Updated July 26, 2023

Definition of Capital Adequacy Ratio

Banks utilize the capital adequacy ratio to evaluate the amount of capital they need to hold with their risk-weighted credit exposures. This ratio, also known as the capital-to-risk-weighted assets ratio, is globally implemented to protect bank depositors, foster stability, and improve the efficiency of banking systems.

Central banks, such as the Federal Reserve in the United States, determine it to prevent commercial banks from assuming excessive leverage that could result in insolvency. Its introduction stemmed from the aftermath of the 2008 financial crisis when the Bank for International Settlements (BIS) imposed restrictions and requirements on banks to safeguard depositors.

Ideally, a financial institution should maintain a CAR that surpasses the designated threshold. This signifies that the institution possesses enough capital to weather unforeseen losses during economic downturns. Conversely, a low CAR indicates that the financial institution is at a heightened risk of failure in any economic disruption.

Formula

The formula for CAR is represented as,

The Tier 1 capital in the numerator primarily includes ordinary share capital, intangible assets, future tax benefits, audited revenue reserves, etc. In contrast, Tier II capital includes unaudited retained earnings, revaluation reserves, general provisions for bad debts, perpetual cumulative preference shares, perpetual subordinated debt, subordinated debt, etc. On the other hand, risk-weighted assets involve a very complex method of evaluating a bank’s loan book to determine its credit, market, and operational risks, ultimately giving the risk-weighted assets.

Examples of Capital Adequacy Ratio (With Excel Template)

Let’s take an example to understand the calculation of the Capital Adequacy Ratio formula in a better manner.

Example – #1

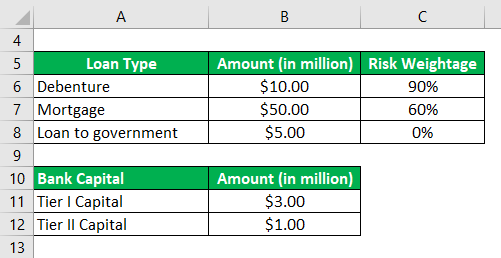

Let us take the example of a bank for which the following information pertaining to its risk capital and loan book is available:

Based on the given information, calculate the capital adequacy ratio for the bank and check if it complies with the minimum requirement of 10%.

Solution:

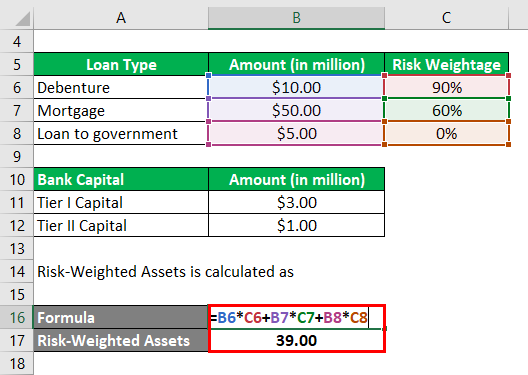

Risk-Weighted Assets is calculated as

- Risk-Weighted Assets = $10.00 Mn * 90% + $50.00 Mn * 60% + $5.00 Mn * 0%

- Risk-Weighted Assets = $39.00 Mn

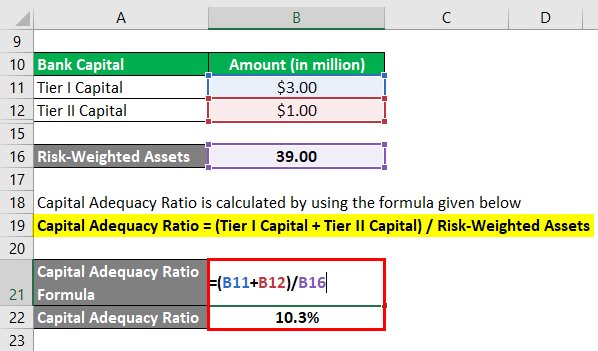

Capital Adequacy Ratio is calculated by using the formula given below

Capital Adequacy Ratio = (Tier I Capital + Tier II Capital) / Risk-Weighted Assets

- CAR = ($3.00 Mn + $1.00 Mn) / $39.00 Mn

- CAR = 10.3%

Therefore, the bank satisfies the minimum requirement of 10% set by the regulatory bodies.

Example – #2

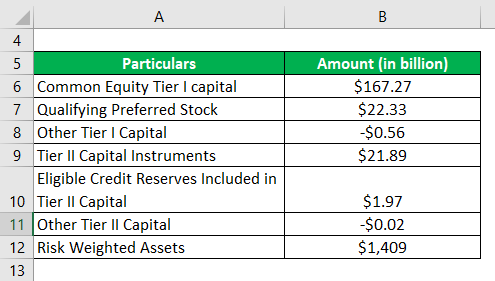

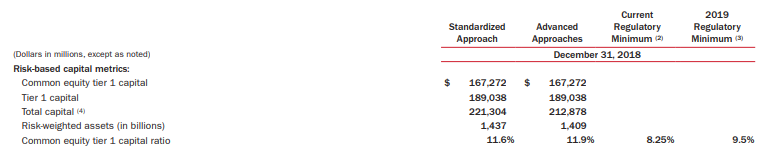

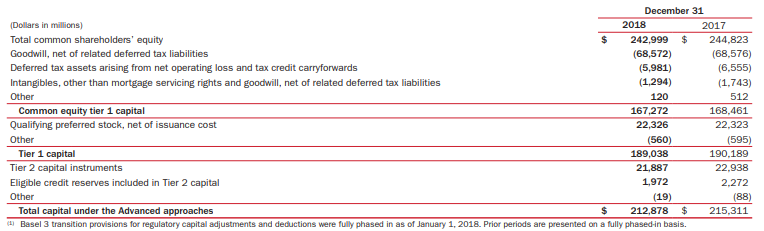

Let us now take the example of Bank of America to calculate the capital adequacy ratio. According to the annual report for the year 2018, the following information is available (under the advanced approach):

Based on the given information, calculate the capital adequacy ratio of Bank of America for 2018.

Solution:

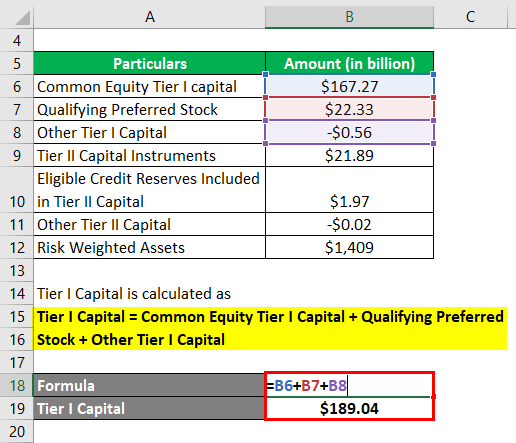

Tier I Capital = Common Equity Tier I Capital + Qualifying Preferred Stock + Other Tier I Capital

- Tier I Capital = $167.27 Bn + $22.33 Bn + ($0.56 Bn)

- Tier I Capital = $189.04 Bn

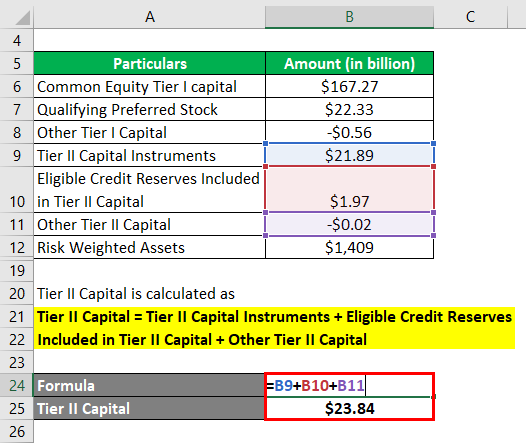

Tier II Capital = Tier II Capital Instruments + Eligible Credit Reserves Included in Tier-II Capital + Other Tier II Capital

- Tier II capital = $21.89 Bn + $1.97 Bn + ($0.02 Bn)

- Tier II capital = $23.84 Bn

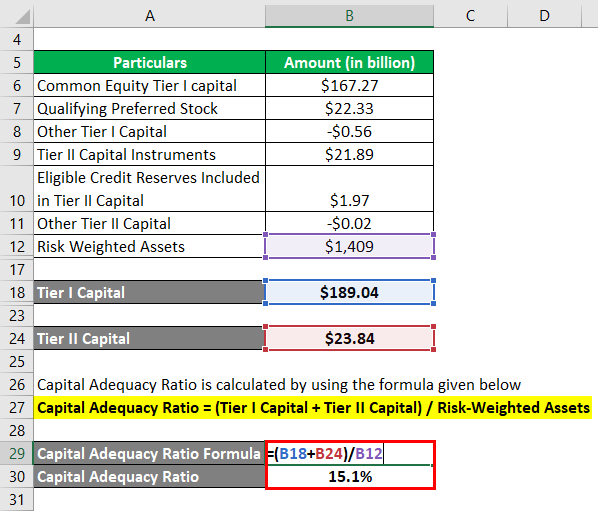

Now, the CAR for Bank of America can be calculated by using the above formula as,

Capital Adequacy Ratio = (Tier I Capital + Tier II Capital) / Risk-Weighted Assets

- CAR = ($189.04 Bn + $23.84 Bn) / $1,409 Bn

- CAR = 15.1%

Therefore, the capital adequacy of the Bank of America stood at 15.1% for the year 2018 under the advanced approach.

Link: media.corporate-ir.net

Advantages and Disadvantages

Some of the advantages and disadvantages of CAR are as follows:

Advantages

- It helps the banks to maintain capital based on the riskiness of each loan exposure. For instance, if two banks have the same loan book size but differ in their level of portfolio risk, they will be required to maintain corresponding bank capital. The higher the risk, the higher the capital required.

- The ratio is a good indicator for investors to understand the overall risk of a bank’s loan book.

Disadvantages

One major limitation of the CAR is that it cannot account for the expected losses that can deform a bank’s capital during any financial crisis.

Conclusion

So, the capital adequacy ratio is a risk measure for commercial banks that helps the regulatory bodies to keep a close track of the risk level of bank lending.

Recommended Articles

This has been a guide to the Capital Adequacy Ratio. We discuss CAR’s introduction, examples, advantages, disadvantages, and a downloadable Excel template. You can also go through our other suggested articles to learn more –