Updated July 24, 2023

Definition of Capitalization Ratio

Capitalization ratio, (CR), also known as the financial leverage ratio, is a financial ratio that measures the extent of total debt in a company against the total capital structure in the company. The ratio reflects the company’s dependence on outside debt and the extent to which it is using its equity capital for its operations and goals.

Formula

It can be calculated using the following formula.

Thus, capitalization ratio can be calculated for any company by dividing the amount of long-term debt by the total capital structure i.e. the aggregate of long-term debt and shareholder’s equity. Shareholder’s equity will mean the book value of the equity investments in the company.

Examples of Capitalization Ratio (With Excel Template)

Let’s take an example to understand the calculation in a better manner.

Example #1

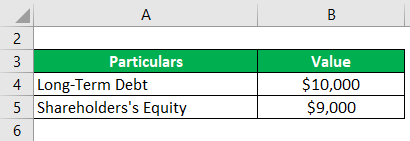

Suppose the following information is available with respect to a company for the year ended 31st December 2019.

Solution:

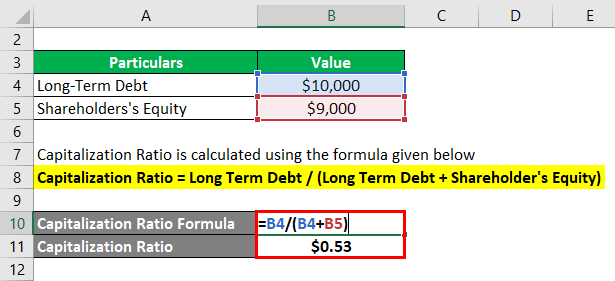

Capitalization Ratio is calculated using the formula given below

Capitalization Ratio = Long Term Debt / (Long Term Debt + Shareholder’s Equity)

- CR = 10,000 / (10,000+9,000)

- CR = 0.53

Here, the ratio comes out to be 0.53.

Example #2

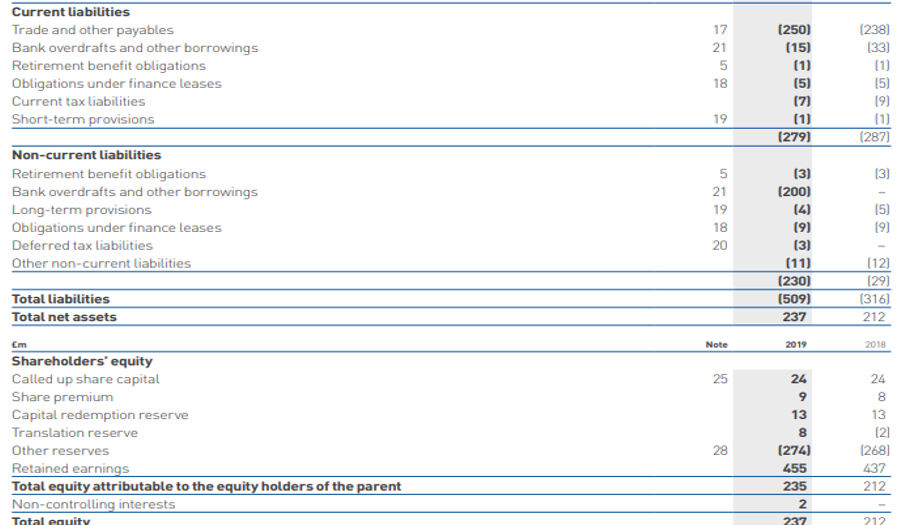

The extracts of financial statements of WH Smith PLC for the period ended 31st August 2019 is provided below. Let us try and examine how can we calculate the capitalization ratio.

Source Link: whsmithplc.co.uk

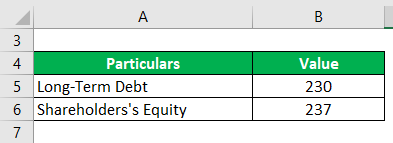

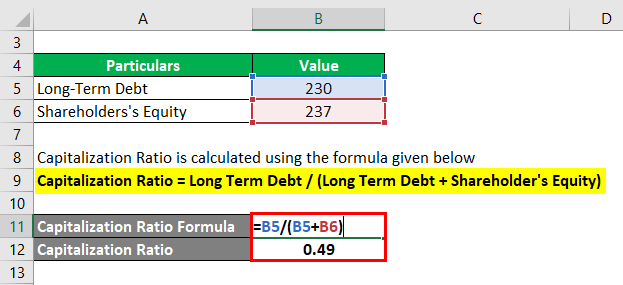

Solution:

Long-term Debt = 230 (The same is represented by way of non-current liabilities in the balance sheet of the company)

Shareholder’s Equity = 237

Capitalization Ratio is calculated using the formula given below

Capitalization Ratio = Long Term Debt / (Long Term Debt + Shareholder’s Equity)

- CR = 230 / (230 + 237)

- CR = 0.49

Here, the ratio comes out to be 0.49.

Importance of Capitalization Ratio

Let us understand the importance of this ratio.

- The ratio is helpful in understanding the financial leverage of the company. It represents the long-term debt of a company against its total capital structure (or capitalization). Thus, the ratio gives and indicates that out of the total capitalization of the company, how much of the company is financed by long-term loans?

- It indicates the level of the company’s dependence on long-term loans to run its operations and finance its assets.

- On average, a ratio of less than 0.50 is considered to be good, as it reflects that the company is financed more by equity than the outside long-term debt. A ratio deteriorates when it keeps on moving above the mark of 0.50.

- This is because the higher ratio would reflect that the company finances its operations and assets by way of long-term loans more. However, the ratio can differ from one industry to another based on the differences in each industry. For example, an industry that involves major investments in fixed assets would normally have a higher ratio than others.

- Thus, it is important to compare the ratio within the industry in which the company operates, rather than following any set benchmark.

Benefits of Capitalization Ratio

The following benefits to the users are given below.

- A higher capitalization ratio will provide better after-tax returns to the shareholders. This is because the interest paid on the debts is tax-deductible in the hands of the company as an expense.

- The ratio indicates the level of existing debts of the company. Thus, financial institutions can make use of this ratio to analyze whether the applicant company is in a position to handle more debts or whether would it be risky to provide more debts to the company.

- To an investor, the ratio provides an idea as to how much the company is dependent on debts.

Conclusion

In the case of capitalization ratios, a lower ratios is always appreciated. But, even if a company has a higher ratio, it can not be said that the company is not financially sound. This is because the usage of debt is not always risky. One should consider other facts also before reaching any conclusion.

Recommended Articles

This is a guide to the Capitalization Ratio. Here we discuss how to calculate the capitalization ratio along with practical examples. we also provide a downloadable Excel template. You may also look at the following articles to learn more –