Updated November 15, 2023

Difference Between Capex vs Opex

Capex is regarded as Capital Expenditure, while Opex is regarded as Operational Expenditure. We log a transaction when a business acquires assets that could benefit the company in the current year and in the long run. For example, machinery or a building that would stay in the firm for the long term for many future financial years. Capex is also known as Capital Expense.

The company/business incurs operational expenses to maintain the smooth running of daily business activities. Converting its inventory, which includes raw materials, into a final product incurs costs for the business. For example, the electricity cost to run the machine and the labor cost to convert flour, sugar, etc. (raw materials) into a biscuit (final product). They also consider the depreciation of fixed assets on a company’s balance sheet as an operating expense.

They account for the fixed asset’s wear and tear, which is depreciation, in the current year. It is also beneficial to claim a tax deduction. Opex is also known as ‘Operating Expenditure’, ‘Revenue Expenditure‘, or ‘Operating Expense’. Other operating expenses include rent, utilities, salaries (wages), SG&A (sales, general, and administration costs), research and development, and business travel.

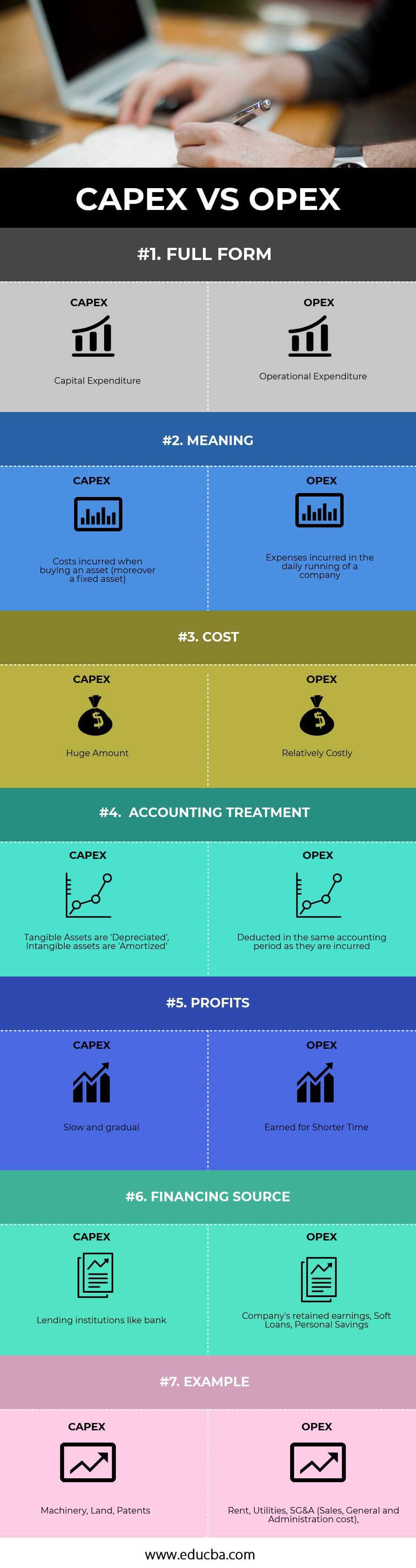

Head To Head Comparison Between Capex VS Opex (Infographics)

Below is the top 7 difference between Capex vs Opex.

Key Differences Between Capex VS Opex

Capital Expenditure vs. Operational Expenditure both sound like ‘Expenditures’ or ‘Expenses’ terminologies. But when you run a business, knowing the difference between the two concisely is essential based on the following factors.

1. Cost

- Cost involves humongous pricing. The reason for utilizing these expenditures throughout the organization’s lifespan is that they are allocated to the expenses incurred while purchasing fixed assets. These fixed assets are usually expensive and will be used over a long period (more than 1 year). Although these expenditures can be significant, they utilize them throughout the entire life of the organization.

- Alternatively, Opex has recurring costs. These are the costs that make sure that the company runs smoothly to ensure revenue. The company pays for these expenses during daily business activities.

2. Accounting

- When creating and maintaining financial statements, the cost incurred while purchasing a fixed asset is not incurred in the year they were purchased. Instead, these assets are depreciated over the asset’s life, which means that the cost of the fixed asset is spread over the years. Any asset with a physical substance is depreciated (For example, Machine, Land, or Building). Assets that lack physical form are referred to as intangible assets, such as patents, trademarks, and franchises. These intangible assets are subject to “amortization” rather than depreciation.

- Costs relating to the Opex are completely deducted from the gross profit. It is because using a product/ service has happened in the current financial year and shall benefit the firm only in the current year. Therefore, the company does not spread these costs across years or carry them forward to the next financial year.

3. Profits

- Profits earned from capital expenditure come in a slow and gradual process. This is because the organization will operate the machine for multiple years. Although these profits incurred are small and incremental, they ultimately accumulate to become significantly substantial over an extended period.

- Unlike capital expenditures (Capex), the profits generated through operating expenses become visible within a shorter period, typically within the current year. As a result, earnings can be substantial yet only occur once, contrasting to the gradual earnings and benefits.

4. Financing

For both, the firm must source financing to keep up its operations.

- Financing requires a huge sum of money; therefore, the company approaches financial lending institutions for loans. Lending institutions (like the bank) lend money at special interest rates, especially for capital expenditure.

- Firms can use their retained earnings or net income from previous years to cater to operational expenses. To cover their operational expenditures, firms can also opt for soft loans that they can pay back in the short term. Firm owners can borrow from their families and friends to run their operating expenses smoothly.

Capex VS Opex Comparison Table

The following Head-to-head comparison table between Capex VS Opex shall give you a better insight.

|

The Basis of Comparison |

CAPEX |

OPEX |

| Full-Form | Capital Expenditure | Operational Expenditure |

| Meaning | Costs incurred when buying an asset (moreover, a fixed asset) | Expenses incurred in the daily running of a company |

| Cost | Huge Amount | Relatively Costly |

| Accounting Treatment | Tangible Assets are ‘Depreciated’; Intangible assets are ‘Amortized.’ | “Incur expenses in the same accounting period they are deducted.” |

| Profit | Slow and gradual | Earned for Shorter Time |

| Financing Source | Lending institutions like bank | Company’s retained earnings, Soft Loans, Personal Savings |

| Example | Machinery, Land, Patents | Rent, Utilities, SG&A (Sales, General, and Administrative costs) |

How can Capex vs. Opex be Helpful in Different Scenarios?

From a perspective of income taxes, a firm prefers Opex over Capex. A business will opt to lease rather than buy a machine to be able to deduct a maximum amount for lease when calculating taxes. Thereby reducing the taxable amount and the income taxes charged. Moreover, the firm will incur a loss once you lease the item again. To facilitate these operational expenses, a company can put in its cash flow from operations.

An entrepreneur who wants to boost his firm’s profits and increase the book value can opt for a capital expenditure against his machine rather than leasing one. Capex will depreciate the value of the machine over a considerable time. The lease amount payable will exceed the deducted depreciation amount. Hence, boosting the profit. The business might need financing from the bank to buy the machine.

Conclusion

Capital expenditures contribute majorly to the future. The life of these assets bought is long horizon; hence, they depreciate over time. Operational expenditure is the day-to-day expenses incurred by the firm to keep the business operations going smoothly.

Both contribute a large percentage of a company’s annual budget. When a firm is under cost-cutting, it must balance Capex and Opex. Firms make a separate budget for their Capex vs Opex to keep a check on their total expenditures.

Recommended Articles

This has been a guide to the top difference between Capex vs Opex. Here, we also discuss the Capex vs Opex key differences with infographics and a comparison table. You may also have a look at the following articles to learn more.