Updated July 25, 2023

Definition of Capital Employed

The term “capital employed” refers to the total amount of funds a company uses to generate profit from its business. In other words, the dollar amount of all the company assets employed in a business determines the capital employed.

Simply put, all businesses run to earn profits and, for that purpose, need to employ funds, which gives rise to the concept of capital employed.

The primary use of CE is in the calculation of return on capital employed (ROCE), which compares the net operating profit generated by a business relative to the CE in the business.

Formula

To derive the formula for current equity (CE), we can express it by subtracting the total current liabilities from the company’s total assets. Mathematically, the active voice representation of the formula is:

The above formula for CE also implies that one can express it as the sum of shareholder’s equity and long-term liabilities, represented mathematically as.

The sum of long-term assets and working capital represents another form of the formula.

Examples of Capital Employed (With Excel Template)

Let’s take an example to understand the calculation of CE in a better manner.

Example #1

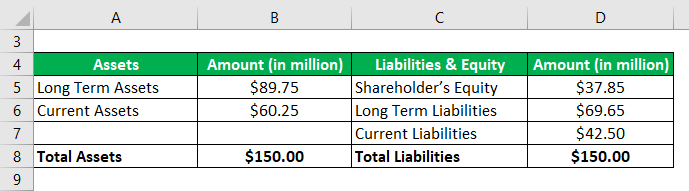

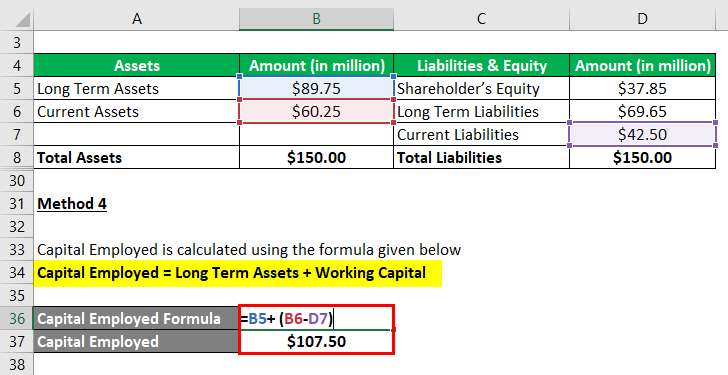

Let us take the example of a company to demonstrate the calculation. The following balance sheet information is available according to the annual report for the year 2018. Calculate the capital employed by the company for the year 2018 using all the three methods of calculation.

Solution: Formula

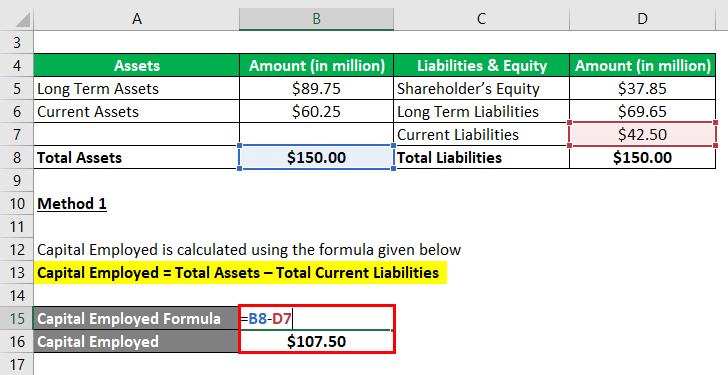

Method 1

CE is calculated using the formula given below

Capital Employed = Total Assets – Total Current Liabilities

- CE = $150.00 million – $42.50 million

- CE = $107.50 million

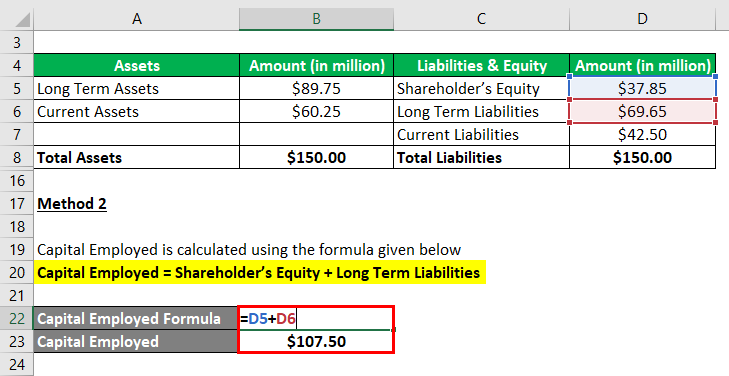

Method 2

Capital Employed = Shareholder’s Equity + Long Term Liabilities

- CE = $37.85 million + $69.65 million

- CE = $107.50 million

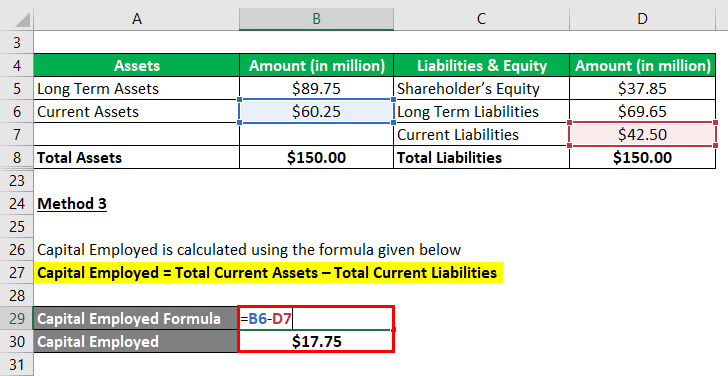

Method 3

Capital Employed = Total Current Assets – Total Current Liabilities

- CE= $60.25 million – $42.50 million

- CE = $17.75 million

Method 4

CE is calculated using the formula given below

Capital Employed = Long Term Assets + Working Capital

- CE = $89.75 million + ($60.25 million – $42.50 million)

- CE = $89.75 million + $17.75 million

- CE = $107.50 million

Therefore, the company’s total CE during 2018 was $107.50 million.

Example #2

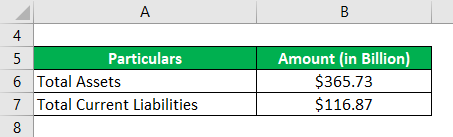

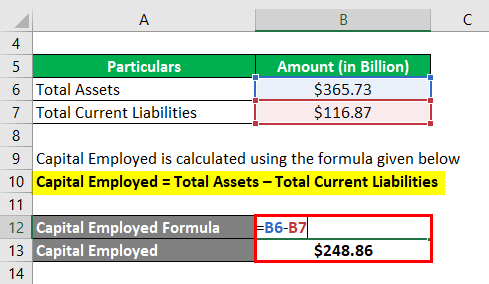

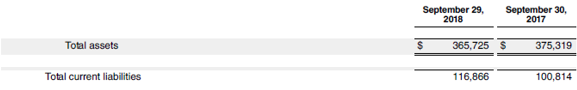

Let us take the example of Apple Inc.’s financial position of 2018 to illustrate the concept of CE. As of September 29, 2018, the company reported total assets of $365.73 billion and total current liabilities of $116.87 billion. Calculate the total capital employed by Apple Inc. in 2018.

Solution:

Capital Employed = Total Assets – Total Current Liabilities

- CE = $365.73 billion – $116.87 billion

- CE = $248.86 billion

Therefore, Apple Inc. employed a total capital of $248.86 billion during the year 2018.

Source Link: Apple Inc. Balance Sheet

Example #3

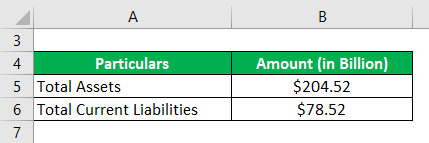

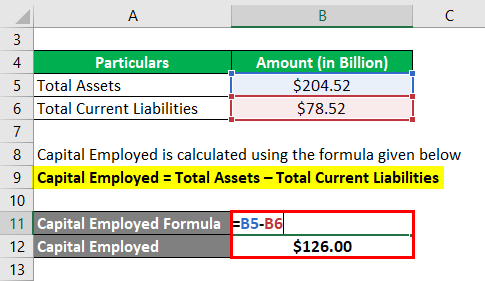

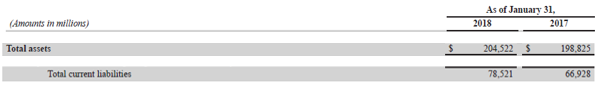

Let us take the example of Walmart Inc. also to illustrate the concept of CE. According to the annual report, the company reported total assets of $204.52 billion and total current liabilities of $78.52 billion as of January 31, 2018. Calculate the capital employed by Walmart Inc. during 2018.

Solution:

Capital Employed = Total Assets – Total Current Liabilities

- CE = $204.52 billion – $78.52 billion

- CE = $126.00 billion

Therefore, Walmart Inc. employed a total capital of $126.00 billion during the year 2018.

Source: Walmart Annual Reports (Investor Relations)

Advantages of CE

Some of the advantages are:

- The metric gives a fair idea of how a company invests the funds to produce profits.

- It is primarily used in the calculation of ROCE, which investors predominantly use to measure the financial performance of companies.

Limitations of CE

Some of the limitations are:

- The value of CE can be manipulated by classifying some of the long-term liabilities as current liabilities or long-term assets as current assets.

- There is no clarity about whether to use book value or replacement value of assets. Both practices are in vogue.

- The metric has limited application in the context of financial analysis.

Conclusion

So, it can be concluded that capital employed gives insight into a company’s capital structure, i.e., the sources of the funds needed for running the business operation. But it is primarily used in conjunction with operating profit in the calculation of ROCE and has limited use otherwise. However, please note that the metric is exposed to risk accounting manipulation.

Recommended Articles

This is a guide to Capital Employed. Here we discuss how to calculate CE, practical examples, advantages, and limitations. We also provide a downloadable Excel template. You may also look at the following articles to learn more –