Carriage Inwards Meaning

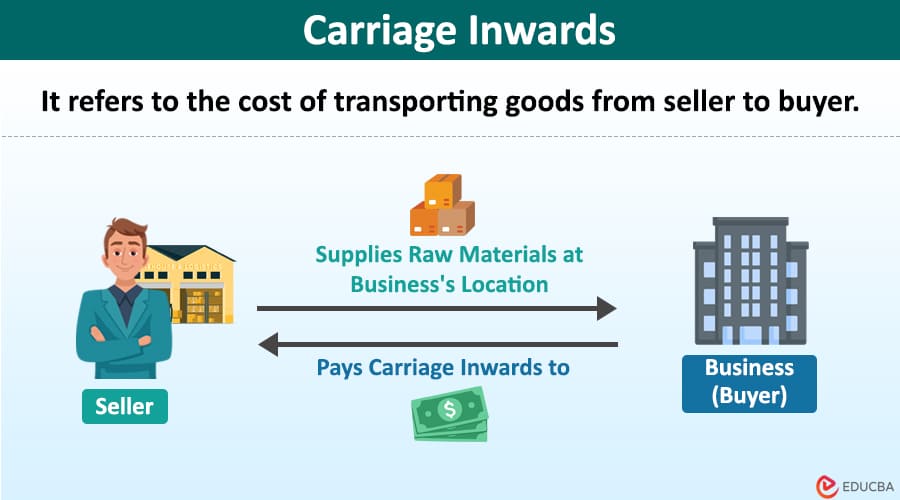

Carriage inwards is the cost of transportation a business (buyer) pays to the supplier when the supplier delivers goods at their place. This cost depends on the transportation mode (air, road, or water), traveling distance, and nature of the goods.

In business, it may also refer to the cost of purchasing assets and stocks. Companies often include carriage inwards in their income statement as part of their Cost of Goods Sold (COGS).

Table of Contents

- Meaning

- Types

- Formula

- Examples

- Journal Entries (With Examples)

- Responsibility

- Carrier Inwards vs. Carrier Outwards

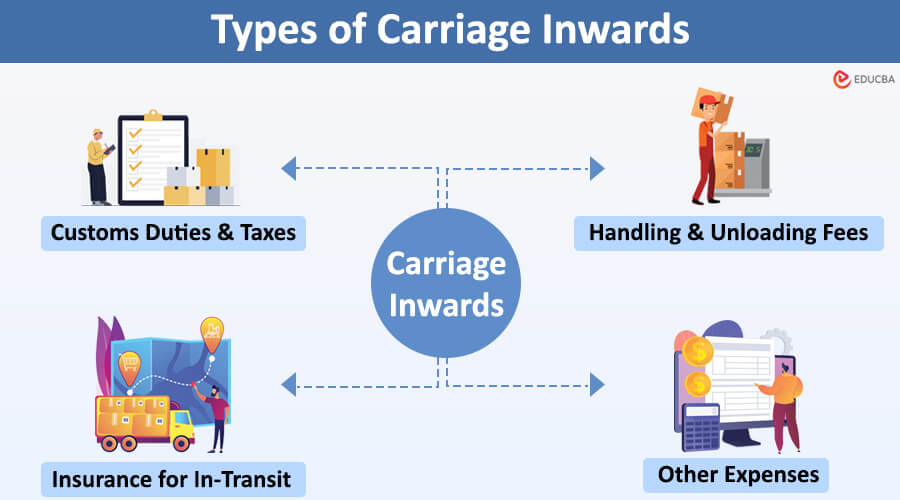

Types

1. Customs Duties and Taxes

It includes customs duties, tariffs, and taxes imposed by the importing country’s government, mainly customs authorities, which buyers must pay.

2. Handling and Unloading Fees

It refers to the costs associated with unloading goods at the destination, including labor charges and equipment usage fees.

3. Insurance for In-Transit

Sometimes, insurance covering the transportation cost of goods is a part of carriage inwards. This insurance ensures protection against loss or damage to the goods during transportation.

4. Other Expenses

It includes other additional costs, such as storage charges for storing goods temporarily at a warehouse if there is a delay in delivery. It might also include permit fees, shipping documentation, and administrative costs.

Formula

The formula to calculate the total cost of sales using carriage inwards is as follows.

Examples

Let’s understand carriage inwards with the following examples.

Example #1

Imagine a boutique named “Royal Fashion” purchasing 100 units of stylish winter custom hoodies from supplier “Fab Hoodies.” However, the seller charges an additional $200 for shipping and handling charges. Let’s calculate the total amount “Royal Fashion” must pay.

Solution:

Let’s calculate the total cost with the following formula.

Total Cost of Sales = Purchase Price + Carriage Inwards (Shipping and Handling)

= $2000 + $200 = $2200

Hence, the total cost that “Royal Fashion” has to pay its seller for procuring jackets is $2,200.

Example #2

Suppose a retail store, “Organic Skin Care“, specializes in selling organic cosmetics. The following are the costs they incur when purchasing their inventory, and we have to calculate the total cost of sales.

- $70,000 for buying the cosmetics

- $2,000 for import taxes and fees

- $1,000 for shipping and handling

- $300 for rail transportation

- $3,000 for setup fees

Solution:

#1: Let’s calculate the carriage inward with the following formula.

Rail Transportation + Setup Fees

= $2,000 + $1,000 + $300 + $3,000

Total Carriage Inward = $6,300

#2: Now, we will calculate the total value of the inventory or the total cost of sales as follows.

= $70,000 + $6,300 = $76,300

So, the total value of the inventory is $76,300. When the store sells cosmetics, the cost of carriage inward and the initial purchase price are included in the revenue section of the cost of goods sold.

Journal Entries (With Examples)

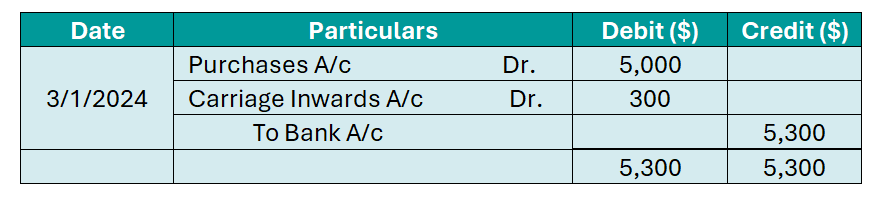

Let’s understand the journal entry of carriage (freight) inwards with the following examples.

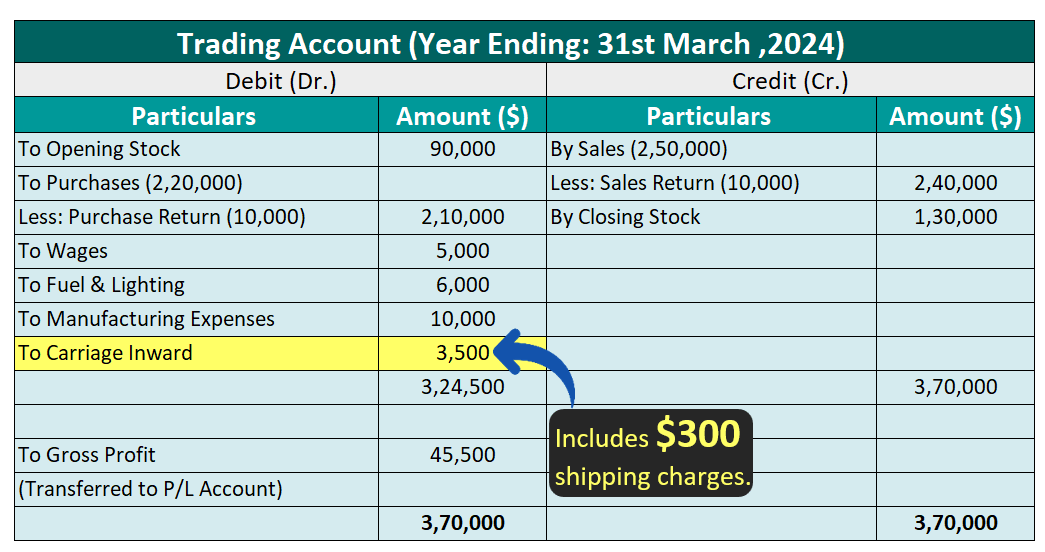

Consider the company XYZ that buys inventory for manufacturing its products. Let’s say it purchases raw materials worth $5,000. However, it must also pay for shipping charges while importing these materials, which cost $300.

1) Journal entry for the purchase of inventory:

This means that Company XYZ has debited the following accounts:

- Purchases account for the raw materials purchased.

- Carriage inwards account for the amount paid as customs duty.

The credit entry is made in:

- Bank account (it represents the amount Company XYZ owes to its suppliers).

Later on, when the business prepares its Trading Account, it can transfer the amount of carriage inwards to the credit side of the account.

2) Journal entry for the transfer of carriage inwards to the trading account is as follows:

3) Carriage inwards is shown as follows in the trading account:

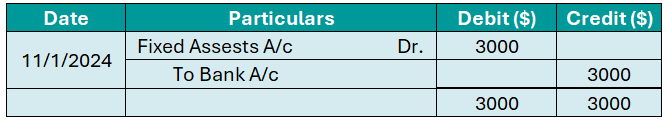

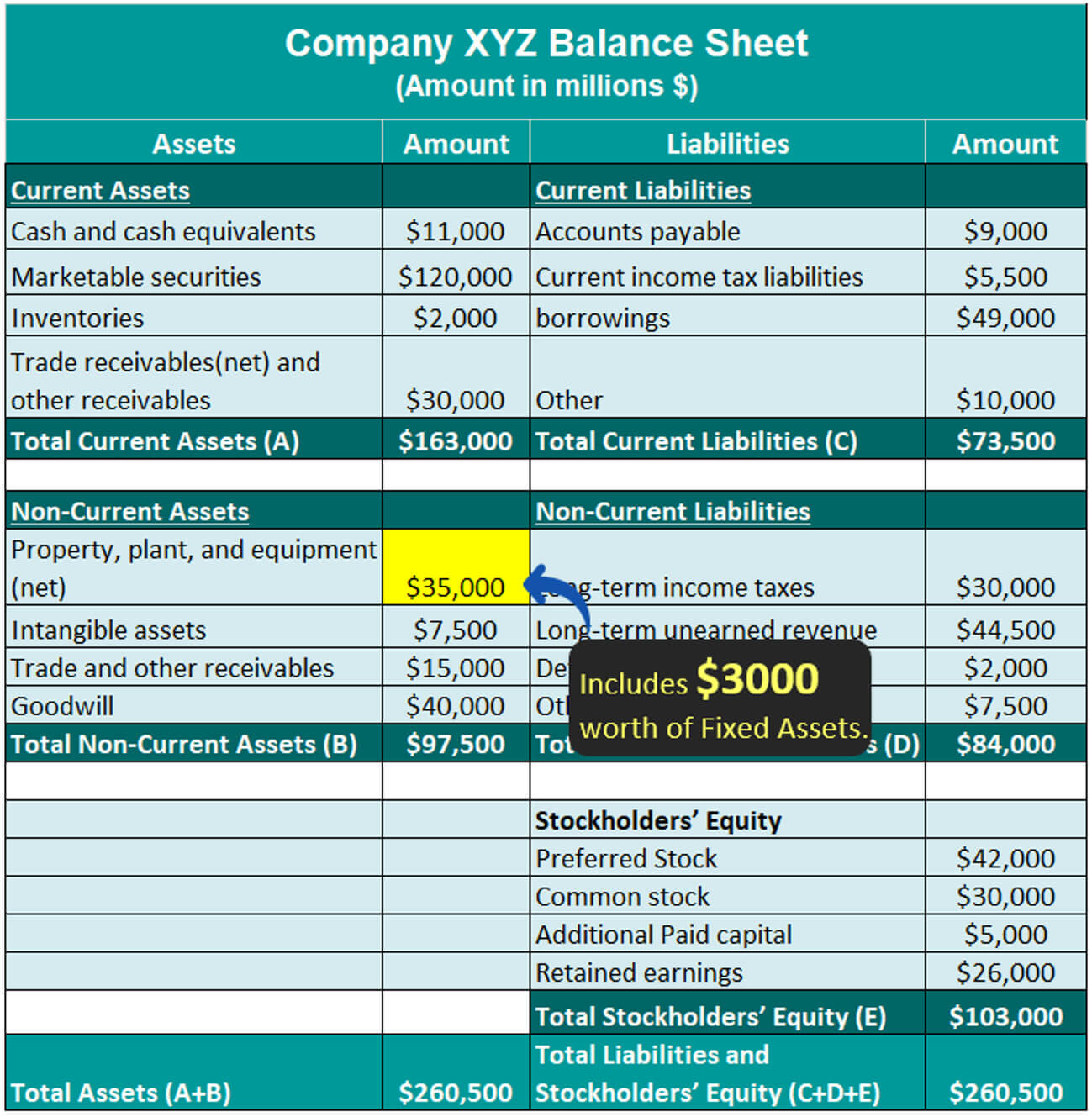

Now, company XYZ has purchased fixed assets worth $3,000.

4) The journal entry for purchasing fixed assets is as follows:

5) The total amount of Property, plant, and equipments in the balance sheet includes the cost of carriage inwards paid for fixed assets:

Responsibility

Carriage inwards is an important concept in shipment agreements. This shipment agreement and the chosen Incoterms (International Commercial Terms) mention the responsibility of who will bear the carriage inwards. And they enter the amount in the trial balance.

The following are the responsibilities according to the Incoterm shipment agreement.

1. Buyer Responsibility

Under Ex Works and FCA (Free Carrier) Incoterms, the buyer is responsible for the full transportation cost from the seller’s warehouse to its destination. The seller is only responsible for making the goods available to the buyer.

2. Seller Responsibility

Under CFR (Cost and Freight) and DAP (Delivered At Place) Incoterm agreements, the seller bears the entire carriage’s inward expenses.

3. Shared Responsibility

In a FOB (Free On Board) or CPT (Carriage Paid To) shipment agreement, the buyer and seller share the responsibility and contribute towards the carriage inwards.

Carriage Inward vs Carriage Outward

The following is the difference between carriage inward and outward.

| Particulars | Carriage Inwards | Carriage Outwards |

| Definition | It is the cost of transporting goods from seller to buyer. | It is the cost of transporting goods from buyer to recipient (customers). |

| Responsibility | The buyer is liable for the transportation cost. | The seller typically bears the cost of transportation. |

| Expense type | Handled as a direct expense. | Handled as an indirect expense. |

Final Thoughts

To conclude, carriage inward is important in a company’s financial analysis. The responsibility of it depends on the buyer and seller’s terms and conditions. It is, therefore, important to understand the process and where to record that transaction in the income statement.

Frequently Asked Questions (FAQs)

Q1. What is the alternate term for carriage inward?

Answer: The alternate terms of carriage inward are freight inwards, transportation inwards, or shipping cost.

Q2. Is carriage inward debit or credit?

Answer: When doing accounting, the company records or enters carriage inwards as a debit in the cash book, like direct expense. (Dr.).

Q3. What is the importance of carriage inward?

Answer: The importance of carriage inward is as follows.

- It helps in assigning transportation costs to relevant accounts.

- It helps to measure the inventory value on the balance sheet.

- Also, it helps choose the correct suppliers who supply materials at relevant costs.

- Businesses can use carriage inwards to manage inventory costs by selecting the proper transportation mode and cost.

- It is essential for maintaining transparent relationships between sellers and buyers.

Q4. What makes carriage inwards a capital expense?

Answer: Companies consider carriage inwards a capital expense because it directly represents the cost of acquiring a fixed or capital asset. In accounting principles, any expenses incurred in purchasing or improving assets are often termed capitalized, i.e., added to the asset’s value.

Recommended Articles

We hope this article on “Carriage Inwards” was informative. For more information on related topics, refer to the article below.