Introduction to a Career in Finance

Finance is an evergreen word. Finance is a word associated with everything, as nothing comes for free in this world, and hence it has a great scope.

Finance is a field concerned with the allocation (investment) of assets and liabilities over space and time, often under conditions of risk or uncertainty. One can also define finance as the art of money management.

Two of the main types of finance include:

- Debt finance: Money borrowed from external lenders, such as a bank.

- Equity finance: Investing your own money or funds from other stakeholders in exchange for partial ownership.

Education Required for Finance

A financial analyst needs a minimum of a basic degree—preferably in a finance-related major, such as accounting, statistics, or economics. However, as in every field, a master’s degree is highly beneficial. In the finance sector, pursuing advanced education can significantly boost career prospects. Analysts aiming for greater job opportunities and higher salaries might consider a master’s degree in finance or a Master of Business Administration (MBA).

The 10 skills that count for your career in finance are:

1. Communication skills

- As in any other industry, communication plays a vital role in the Finance Industry; it is one of the fundamental aspects seen in a candidate while making a judgment.

- Sound knowledge of the subject and good communication are perfect for recruiters.

2. Basic Accounting Knowledge and a Minimal Accounting Degree from a Recognized Institution

- Sound knowledge with some real-time work experience will land the dream job.

- A Career in Finance means a candidate should have demonstrated practical knowledge of the subject; just mentioning it in the resume will not work.

- Hiring organizations can easily support candidates with a basic degree and fair knowledge of the subject.

3. Interpersonal Skills

- Finance professionals are no more just bound to cubicles; they play a dynamic role in today’s era.

- In today’s era, we require a good number of resources to work in the finance sector as we need to deal with clients regularly, and for this, Interpersonal skill is an added advantage.

- As in every field, finance also has a lot of competition in the market, so for building a good relationship with different customers worldwide, it is essential to excel.

- When we compare two equally qualified hires, interpersonal skills are the most common point of difference, which means a lot.

4. Financial Reporting

- Professionals require financial reporting skills, especially in growing areas like super forecasting.

- However, finding a candidate with strong financial reporting skills is difficult.

5. Analytical Ability

- Candidates with high analytical abilities are the most preferred as they can implement their thinking, analyze the scenarios, and draw definite conclusions.

- Candidates looking for a successful career in finance must demonstrate their analytical abilities with real-world examples and some of their demonstrated work.

6. Problem-Solving Skills

- It is not just essential to have complete knowledge of the system, but the ability to learn is what matters; it is important to stay calm and have the ability to tackle complex problems.

- The record of solving the problem and bringing it to closure is the thing that makes the candidate stand out.

7. Knowledge of Information Technology

- The main focus in today’s era is on digitization and automation. Therefore, it has encouraged managers to look for financial domain knowledge and IT skills knowledge.

- Automation, Predictive Analytics, and SAP are preferred IT skills in the market.

8. Managerial-level Experience

- It is always good to have managerial skills as it will help to own things much better.

- If someone has proven their ability to manage teams during their career in any field, they are bound to excel in a leadership position.

9. Commercial Data

- The company expects employees to be well-versed in the company’s fiscal data and market standards.

10. Innovation in the Finance Sector

- Finance and accounting may be associated with a monetary system, but that doesn’t mean innovation doesn’t have its place; there is always a lot of scope for innovation in every field.

Career Path In Finance

The finance sector includes the following major sectors:

- Banks

- Investment Funds

- Insurance Companies

- Real Estate

The finance sector can fetch you any job you desire–from an accountant in a small firm to an investment banker in a giant MNC.

It’s up to the person what kind of city, salary, post, etc., he wants.

Job Position or Application Area

The different areas of work in financial services:

- Careers in Retail and Commercial Banking.

- Commercial Finance.

- Corporate Finance.

- Financial Accounting.

- Financial Planning & Wealth Management.

- Specialist Markets.

- Structured Finance.

Salary

As mentioned above, finance is an evergreen field, so there is no way that a person with sound knowledge and an adequate degree cannot get a good salary. The median annual wage for financial analysts was $84,300 in May 2017.

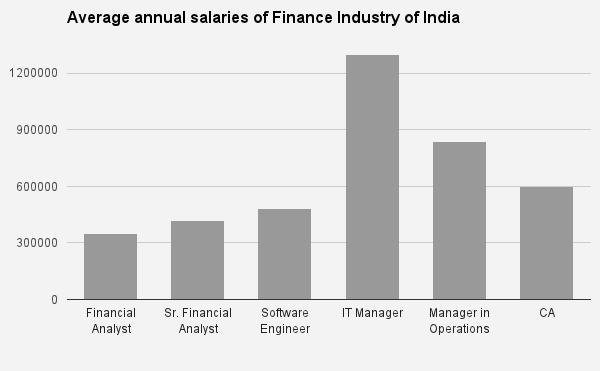

Below is the graph where the salary of various posts in finance:

Career Outlook in Finance

The employment of financial analysts in this domain is projected to grow 11 percent from 2016 to 2026, which is faster than the average for all the other occupations.

Conclusion – Career in Finance

An extra precaution is required when monetary things are involved; the same applies to the Financial sector. It is sometimes stressful, and one needs to stand out to get lucrative salaries in this sector regarding domain knowledge and communication abilities. Therefore, On the other hand, successful people show a distinct passion for their work, which is very much evident to their colleagues and seniors, and it makes them shine like a star, and they become an asset to the company.

Recommended Articles

This has been a guide to Career in Finance. Here we have discussed education, career path, job position, salary, and career outlook in finance. You may also look at the following articles to learn more –