Updated July 20, 2023

Definition of Capital Investment

Capital investment is the money invested by the business on long-term fixed assets such as land, building, plant & machinery, etc. that can help the business to generate income for more than a year rather than using the amount for routine expenses like wages, power & fuel, purchase of goods, etc. and generally these investments requires huge funds of the business.

Explanation

It involves expenditure on long-term assets that will provide economic benefits to the business for a duration that is longer than a year. The business needs land & building to start a business then they have the option to rent it or purchase it. Purchasing land & building requires heavy investment and such investment is an example of capital investment on Land & Building as that Land & Building will be used by the business for several years. Apart from Land & Building, Plant & machinery are needed to manufacture goods and these Plant & Machinery are again the capital investment for the business as the same will be used for more than a year to manufacture the goods that the business deals with. Most companies raise money from debt and equity funds to arrange the funds required for the capital investment of the business.

How Does it Work?

It is the business investment in the acquisition of long-term fixed assets. Therefore, it requires a huge amount of funds. The various ways through which a business owner arranges these funds are as follows: Small businesses can have their own savings that can be used to purchase a capital asset or they can ask their friends and relatives to provide them loans apart from the financial institutions.

Even the big companies try to utilize their own reserves or available cash funds for the purchase of a capital asset. Reserves are the accumulated profits of the company which is basically in layman’s language, the savings of the company but if the company doesn’t have a sufficient amount of owned funds then they can raise money through equity and debt funding i.e., by issuing equity shares, preference shares or debentures to the public for raising funds. Even companies can take loans from banks or from other financial institutions to fulfilling the need for funds that are required to purchase the capital asset.

Example of Capital Investment

Mr. John wishes to start a business of food in California. He planned out the things that he needs to set up a business.

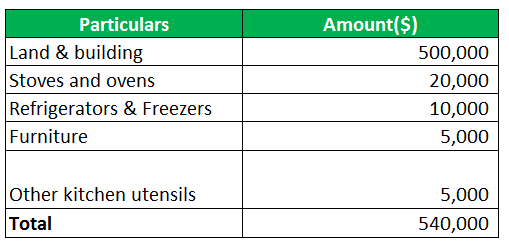

The main things that he requires are as follows with their estimated cost price.

- Land & building worth $500,000

- Stoves and ovens worth $20,000

- Refrigerators & Freezers worth $10,000

- Furniture worth $5,000

- Other kitchen utensils $5,000 (usable for more than a year)

- Vegetables worth $200

- Flour and spices worth $500

Now from the above expenditure calculate the amount of capital investment.

Solution:

It is a heavy investment that will provide benefits for several years. So the total capital investment is:

Therefore, the total capital expenditure is $540,000. The vegetables, flour, and spices will give benefit only for a year and will be purchased regularly for routine operations so they are not capital investments.

Importance of Capital Investment

The capital investment is done by every business owner to own the assets that will be required for the growth and survival of the business. It involves spending funds for generating future economic benefits, increasing the efficiency of operations, generating revenues at a large scale, and acquiring a large share in this competitive market.

Capital Investment vs Working Capital

The difference between Capital Investment and Working Capital is as follows:

- Capital investment refers to the investment in long-term assets which includes both tangible assets such as plants & machinery, furniture, building, etc., and intangible assets such as goodwill, patent, intellectual property, etc. whereas working capital refers to the expenses that are incurred during the normal course of business and are calculated by deducting current liabilities from the current assets of the business.

- It is an investment that will give benefits for a longer duration i.e. for more than a year but working capital calculates the short-term liquidity position of the business.

Advantages

- The main advantage of capital investment is the flow of economic benefit for several years i.e., the same asset will be used over a long period of time to generate revenues for the business. These are generally one-time investments but are being used for many years.

- It also helps in providing employment to the public as manpower will be required to operate such heavy investments like plants & machinery. Therefore, Capital investment helps in reducing unemployment.

- A good capital investment can provide a competitive advantage over the competitors as it can help in providing better goods and services to the customers than the competitors.

Limitations

- It requires a huge amount of funds that increase the cost of the business. For example when the business takes a loan from a financial institution the latter charges interest on that loan which increases the expense of the business.

- Business is all about taking risks. The purchase of a capital asset is again a risk for the company because if the asset fails to provide the expected economic benefits due to any factor like change in demand, changes in government policies, technological changes, etc. then this will result in the loss to the business.

Conclusion

It involves expenditure on the assets that will be used for a longer duration. The choice of capital investment should be done wisely as these investments require a large number of funds. But there are many sources from which the funds can be arranged apart from using owned funds like equity and debt funding, a loan from financial institutions, etc.

Recommended Articles

This is a guide to Capital Investment. Here we discuss the introduction to capital investment along with examples, advantages, and disadvantages. You may also have a look at the following articles to learn more –