Updated July 15, 2023

Definition of Capital Expenditure

Capital expenditure, also known as CAPEX, can define as the amount of funds utilized by an organization to buy, upgrade and maintain long-term tangible/ non-tangible assets such as buildings, property, vehicles, equipment, industrial plant, technology, goodwill, etc., which expects to provide long term future economic benefits usually for a period longer than one accounting period.

Explanation

CAPEX often describes expenditures like venturing into new projects or adding to existing investments. It creates a substantial effect on the long-term and short-term financial position of an organization. Depending upon the type of expenditure, the amount spent will record and report under various assets like land and buildings, plant and machinery, furniture and fixtures, etc. The cost of these assets accepts land allocated as depreciation expense over some time for which capital assets are expected to generate future economic benefits of its useful life. Cashflows incurred under capex are usually reported under investing activities as part of cashflows.

Characteristics of Capital Expenditure

- Capex is generally made to acquire fixed assets with a useful life of more than one accounting period.

- It may sometimes add value to an asset by incurring upgrading and maintenance expenditures, thereby increasing the shell life of an investment. For example, a machine installed in a company that produces 100 units per day undergoes an upgrade, increasing its capacity from 100 to 150 units per day. Hence CAPEX increases the value of assets.

- Only expenditures over one year of useful life will consider CAPEX. Normal maintenance expenses, like general repairs, painting, etc., will not be considered CAPEX.

- CAPEX increases the profit earning capacity of the business in the long term.

- It requires huge funds as the value of such assets is usually very high.

- The decisions made regarding CAPEX are irreversible once the amount spent on any fixed asset cannot reverse.

- The amount of Capex charges as an expense in more than one accounting period.

The Formula of Capital Expenditure

There is no established or fixed formula for calculating CAPEX. The definition of CAPEX may vary from business to business. A Capital asset for one may be trading goods for another. Still, to find CAPEX, one can use two balance sheets of an entity and compare each figure of fixed assets like Buildings, machinery, furniture, or any other capex item and adjust the difference with other adjustments like depreciation, amortization, impairment, etc. The resulting figure will give details of net capital expenditure.

Examples of Capital Expenditure

Following are examples given below:

Example #1

Calculate capex incurred during the FY 2019 with the help of the following information:

| 1. Opening balance in Plant Property and equipment(PPE) cost was $10,00,000 |

| 2. Closing balance in PPE – $16,00,000 |

| 3. Depreciation charged – $3,00,000 |

Assume there is no other related transaction.

Solution:

| Sr. no. | Particulars | Amount($) |

| 1 | Closing Balance of PPE | 16,00,000 |

| 2 | Less: Opening Balance of PPE | 10,00,000 |

| Change in PPE | 6,00,000 | |

| 3 | Add: Depreciation | 3,00,000 |

| Capex during the year | 9,00,000 | |

Example #2

Classify each of the following as Capex/operating expenditure with justification

| 1. Incurred $20,000 to increase the operating capacity of the machine. |

| 2. Depreciation charged on machinery. |

| 3. Incurred general repair and maintenance of building $1,000 |

| 4. Purchased Orange Inc. company at a gross valuation of $2,00,000 |

Solution:

| Sr. No. | Nature | Justification |

| 1 | Capex | As the expenditure incurred will increase the operating capacity of the machine, it will provide benefits for more than one period. |

| 2 | Operating | As expenditure on the capital asset was already incurred at the time of inception, this is a part of the capex charged in the current financial year as an expense. |

| 3 | Operating | As this is a general repair cost that will not increase operating capacity and are routine |

| 4 | Capex | This is an investment in purchasing an entire business; it will be classified as capex as it will provide long-run benefits and involves huge costs. |

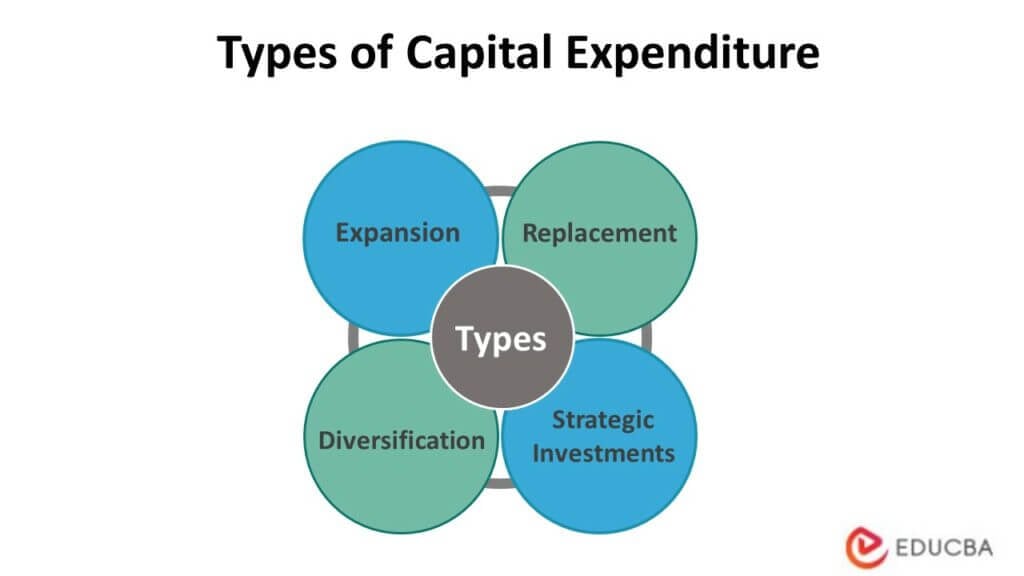

Types of Capital Expenditure

We have tried to group CAPEX into four main categories as follows: –

- Expansion: Complete new project undertaking or increase existing asset base, which helps in increasing production capacity.

- Replacement: Obsolete machines and equipment must be replaced due to wear and tear and the advancement of technology.

- Diversification: Certain expenses are made to diversify the business into new product lines and fields for multiple achievements.

- Strategic Investments: Expenses such as land, property, etc., are caused due to strategic investment decisions. That will surely reap the benefit either way.

Challenges of Capital Expenditure

The following are the challenges faced due to CAPEX –

- Substantial funds: Normally, huge funds are required for processing a capital expenditure, and the availability of funds may be an issue. Therefore, organizations must wisely make capex decisions.

- Irreversible: The decision cannot be changed easily once a CAPEX is incurred. Reversing the capex decision may prove to be significantly costlier for any entity.

- Uncertainty: It becomes difficult to foresight expenses that may occur in the future. CAPEX involves huge costs and results that may extend to the end. Hence, characterizing the exact CAPEX decision is uncertain, affecting future expenses.

- Measurement Issue: The cost and benefits of CAPEX are challenging to identify and measure

- Temporal Spread: Decisions made regarding CAPEX are consistent over a long time, and investments it includes are called long-term investments. These long-term investments create problems getting the exact discount rates and maintaining their equivalence in the coming period.

Importance of Capital Expenditure

- Long Term Effects: Effects of CAPEX sustained for a long-term period. Smoothness in running a business may be a result of previous CAPEX.

- High Initial Cost: The expenditures on the fixed assets may be expensive initially but provide potential solid benefits for the companies or organizations in the long run.

- Depreciation: By spending through CAPEX, there is an increase in an asset account which in turn increases the depreciation once the capital assets are put into use. This reduces the value of the capital asset and, in turn, provides tax benefits to a company.

- Business Valuation: Capex plays a significant role in determining the entity’s net worth. Valuation of existing capital assets is vital in business sales, amalgamation, merger deals, etc.

Difference Between Capital Expenditure and Operating Expenses

Operating expense is the expenditure done on the day to day basis for the regular functioning of the business, such as administrative expenses, general repair and maintenance, and utility expenses. In contrast, CAPEX incurs for providing long-term monetary benefits. The income statement records operating expenses as an expense. In comparison, CAPEX capitalizes in the balance sheet as assets and allocates as expenses throughout its useful life. Operating expenses are usually of a lower value as compared to Capex. Generally, for processing capex, Higher level management approval requires, which may not be essential in operating expense cases.

Conclusion

Capex is expenses expected to benefit the business organization for more than one accounting period. Each organization needs to undergo CAPEX initially and even regularly as per requirement. Capex involves a huge funds outlay, requiring higher management approval. Every organization should wisely incur capex as these are irreversible decisions, and business model failure may lead to the winding up of the organization. Low funding costs may be one of the indicators of efficient CAPEX funding.

Recommended Articles

This is a guide to Capital Expenditure. Here we also discuss the definition and challenges of capital expenditure, examples, and importance. You may also have a look at the following articles to learn more –