Updated July 27, 2023

Definition of Corporate Finance

Corporate finance is one of the crucial parts of finance, which deals with capital budgeting, financing, and return of capital invested in the business, including dividend decisions.

In other words, we can say that corporate finance is nothing but a branch of finance whose objective is to increase the value of shareholders’ wealth by implementing financial strategic planning with the balancing of internal and external risk. So a professional in corporate finance is primarily tasked to deal with various funding sources, budgeting, and analyzing and monitoring fund investors.

Corporate finance offers a lucrative career path with significant growth opportunities and attractive remuneration. It is not so vibrant at the past when a professional gets an opportunity for experimentation, analysis, allocation, and measuring optimum utilization of various resources to maximize the owner’s funds. The following essential qualities are considered for a potential candidate in this field –

Education Required for Making a Career in Corporate Finance

To establish themselves as finance professionals or advance in their career path, individuals can pursue certifications such as Chartered Accountancy (CA) or Cost and Management Accountancy (ICWA) or obtain a Master of Business Administration (MBA) with a specialization in finance. Still, various certificate and training courses are provided by some renowned business schools and universities worldwide covering this particular niche of finance. But the cost of participation in those courses varies from one school to another, and that is why the aspirant should consult the institutions individually to obtain specific information regarding tuition fees and faculties. Some of the acclaimed corporate finance courses are as follows:

- Chartered Financial Analyst (CFA)

- Certified Financial Planner

- Chartered Institute of Management Accountancy

- Chartered Accountancy from the Institute of Chartered Accountants in England and Wales

- Financial Risk Management

- Certified Public Accountants (CPA)

- Bachelor of Financial and Investment Analyst

- Company Secretary from the Institute of Company Secretaries of India

- Financial and Banking Analysis certification

- Post-graduation diploma in financial management

These courses give an edge to the career path considering the real business situations and challenges.

Career Path in Corporate Finance

The professional who has aspired to establish anyone in corporate finance must have strong analytical skills, problem-solving, and commercial awareness; these are the key ingredients that companies search for in a candidate. The job of corporate finance professional encompasses four crucial responsibilities, including identifying the requirement, taking strategy, allocating financial resources, and monitoring the investment to achieve the business goal.

The career path of a professional in corporate finance is highly lucrative as it pops up mammoth learning opportunities. The professionals of this knowledge domain demand high respect in the corporate world as they handle areas such as business valuation for listing in the stock market, dealing with mergers and acquisitions, issuing debentures and bonds for raising debts, capital structure decisions, cross-border transactions involving international financial management, managing currency and it’s volatility, strategizing various risk management measures such as currency hedging, swaps including interest rate swaps and working capital management.

Job Positions or Application Areas

There are many career options for an enthusiast to become a corporate finance professional. Some prominent position which is highly demanding is as follows.

- Chief Financial Officer ( CFO)

- Investment Manager

- Fund Manager

- Financial Analyst

- Cost Analyst

- Treasurer

- Controller

- Credit Manager

- Benefits Officer

- Investor Relations Officer

In today’s business world, corporate finance encapsulates various roles in various industries like banks, corporates, institutions, PSU and public accounting, and various consulting firms. So as a student or a professional, you have to be cautious about your strengths and interest to choose the right direction in your career path. A professional can also become an entrepreneur in a consulting role by opening up his firm with a certificate of practice from any of the reputed institutes such as CA, ICWA, CFA, CPA, etc.

Salary

The professionals of corporate finance are renowned for being highly paid. However, it differs from company to company or industry-wise depending on the intricacies of policies, experience, and qualification of the employee and the organizational structure and ecosystem of the industry. In India, people in this profession can expect to start earning at a minimum of Rs.50000 – 60000 per month, and experience can go beyond Rs.500000 per month, approximately associated with some incentives or bonuses or attractive perks.

Career Outlook in Corporate Finance

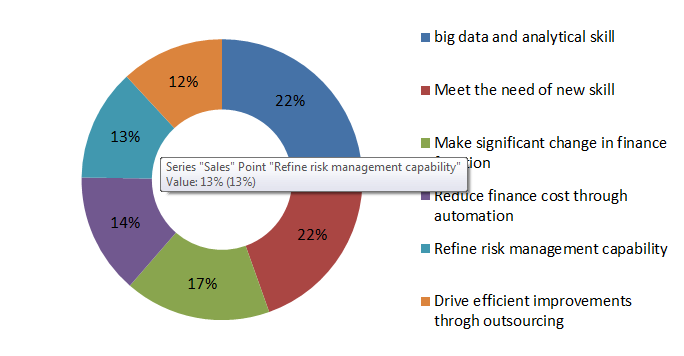

The career prospects and demand in corporate finance present significant challenges. Businesses highly value young, talented financial advisors who make pivotal growth-driving decisions in a fiercely competitive environment. The intricacies of the market necessitate a growing need for diverse financial decisions, leading to a projected growth rate of 11 percent in financial jobs from 2016 to 2026—exceeding the average growth rate of other occupations. While technological advancements such as artificial intelligence, cloud computing, and robotic process automation may render certain mundane accountancy roles obsolete, they also bring new opportunities aligned with evolving market demands. The future finance workforce requires technological proficiency, knowledge, emotional intelligence, and strong interpersonal abilities. Forecasts indicate that future finance functions will transform, as depicted in the chart below.

Recommended Articles

This is a guide to Career in Corporate Finance. Here we discuss the Education, Career Path, Job Position, Salary, and Career Outlook in Corporate Finance. You may also look at the following article to learn more –