Updated July 27, 2023

Capital Asset Pricing Model Formula (Table of Contents)

What is the Capital Asset Pricing Model Formula?

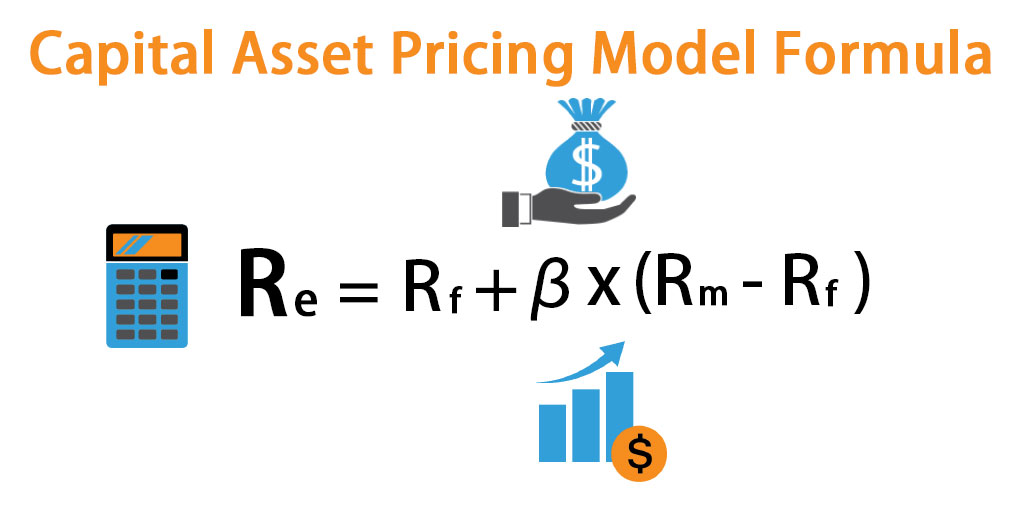

The term “capital asset pricing model” refers to the formula that defines the relationship between the expected rate of return of the security and systematic risk.

In other words, the formula basically uses the systematic risk to calculate the expected rate of return of the security. The formula for Capital asset pricing model can be derived by adding the risk-free rate of return to the product of beta of the security and market risk premium (= market return – risk-free rate).

Formula for Capital Asset Pricing Model

where,

- Re = Expected Rate of Return

- Rf = Risk-Free Rate of Return

- β = Beta of the Security

- Rm = Market Rate of Return

Examples of Capital Asset Pricing Model Formula (With Excel Template)

Let’s take an example to understand the calculation of the Capital Asset Pricing Model in a better manner.

Capital Asset Pricing Model Formula – Example #1

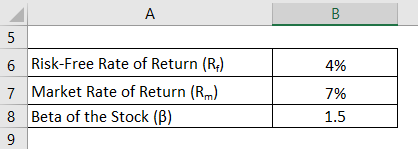

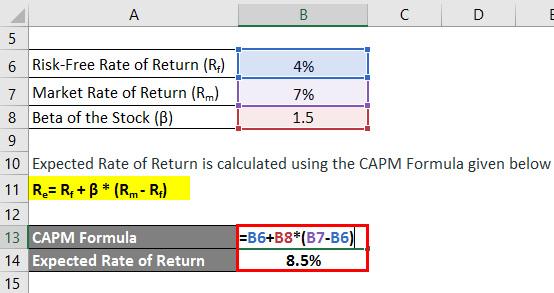

Let us take the example of Phil who has recently purchased stocks worth $5,000. Now, he came to realize that the market is currently expected to generate a return of 7% during the next year, while the 10-year treasury bills are trading at 4% per annum. The stocks purchased by him have a beta of 1.5 when compared to the market. Calculate Phil’s expected rate of return based on the capital asset pricing model.

Solution:

Expected Rate of Return is calculated using the CAPM Formula given below

Re= Rf + β * (Rm – Rf)

- Expected Rate of Return = 4% + 1.5 * (7% – 4%)

- Expected Rate of Return= 8.5%

Based on the capital asset pricing model, Phil should expect a rate of return of 8.5% from the stocks.

Capital Asset Pricing Model Formula – Example #2

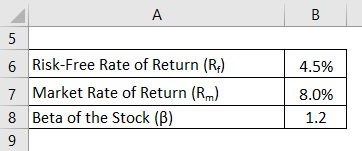

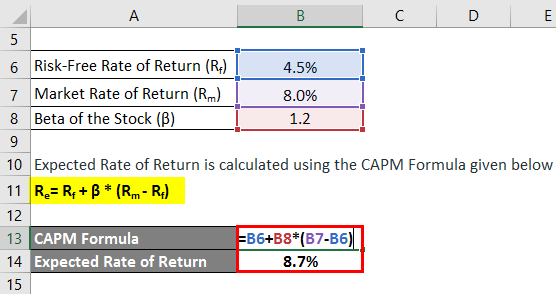

Let us take another example where the investor had purchased in some stocks one year back. During that period, the overall market has grown by 8%, while the stock purchased by him has generated a return of 9%. The relevant 10-year treasury bills are trading at 4.5% per annum. The stocks purchased have a beta of 1.2 when compared to the market, i.e. the stock is riskier than the market. The investor wants to evaluate whether the stock generated adequate return given its risk level. Help the investor to calculate the expected rate of return based on the capital asset pricing model.

Solution:

Expected Rate of Return is calculated using the CAPM Formula given below

Re= Rf + β * (Rm – Rf)

- Expected Rate of Return= 4.5% + 1.2 * (8.0% – 4.5%)

- Expected Rate of Return = 8.7%

Based on the capital asset pricing model and given risk level of the stocks, the expected rate of return of the stocks is 8.7%, while the investor has realized an actual return of 9.0%. Therefore, the investment has generated an adequate return to beat the expected rate of return.

Explanation of CAPM Formula

The formula for CAPM can be derived by using the following steps:

Step 1: Firstly, determine the risk-free rate of return prevalent in the market. Typically return earned on government securities or Treasury bills are used as a proxy for the risk-free rate of return as these securities are considered to have the minimum risk. It is denoted by Rf.

Step 2: Next, determine the rate of return expected in the broader market based on certain benchmark which can be the stock market index. It is denoted by Rm.

Step 3: Next, calculate the market risk premium for the security by deducting the risk-free rate of return (step 1) from the rate of return expected from the market (step 2). It can be seen as the surplus return expected by the investor over and above the risk-free rate in order to be compensated for investing in the relatively riskier security.

Step 4: Next, determine the beta of the security based on its relative movement with respect to the market or any benchmark index. Basically, it is the measure of the volatility of the stock’s returns which is computed by evaluating its price fluctuation vis-à-vis the movement witnessed in the overall market. It is denoted by β.

Step 5: Finally, the formula for CAPM can be derived by adding the risk-free rate of return (step 1) to the product of beta of the security (step 4) and market risk premium (step 3) as shown below.

Relevance and Uses of Capital Asset Pricing Model Formula

From the perspective of a financial analyst, it is important to understand the concept of capital asset pricing model as it has extensive application in the finance industry. One of its primary application includes calculation of the cost of equity which is eventually used in the calculation of the weighted average cost of capital (WACC). Further, WACC itself is found widespread application, that includes financial modeling, calculation of net present value by discounting the future cash flows, determination of enterprise value and equity value.

Capital Asset Pricing Model Formula Calculator

You can use the following Capital Asset Pricing Model Formula Calculator

| Rf (%) | |

| β | |

| Rm (%) | |

| Re | |

| Re = Rf + [β X (Rm - Rf)] |

| 0 + [0 X (0 - 0)] = 0 |

Recommended Articles

This is a guide to the Capital Asset Pricing Model Formula. Here we discuss how to calculate the Capital Asset Pricing Model along with practical examples. We also provide a Capital Asset Pricing Model calculator with a downloadable excel template. You may also look at the following articles to learn more –