Meaning in Economics

In Microeconomics and international trade, “capital account” means an account that records the inflow and outflow of capital (money, property, and investments) of the country.

A capital account is a component of a country’s balance of payments or BoP (BoP= Current Account + Capital Account). While the current account deals with the everyday exchange of goods and services, the latter deals with large financial and physical transactions.

This account includes transactions of both big corporations as well as small transactions made by individuals.

You can think of it as a ledger that keeps track of a country’s financial transactions with other countries. Suppose a multinational company buys a property or invests in a business in another country; it is documented in the capital account.

Similarly, when a country’s citizen invests in assets abroad, that’s also part of this account record. It can also include purchasing and selling fixed assets like buildings, equipments, and even intangible assets such as patents or trademarks across borders.

Table of Content

Examples

Following are some examples of capital accounts:

Example #1: Foreign Direct Investments

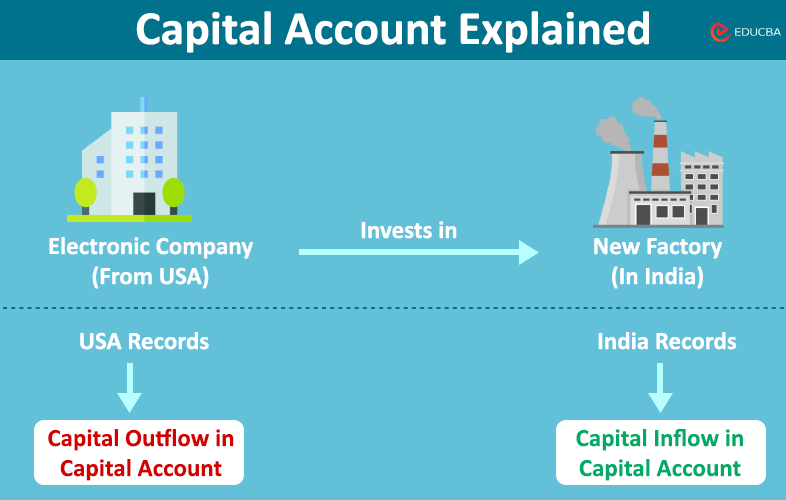

Suppose an electronics manufacturer from the US decides to build a factory in India; that is called a Foreign Direct Investment or FDI. This transaction will be recorded in both country’s capital accounts. India will record it as a capital inflow, while the US will record it as a capital outflow.

Example #2: International Loan

Imagine a scenario where a country grappling with a financial crisis, say Venezuela, asks for a loan from another country like the US. This also constitutes a component of the capital account as a financial transaction is taking place between two countries.

Example #3: Purchase of Property

Suppose an individual from Canada purchases real estate in Australia, this will become a part of the capital accounts of both countries.

Working

This is how the capital account works:

- Recording Transactions: This account records all financial transactions involving a change in asset ownership between residents and non-residents of a country. These transactions include foreign direct investment, portfolio investment, and other capital flows such as loans, grants, and donations.

- Balance in the Account: A country’s capital account can have a surplus, a balance, or a deficit. A balance occurs when the money coming in and going out of the country is exactly equal. A surplus occurs when the money (investment) coming into the country is more than the money going out. Conversely, a deficit occurs when the money leaving the country is more than what comes in.

- Impact on Exchange Rates: The transactions of this account also impact the country’s exchange rate. For example, when there’s a large influx of money into the country, the value of its currency increases due to an increase in demand and vice-versa.

- Capital Controls: Some countries may impose capital controls, which limit the flow of capital in or out of the country to maintain exchange rate stability or to prevent financial crises.

- Relationship with Other Accounts: This account is related to the current account, which records transactions related to trade in goods and services, and the financial account, which records transactions related to cross-border investment and borrowing.

Types

There are two main types of capital accounts.

- Financial Account: It primarily tracks investments and financial assets moving in and out of a country. The financial account includes intangible transactions like foreign direct investments (such as buying companies or starting new businesses abroad), portfolio investments (like buying stocks or bonds in other countries), loans, and bank deposits between countries.

- Non-Financial or Physical Account: This account is mainly focused on the buying and selling of physical or tangible assets, like buildings, machinery, and land, between countries. For instance, if a country sells or buys machinery or real estate from another nation, these transactions are part of the physical account.

Importance

Here’s why this account is important to countries, companies, and individuals.

- International Financial Relationships: It acts like a financial report card that reflects a country’s connections and investments with the rest of the world.

- Economic Health Indicator: Economists and policymakers can understand a country’s economic health by tracking the inflow and outflow of money, investments, and assets.

- Investment and Growth: A healthy account signifies a country’s ability to attract investments and funds from foreign companies and individuals. These investments can fuel economic growth by providing resources for businesses, infrastructure, and innovation.

- Policy Decision-making: Governments use data from this account to make informed decisions. They can adjust policies to encourage or regulate international investments, loans, or trade to maintain a balanced and stable economy.

- Overall Balance of Payments: This account, along with the current account, helps create the balance of payments. It gives a comprehensive overview of a country’s economic transactions with the rest of the world, aiding in understanding its financial standing globally.

Financial Account vs. Capital Account

Here are some key differences between financial and capital accounts:

| Aspects | Financial Account | Capital Account |

| Nature of Transactions | Records financial or monetary transactions. | Records financial and non-financial asset transactions. |

| Components | Foreign portfolio investment, loans, deposits, and central bank reserves. | Foreign direct investment (FDI), physical assets (like property), changes in reserves, and intangible assets (like patents). |

| Economic Impact | Affects short-term financial conditions like exchange rates and investment inflows/outflows. | Affects long-term economic growth and stability. |

Final Words

This account plays a crucial role in understanding a nation’s overall economic health and its relations with other nations. It is primarily focused on tracking how governments, individuals, and companies of a country financially interact with other countries.

Frequently Asked Questions (FAQs)

Q1. What is a capital account in accounting?

Answer: The capital account in accounting is different from the one in economics. While the capital account in economics is a part of the balance of payments of a country, the account in accounting is a part of the balance sheet of a business. It records the investments made by the owners or shareholders in the business. It includes both the contributions and the withdrawals. It essentially signifies how much of the company the shareholder or the owner owns at a particular moment.

Q2. What is the formula for capital accounts in BoP (Balance of Payments)?

Answer: The formula is:

Recommended Articles

If you found this article on Capital Account helpful, you might want to check out the following EDUCBA articles: