Updated November 21, 2023

Capital Gains Yield Formula (Table of Contents)

- Capital Gains Yield Formula

- Capital Gains Yield Calculator

- Capital Gains Yield Formula in Excel (With Excel Template)

Capital Gains Yield Formula

Where,

- P0: Initial Stock Price

- P1: Stock Price after the First time period.

The formula of capital gains can be stated as the ending price divided by the initial price minus one. Again, the alternative formula rearranges the capital gains yield formula shown earlier.

Capital Gains Yield Formula = Delta P / P0.

Capital games yield denotes the absolute return of a stock based on the appreciation of that particular stock after purchasing. The formula of capital gains yields is calculated by excluding the dividend paid by the stock. The dividend yield formula can calculate the dividend yield. We get the total return from this particular stock by combining capital gains yields and dividend yields. Capital gains are primarily used to calculate the rate of change of the stock price only. The rate of change can be found by subtracting the end amount from the buying price and then dividing it by the original amount.

Examples of Capital Gains Yield Formula

Example #1

Rajesh bought a share of Marico Ltd @ INR 600 on 1 January 2015. At the end of the year, they appreciated by 50%, and the stock price was quoted at INR 900. Marico announced a dividend of INR 12/ share at the end of the calendar year 2015. Calculate the Capital Gains Yields.

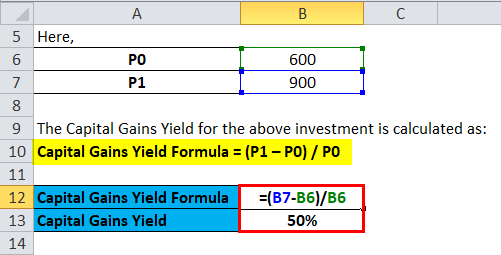

The Capital Gains Yield for the above investment is calculated as follows:

- Capital Gains Yield Formula = (P1 – P0) / P0

- Capital Gains Yield = (900-600)/600

- Capital Gains Yield = 300/600

- Capital Gains Yield = 0.5 or 50%

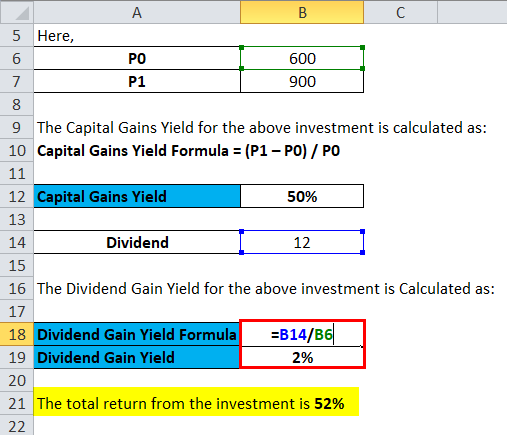

The Dividend Gain Yield for the above investment is 12 /600 = 0.02 or 2%

The total return from the investment is 52%.

Example #2

Mr. Jagmohon bought TATA Steel Limited on 1st April 2017@ at INR 550/ share and sold @ INR 450 on 31st December 2018. TATA Steel has allotted a dividend of INR 2/ share during the period. Calculate the Capital Gains Yields.

Since Mr. Jagmohon sold TATA Steel at a loss of INR (550-450) or INR 100, there has been no capital appreciation and capital appreciation in the Books of Mr. Jagmohon. So, the Capital yield formula is not applicable here. TATA Steel has announced a dividend of INR. 5.5/ Share during that period.

Again, as the dividend does not comprise a substantial portion of the stock, there is also no scope for capital appreciation. Thus, the capital Yield formula is not required.

Thus capital yield formula would be NIL. But the Dividend yield ratio would be 5.5/550= 0.01 or 1%

Example #3

Yami wants to see how much she has earned on a particular stock only based on capital appreciation/depreciation. She saw that when she bought the stock, the price was INR 100. After 2 years, the stock price has increased to INR 200 per share. What is the Capital Yield on that particular stock?

The Capital Gains Yield for the above investment is calculated as follows:

- Capital Gains Yield Formula = (P1 – P0) / P0

- Capital Gains Yield = (INR 200 – INR 100) / INR 100

- Capital Gains Yield = INR 100/ INR 100

- Capital Gains Yield = 1 or 100%

Thus there has been a capital appreciation of 100%

Explanation of Capital Gains Yield Formula

- The requirement of capital yield formula is used when there is a change in the buying price of a stock and with the selling price of the particular stock within a one-year time frame. When a stock price appreciates, the holder of the stock sales at a premium price, and the difference of the amount is entitled to a short-term capital gains tax.

- You can calculate the capital yield by subtracting the purchase price from the ceiling price, dividing the result by the purchase price, and then multiplying by 100. Thus we get capital gains to yield at absolute percentage terms.

- If security cannot generate a positive return, the selling price is higher than the buying price; there is no point in capital gains. In some cases, the dividend yield ratio may be higher, but the capital gain may be zero.

- Again, the stock may deliver a lower dividend yield, but there might be a capital gain. In that case, the company reflects its growth in the stock price instead of distributing it through a dividend.

Use of Capital Gains Yield Formula

- For every investor, capital gains used to be one of the prime aspects in calculating the premium value received against a stock. If the company has a good growth story, the stock price will reflect a premium price, and the appreciation will be reflected through the stock price.

- In practice, most companies don’t pay dividends despite higher profitability growth every year. The company compiles undistributed dividends within its profits. Thus, the stock price denotes the absolute return in the form of the stock price.

- Thus there is no dividend yield ratio for the investor. The stock market’s appreciation of the stock price shows that the company is experiencing growth. The difference between the buying price and selling price of a stock reflects the absolute capital gain yield.

Capital Gains Yield Calculator

You can use the following Capital Gains Yield Calculator

| P1 | |

| P0 | |

| Capital Gains Yield Formula = | |

| Capital Gains Yield Formula = |

|

|

Capital Gains Yield Formula in Excel (With Excel Template)

Here we will do the same example of the Capital Gains Yield formula in Excel. It is very easy and simple. You need to provide the two inputs, i.e., Initial Stock Price and Stock Price after First time period

You can easily calculate the Capital Gains Yield using the formula in the template provided.

First, We Calculate Capital Gains Yield Using Formula

Then We Calculate the Dividend Gain Yield

Conclusion

In case of appreciation of a stock price, investors require both dividend yield and capital gains yield. In most cases, a growing business gives a scope of capital appreciation for the shareholders. Yields refer to the profits generated after selling a particular stock at a premium price over some time based on the invested amount. The excess cash flow the investor receives after investing in the security measures the return on investment. In most cases, you compute a yield yearly, and in extreme cases, you calculate results every six months or every quarter.

Recommended Articles

This has been a guide to a Capital Gains Yield formula. Here we discuss its uses along with practical examples. We also provide Capital Gains Yield Calculator with a downloadable Excel template. You may also look at the following articles to learn more –