as and whenever planned by their institute. |

| Article-ship/ Internship and its tenure. | A 3-year article-ship under any Chartered Accountant or a CA firm is mandatory. | Aspirants must not miss out on internships after finishing their MBA courses. |

| Tenure | A CA course can be time-consuming since it takes a minimum of four to five years to complete. | An MBA course takes around two years to complete. |

| Expenses | A CA course is not that expensive compared to an MBA course. | MBA courses often carry a significantly higher cost compared to the CA course. The expenses involved in an MBA course will vary from institute to institute, country to country, and the type of course. |

| Difficulty Level | A CA course is way tougher than an MBA course. | MBA course is not that tough as compared to CA. |

| Subjects | CA course provides insight into the business environment, financial accounting, reporting, auditing, taxation, and general management. | MBA focuses on accounting, economics, operations, human resource, marketing, etc. |

| Job Roles | A CA can work as a public accountant, management accountant, government accountant, internal auditor, etc. | MBA can apply for the role of managers, leaders, sales heads, operations, HR, project managers, etc. |

| Recognition | In India and a few Middle Eastern countries, the profession of Chartered Accountancy is highly recognized, while other international English-speaking countries remotely recognize it. | MBA is widely recognized not just in India but in many other foreign countries too. |

| When Can an Aspirant Pursue the Respective Courses? | An aspirant can enroll for the CA course right after he or she has completed his or her high school. | An aspirant can enroll for the MBA course right after he or she has completed his or her graduation. |

Conclusion

An aspirant must consider CA as his or her career option only if he or she is interested in and wants to make a career in business and finance. The aspirants who are very much interested in learning financial accounting and reporting, which include taxation, auditing, and general management, and are ready to invest a minimum of 4 to 5 years to get hold of this degree can readily opt for CA over any other course. On the other hand, graduates who are interested in making a career in business and management and have the qualities to become good leaders can readily apply for an MBA program. When deciding between a CA and an MBA, it’s essential to weigh factors such as the time commitment, career goals, and the type of skills each program offers, keeping in mind the valuable distinctions in the diploma vs certificate landscape.

Recommended Articles

This is a guide to CA vs MBA. Here we discuss the CA vs MBA key differences with infographics and a comparison table. You can also go through our other related articles to learn more –