Updated July 3, 2023

What is a Cash Book?

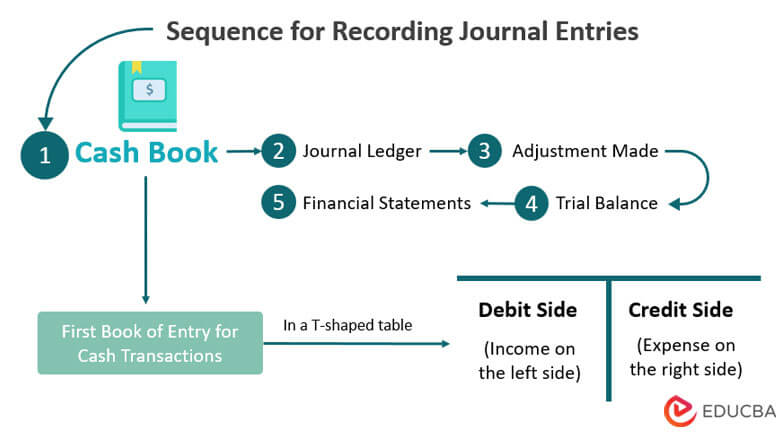

A cash book is a first and foremost book in the books of accounts that manages only the cash transactions of a company. It is a T-shaped table with two sides, viz., Debit Side (on the left) and Credit Side (on the right).

The debit side shows the income/remaining balance from the previous month. The credit side analyses the expenses and balances the cash book as per the income.

We have all seen that diary our local shopkeepers use to jot down each item they sell daily. This diary acts as their simple cash book, helping them keep track of the money that comes in and goes out throughout the day. This type is also known as a single-entry cash book.

Larger businesses rely on double-entry cash books to keep tabs on all their cash transactions in the order they occur. These differ from single-entry as they provide an in-depth view of cash inflows and outflows. It allows recording both the source and use of funds in each transaction.

A small example of an entry is:

“19th May 2023 – Received $500 cash from a customer for goods sold.”

Types of Cash Book

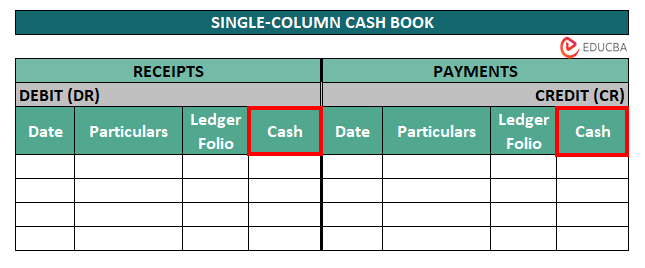

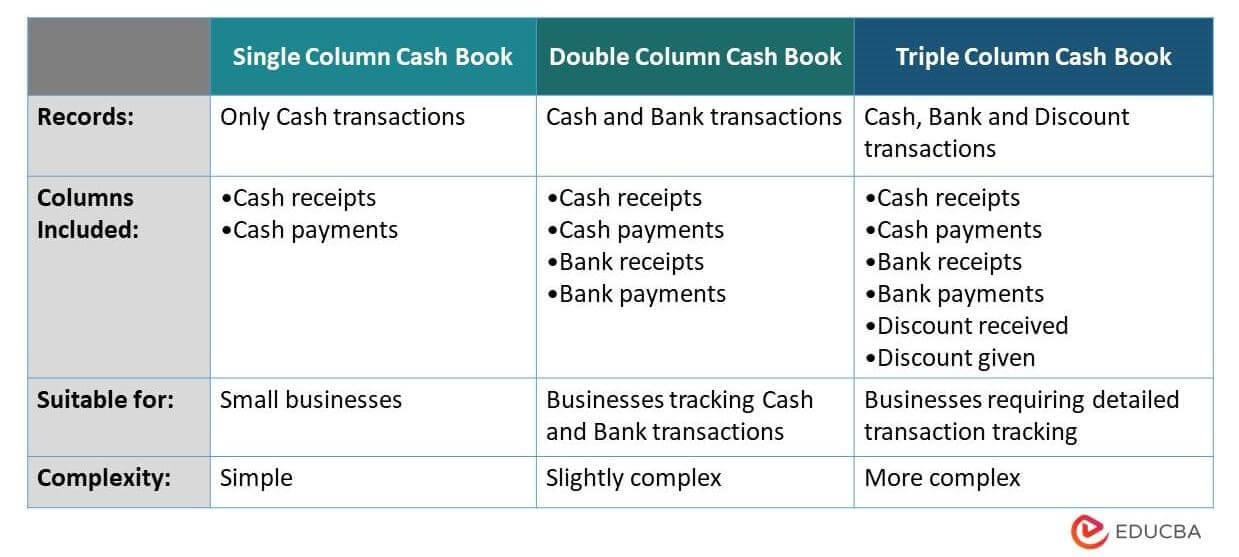

1. Single-Column Cash Book

A single-column cashbook is the simplest form. It has just one column each for debit and credit for writing down all the cash transactions. On the debit side, a firm can record any cash that it has at the beginning of the month or any income it receives. On the credit side, all expenses can be recorded. Small businesses often use this type of cash book to record and track cash inflow and outflow.

Format of a Single-Column Cash Book

- Date column: The transaction date.

- Particulars column: Short description of the transaction.

- Ledger folio: Serial number/ Unique number for the transactions.

- Amount column: Cash received on the left and paid on the right.

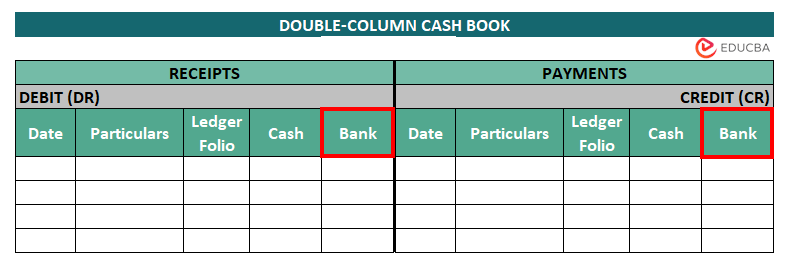

2. Double-Column Cash Book

A double-column cashbook is a better and more detailed version of a single-entry book. Here, the debit and credit sides are subdivided into separate columns for Cash and Bank. The cash column denotes the money you have in your hands, like the actual cash you hold. The bank column represents the money you deposit or withdraw from your bank account.

Format of a Double-Column Cash Book:

- Date column: The Date of the transaction.

- Particulars column: Brief description of the transaction.

- Ledger folio: Serial number/ Unique number for the transactions.

- Cash: Cash transactions on the debit and credit side.

- Bank: Bank transactions on the debit and credit side.

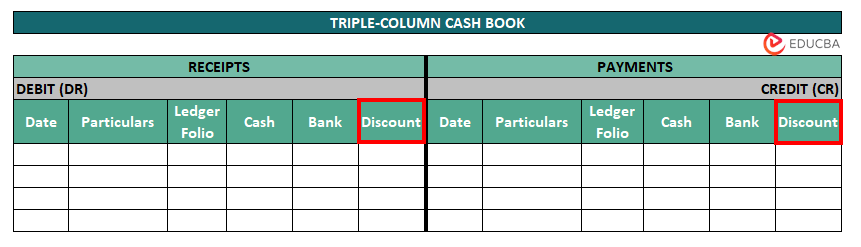

3. Triple-Column Cash Book

A triple-column is an extended version of the double-column cash book. Along with columns for cash and bank, it includes a third column for writing down the discounts. The discount column shows the amount of discount paid or received on any cash or bank transaction.

For example, when a company buys something and receives a discount, the accountants write down the discount received in the discount column. Similarly, when the company sells something and gives a discount to customers, the accountants record the amount of discount offered. This type can be helpful to avoid the repetition of discounts in the total cash.

Format of a Triple-Column Cash Book:

- Date column: The transaction date.

- Particulars column: Brief description of the transaction.

- Ledger folio: Serial number/ Unique number for the transactions.

- Cash: Cash transactions on the debit and credit side.

- Bank: Bank transactions on the debit and credit side.

- Discount: Records any cash discount received or paid.

Examples of Cash Book

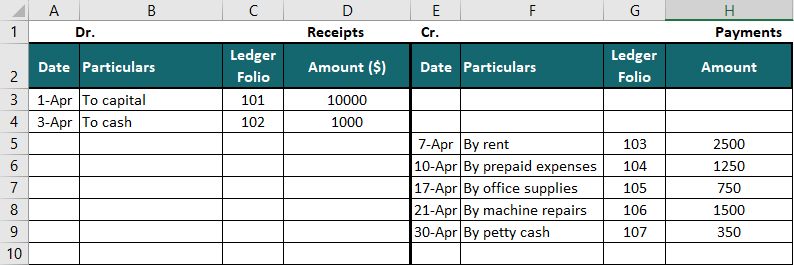

Example 1: Using Single-Column Cash Book

Mr. David started a business ‘David and Sons’ with a Capital of $10000 on 1st April. Following are the transactions made by David and Sons for April 2023. Prepare a single-column cashbook using the data given below.

| Date | Particulars. | Amount ($) |

| 1st April | The business started with cash | 10000 |

| 3rd April | Cash received from Nathen | 1000 |

| 7th April | Rent paid for April | 2500 |

| 10th April | Prepaid expenses | 1250 |

| 17th April | Office supplies bought | 750 |

| 21st April | Paid for machinery repairs | 1500 |

| 30th April | Petty cash expenses paid | 350 |

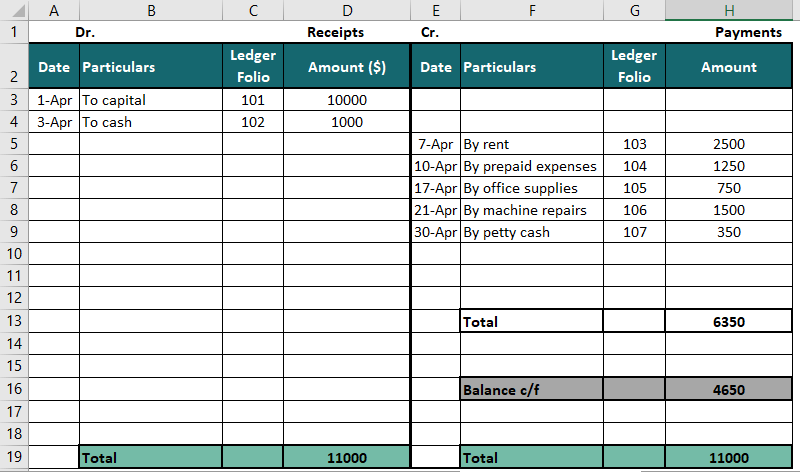

Solution:

The solution to the above-mentioned problem is in the single-column format.

Step 1: Pass all the journal entries in the below format as per the table below.

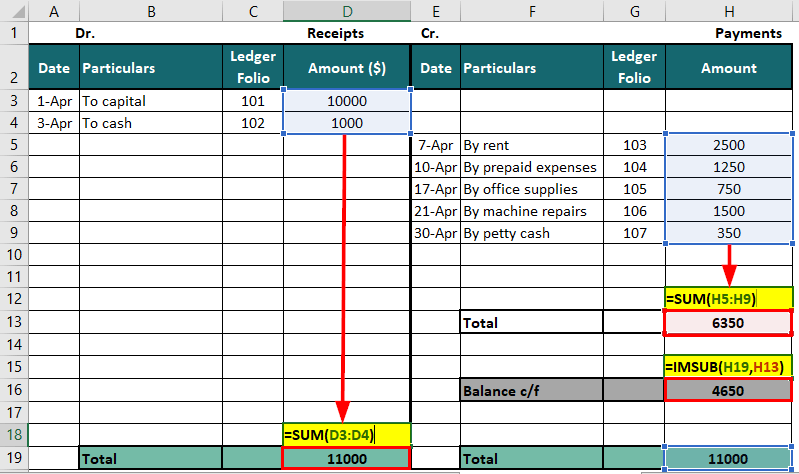

Step 2: Calculate the total of both sides in cells D19 & H13, respectively. Also, balance the ledger by calculating the difference between the debit and credit side totals in cell H16 (H19-H13).

Here, $6350 in H13 represents the total expenses out of $11000.

Therefore, the balance c/f of $4650 in cell H16 represents the remaining cash balance of $11000.

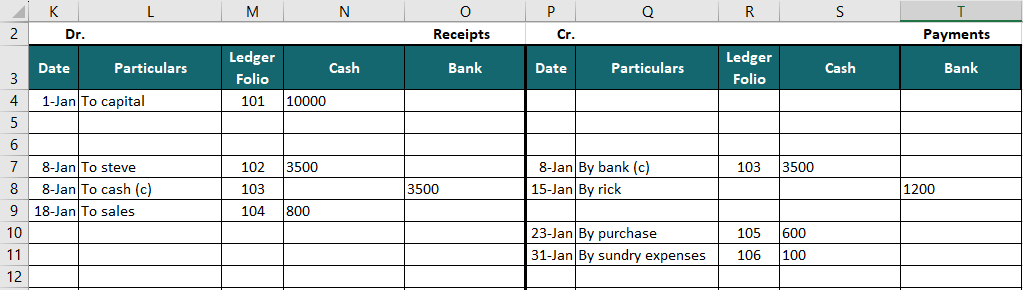

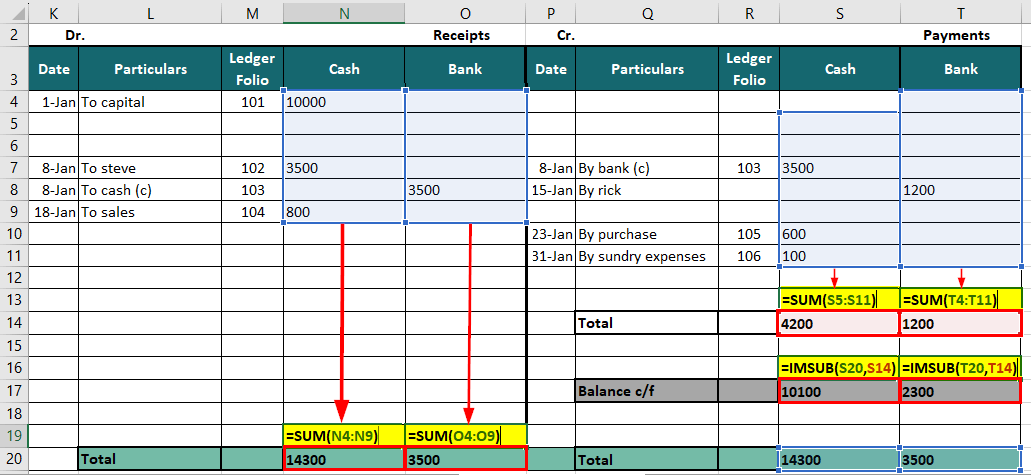

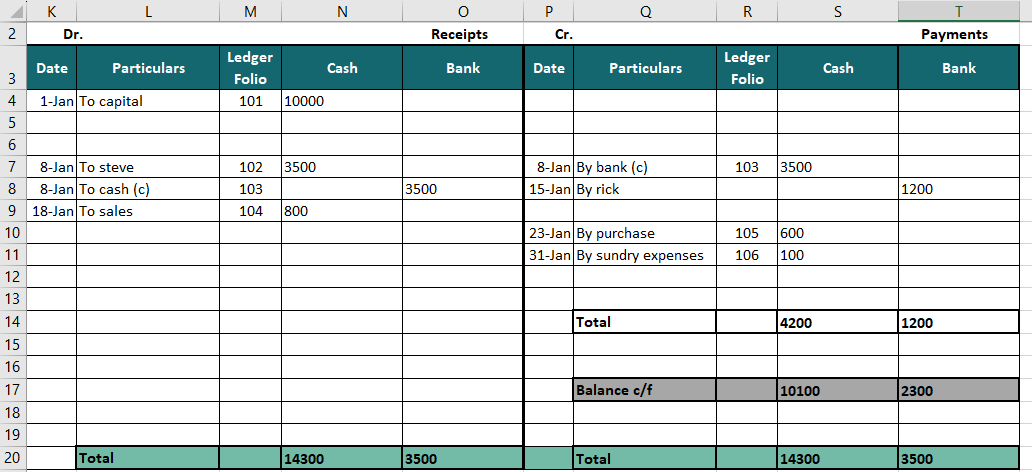

Example 2: Using Double-Column Cash Book

On 1st January 2023, Matt Company started its business ‘Matt’s Textile’ with $10000. Prepare a double-column cash book using the following transactions for the remaining month of January.

| Date | Particulars | Amount ($) |

| Jan 8 | Received a cheque from Steve and deposited it in the bank account. (Contra Entry) | 3,500 |

| Jan 15 | Paid by cheque to Rick: | 1,200. |

| Jan 18 | Received cash for sales: | 800. |

| Jan 23 | Paid for cash purchase: | 600. |

| Jan 31 | Paid sundry expenses in cash: | 100 |

Solution:

Step 1: Pass all the journal entries by separating cash and bank transactions as below.

Step 2: Calculate the total of both sides in cells N20, O20, S14, & T14, respectively.

Also, balance the ledger by calculating the difference between them in cells S17 & T17.

Here, 4200 and 1200 in cells S14 and T14, respectively, represent the total expenses for the entire month.

Therefore, the balance carried forward (c/f) of 10100 and 2300 in cells S20 and T20 represents the remaining cash balance out of 14300 and 3500, respectively.

Advantages of Cash Book

1. Effective Cash Management: A cash book helps businesses keep track of their cash transactions (inflow and outflow). It is useful for companies to manage the flow of money properly and make the right decision for financial stability.

2. Accurate Reconciliation: Reconciliation of cash and bank statements is a very important step. Reconciliation means comparing the cash book and passbook to find and rectify any errors or omissions. This improves the accuracy of the books of accounts.

3. Timely Transaction Tracking: The user records all the entries in the cash book immediately. i.e., as soon as the transaction occurs, this ensures that all the cash inflow and outflow are proper and error-free. By maintaining a timely and chronological entry system, businesses can avoid missing an entry or wrong information.

4. Segregation of Cash Activities: In large organizations, maintaining a cash book makes it easier to separate their cash and non-cash transactions. It is useful for predicting cash usage and future needs.

5. Discount Tracking: Discount tracking through a triple-column cash book maintains the record of discounts received and paid. An organization can track and analyze the impact of discounts on their cash transactions. This helps determine the effectiveness of the discount schemes for the customers and the vendors.

6. Support for Budgeting and Planning: It is important to set financial goals using the collected data. Businesses can use the data to create accurate budgets and make proper decisions about income and expenditure with a detailed cash tally report. This improves financial planning and helps in creating realistic financial goals.

7. Audit and Compliance Readiness: When creating an audit report, it is a very reliable source of information. During audits, it helps to follow financial regulations and internal control requirements. It reduces the risk of non-compliance and saves the company from any legal action.

Comparison Table – Cash Book Types

Cash Book for Large Organizations

Smaller organizations use a single book to record both cash receipts and payments. But due to a high volume of cash transactions in large organizations, it becomes difficult to manage it. So, they divide it into two parts for ease of use.

1. Cash Disbursement Journal

A Cash Disbursement Journal, also known as a Cash Outflow Journal, records all cash payments made by the organization. It includes payments for various expenses such as salaries, utilities, suppliers, and other operating costs.

2. Cash Receipts Journal

On the other hand, a Cash Receipts Journal, also known as a Cash Inflow Journal, records all cash the organization receives. It includes cash sales, customer payments, interest income, and other sources of cash inflows.

What is a Petty Cash Book?

A petty cash book is often mistaken as a type of cash book like a single or double-column. But it is nothing more than a simplified form of a cash book. It is specifically for recording less number of transactions with smaller amounts.

A petty cash book records everyday minor expenditures such as office supplies, refreshments, or travel expenses. It allows easy tracking and keeps these small transactions in order. Depending on the user, petty cash books can follow a single, double, or triple column format.

Conclusion

A cash book is an essential tool for all sizes of business organizations and individuals, irrespective of single, double, or triple columns on both sides of the T-table. All three formats use cash columns, even if it’s petty or regular. A petty cash book makes recording and maintaining everyday transactions a piece of cake. A single-column format is easy to make for people without the necessary accounting knowledge. A double and triple column format is a tool to display detailed information for cash and bank transactions separately.

In conclusion, it is a vital part of every organization’s financial management, and it is unavoidable.

Frequently Asked Questions (FAQs)

Q1. What is the difference between a Cash Book and a Pass Book?

Answer:

| Aspects | Cash Book | Pass Book |

| Meaning | Records cash inflows and outflows. | Records transactions related to bank account deposits, interest, and other bank-related activities. |

| Recorded by | The company or accountant. | By the bank using a bank statement or a passbook. |

| Nature of Transactions | Physical cash payments/receipts. | Electronic transactions or any transition through a bank. |

| Usage | Track small-scale cash transactions. | Track small-scale bank transactions to keep the record in sync with the actual bank records. |

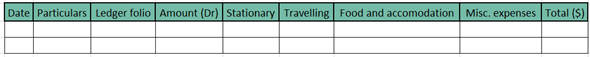

Q2. What are the Types of Petty Cash Books?

Answer: There are two types of petty cashbooks as follows:

Imprest petty cash book: Imprest petty cash book maintains a fixed amount of money in the account. It follows a double-entry accounting system and can be in a single, double, or triple column format, depending on the maker’s convenience.

Columnar or analytical petty cash book: This type has multiple columns on the credit side to segregate and track expenses. It can be tedious to make a double or triple column petty cash book for this method.

For a better understanding of the format, here’s the format of a columnar petty cashbook

In this format, the columns stationary, traveling, food and accommodation, and misc expenses segregate the expenses of large companies that want to keep a detailed record of their daily expenses. The amount column tracks the monthly balance they allocate to petty cash expenses. You can change the headings per your requirement.

Q3. What is the Difference Between a Cash Book and a Cash Journal?

Answer:

| Aspects | Cash Book | Cash Journal |

| Purpose | Provides a systematic and chronological record of cash receipts and cash payments. | Serves as a record for all cash-related journal entries. |

| Sections | Different sections for receipts, payments, and discounts. | Includes all cash transactions irrespective of their nature. |

| Information/Data | The cashbook includes only the inflow and outflow of cash. | The cash journal includes additional information regarding the nature of the transaction, accounts involved, explanations, or notes. |

Recommended Articles

This is a guide for Cash Book. Here, we have discussed the three types of cash books with the help of examples. You may also go through the following articles to learn more –