Cap Table Investor Concerns: Importance of Accuracy

A capitalization table, or cap table, is an important tool for any company. It details your company’s share ownership holdings, including convertible equity, warrants, and preference shares. Accurately maintaining the cap table helps address cap table investor concerns by supporting informed investment decisions and effective business governance.

Given this importance, your company’s cap table should reflect the current equity holdings. As investors review your cap table when considering funding, they may have a few concerns about its accuracy. This article addresses these cap table investor concerns and explains their impact on the business.

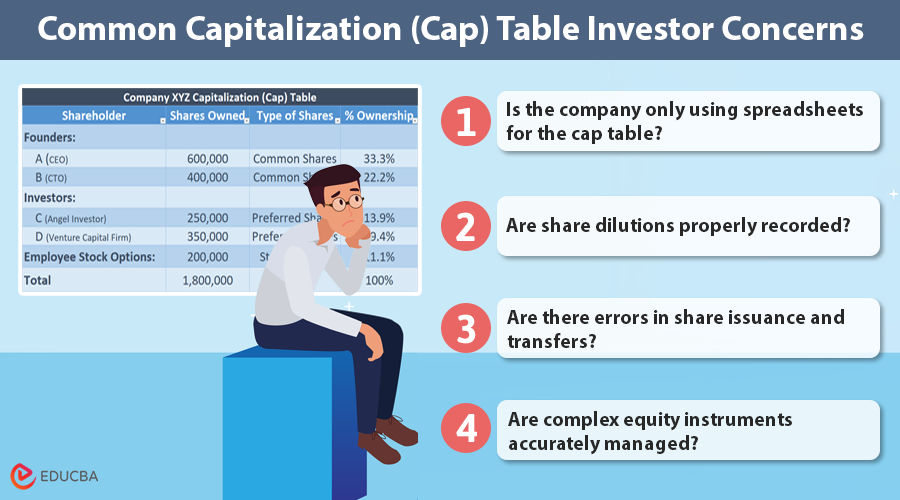

Common Cap Table Investor Concerns

The following are a few concerns investors might have about your company’s cap table.

1. Is the Company Only Using Spreadsheets for the Cap Table?

Investors may worry about the cap table’s accuracy if it’s only maintained in a spreadsheet. Also, the information in the cap table will become complex as the company grows, making it tough to automate.

Automated software is a substitute for spreadsheets. With a committed software solution, you can quickly complete all the tasks without errors, which will always present with any approach requiring manual input.

2. Are Share Dilutions Properly Recorded?

The company’s existing shareholder’s ownership percentage dilutes whenever a new share issuance occurs. A major concern investors might have about the cap table is not properly recording the dilution of ownership. Failing to record the information about dilution may misrepresent the ownership details, and you may lose the investors’ confidence.

If you do not update your cap table after issuing new shares, investors will not know the actual dilution of their ownership stake, which will impact their decisions to invest further and may lead to disputes in the future. Timely updates are crucial to addressing cap table investor concerns.

3. Are There Errors in Share Issuance and Transfers?

Investors are concerned about mistakes in documenting share issuance and transfers. These mistakes are typical when you manually enter data, miss updating the cap table quickly, or have any ambiguity regarding equity grants.

If you do not properly record the stock options you give to your staff, it could lead to disputes over ownership. Investors should believe that the cap table fairly depicts the present ownership structure of the business.

4. Are Complex Equity Instruments Accurately Managed?

Companies, especially in specialized fields like defense tech, may use complex stock structures like convertible notes. This is typical in cases when the organization lacks a company valuation system in place. These complex securities further complicate the cap table.

Investors need to understand these instruments shown on the cap table to have a grip on their ownership interest. Any problems with this can distort their business share and lead to conflicts. Therefore, organizations should carefully record them to ensure precision.

5. Is the Cap Table Transparent and Up to Date?

Investor confidence depends mostly on openness. Their ownership share in the cap table must always be clear and precise. You will lose investor confidence if your company’s cap table lacks this transparency because of inadequate or late updates.

Thus, to keep current investors and attract new ones, you must ensure that the cap tables are accurate, easily available, and understandable.

6. Is the Cap Table Compliant with Regulations?

Compliance with applicable rules and regulations is important while maintaining a cap table. Your cap table’s accuracy will impact the company’s compliance with various laws and regulations. If you fail to document the securities properly, it could lead to potential fines and legal complications.

Investors will be concerned about the cap table’s adherence to regulations and will need assurance that the company maintains accurate and compliant records.

7. Has a 409a Valuation Been Completed Before Issuing Options?

Ignoring a 409a valuation before providing options and changing it on the cap table may worry investors because of error and legal implications. Before providing equities, an accurate 409a valuation by an independent valuation specialist is essential.

Ignoring this step can cause legal problems and IRS conflicts, which could further cause investors to question the business’s performance. This may affect your future fundraising since investors examine companies based on their accuracy in valuing and maintaining a clean cap table.

Best Practices for Addressing Cap Table Investor Concerns

Investors gain confidence through the following practices:

- Invest in cap table management tools. Different platforms help you automatically update the cap tables to guarantee they show the current ownership structure.

- Frequent audits and reconciliations help you find and fix disparities. Cross-checking the cap table with other financial data can also guarantee consistency.

- Documentation is the key. Record all the instruments and stock options you provide, including their terms and conditions. This will help you better grasp the capital structure.

- Professionals and financial advisers can help you to guarantee that your cap table is accurate and compatible with all the pertinent laws and regulations. They can also help you arrange your equity, understand its effects, and keep correct records.

Final Thoughts

Investors mostly depend on cap tables to make investment decisions, grasp their equity interests, and assess possible profits. Any errors in the cap table could thus affect your capital structure and capacity to draw in and keep investors.

Cap table management systems can solve the above-described cap table investor concerns and automate the job. These systems can also produce comprehensive reports and provide simple access to cap table data, enhancing regulatory compliance and openness.

Recommended Articles

To further enhance your understanding of shareholder’s equity and related-topics, you can refer to the below articles.