Updated July 24, 2023

Capital Investment Formula (Table of Contents)

What is the Capital Investment Formula?

The term “capital investment” refers to the investment made in the acquisition of capital assets such as land, plants, buildings, etc. The capital investment is eventually reflected in the gross/netblock, mostly as part of the property, plant, and equipment (PP&E) which is captured as a separate line item in the balance sheet.

The formula for capital investment can be expressed as an aggregate of a net increase in the value of gross block and depreciation charged for the period. Mathematically, it is represented as,

Examples of Capital Investment Formula (With Excel Template)

Let’s take an example to understand the calculation of Capital Investment in a better manner.

Capital Investment Formula – Example #1

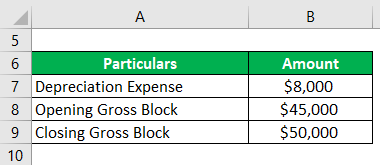

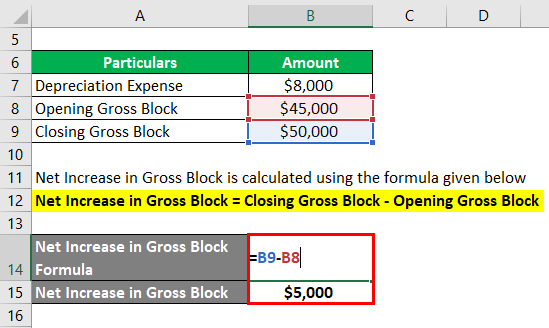

Let us take the example of a company and compute its capital investment in 2018 on the basis of the following information, Depreciation expense of $8,000 (income statement), Gross block at the start of the year of $45,000 (balance sheet), Gross block at the end of the year of $50,000 (balance sheet).

Solution:

Net Increase in Gross Block is calculated using the formula given below

Net Increase in Gross Block = Closing Gross Block – Opening Gross Block

- Net Increase in Gross Block = $50,000 – $45,000

- Net Increase in Gross Block = $5,000

Capital Investment is calculated using the formula given below

Capital Investment = Net Increase in Gross Block + Depreciation Expense

- Capital Investment = $5,000 + $8,000

- Capital Investment = $13,000

Therefore, the company incurred a capital investment of $13,000 during the year 2018.

Capital Investment Formula – Example #2

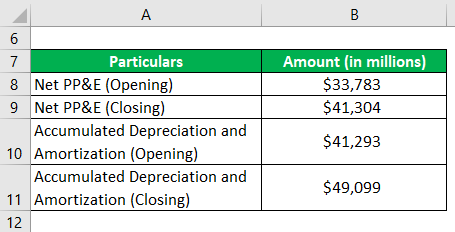

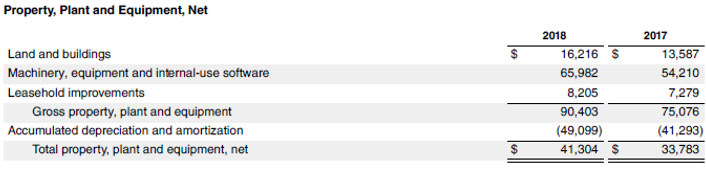

Let us now take the example of Apple Inc. to illustrate the computation of capital investment based on the following information, Accumulated depreciation and amortization at the start of 2018: $41,293 million, Accumulated depreciation and amortization at the end of 2018: $49,099 million, Net PP&E at the start of 2018: $33,783 million, Net PP&E at the end of 2018: $41,304 million.

Solution:

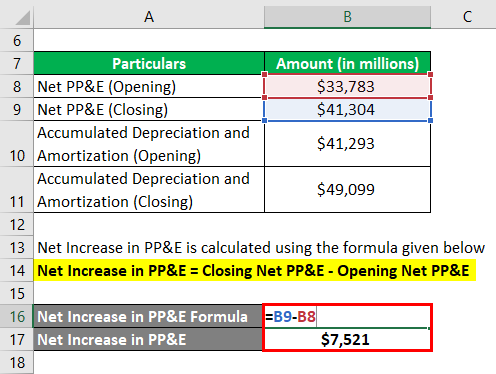

Net Increase in PP&E is calculated using the formula given below

Net Increase in PP&E = Closing Net PP&E – Opening Net PP&E

- Net Increase in PP&E = $41,304 million – $33,783 million

- Net Increase in PP&E = $7,521 million

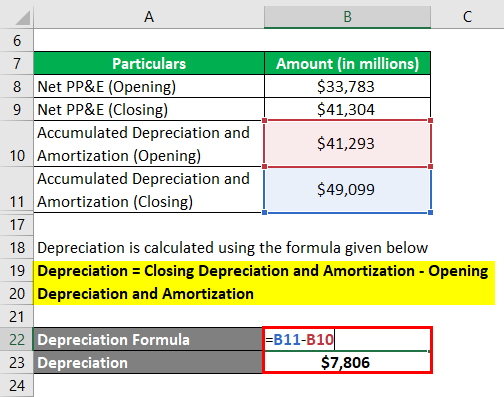

Depreciation is calculated using the formula given below

Depreciation = Closing Depreciation and Amortization – Opening Depreciation and Amortization

- Depreciation = $49,099 million – $41,293 million

- Depreciation = $7,806 million

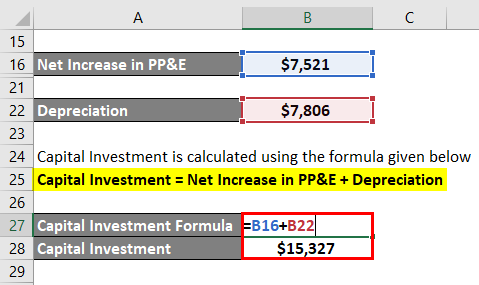

Capital Investment is calculated using the formula given below

Capital Investment = Net Increase in PP&E + Depreciation

- Capital Investment = $7,521 million + $7,806 million

- Capital Investment = $15,327 million

Screenshot of Income Statement Used for Calculation

Source Link: Apple Inc. Balance Sheet

Explanation

The formula for capital investment can be derived by using the following steps:

Step 1: Firstly, determine the value of the gross block of the subject company at the start of the period and at the end of the period, and is easily available in the balance sheet. Next, compute the net increase in the gross block by subtracting the opening value of the gross block from the closing value of the gross block.

Net Increase in Gross Block = Closing Gross Block – Opening Gross Block

Step 2: Next, determine the value of the depreciation expense charged for the given period. It is available as a separate line item in the income statement or the cash flow statement. Otherwise, it can be computed by subtracting the value of accumulated depreciation at the start of the period from the value of accumulated depreciation at the end of the period.

Step 3: Finally, the formula for capital investment can be derived by adding a net increase in the value of gross block (step 1) to the depreciation expense (step 2) charged for the period as shown below.

Capital Investment = Net Increase in Gross Block + Depreciation Expense

which can also be expressed as,

or

Relevance and Use of Capital Investment Formula

From the point of view of any business, it is very important to understand the concept of capital investment because as the name suggests it is of high value and is intended for operational improvement. Capital investment is incurred either for setting up new equipment/ facilities or upgrading of the existing equipment/ facilities to make sure that the company operates with state-of-the-art technology. The objective of capital investment is potential benefits in the future which is usually part of a company’s long term strategic goals.

However, one of the biggest challenges related to capital investment is that it is a fixed cost in nature (depreciation) and in the company fails to scale up its operations as per plan, then capital investment can result in significant financial agony. As such, a wrong decision associated with capital investment can have a damaging effect on the company’s growth.

Capital Investment Formula Calculator

You can use the following Capital Investment Formula Calculator

| Net Increase in Gross Block | |

| Depreciation Expense | |

| Capital Investment = | |

| Capital Investment = | Net Increase in Gross Block + Depreciation Expense | |

| 0 + 0 = | 0 |

Recommended Articles

This is a guide to Capital Investment Formula. Here we discuss how to calculate Capital Investment along with practical examples. We also provide a Capital Investment calculator with a downloadable excel template. You may look at the following articles to learn more :