Updated July 28, 2023

Cash Conversion Cycle Formula (Table of Contents)

- Cash Conversion Cycle Formula

- Examples of Cash Conversion Cycle Formula (With Excel Template)

- Cash Conversion Cycle Formula Calculator

Cash Conversion Cycle Formula

Cash conversion cycle term we used primarily in accounts and finance. Cash conversion itself has meaning in terms only. The cash conversion cycle means how many days or month a company takes to convert its inventory into cash.

Formula for Cash Conversion Cycle(CCC)

Where

- DIO: Stands for day’s inventory outstanding

- DSO: Stands for days sales outstanding

- DPO: Stands for day’s payable outstanding.

Examples of Cash Conversion Cycle Formula (With Excel Template)

Let’s take an example to understand the calculation of the Cash Conversion Cycle in a better manner.

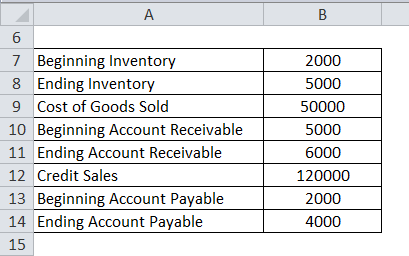

Cash Conversion Cycle Formula – Example #1

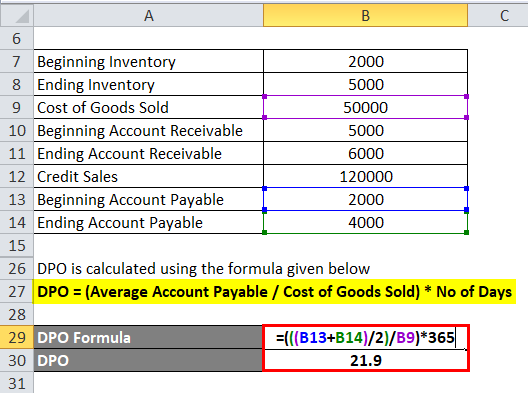

A company reported RS 2000 as beginning inventory and 5000 as inventory for the financial year ended 2017 with the cost of goods sold 50000. And at the beginning of the year, receivable was 5000; at the end of the financial year, receivable was 6000, and credit sales were 120000. And accounts payable at the start was 2000, and at the yearend, it is 4000.

So first, we have to calculate DIO.

The formula to calculate DIO is as below:

DIO = (Average Inventory / Cost of Goods Sold) * No of Days

- DIO = (((2000 + 5000)/2) / 50000) * 365

- DIO = 25.55

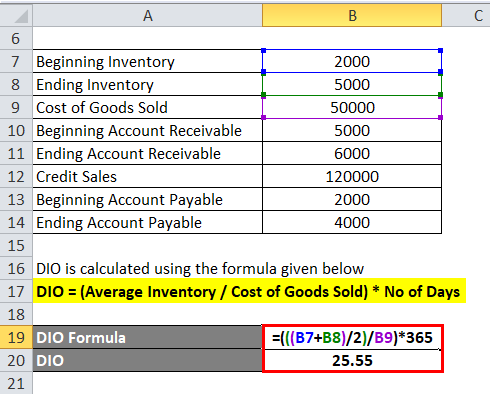

Second, we have to calculate DSO

The formula to calculate DSO is as below:

DSO = (Average Account Receivable / Total Credit Sales) * No of Days

- DSO = (((5000+6000)/2) / 120000) * 365

- DSO = 16.73

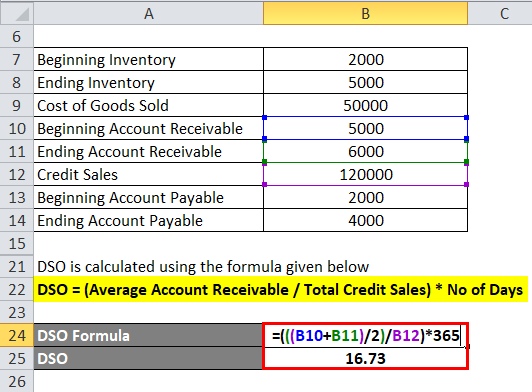

Third, we have to calculate DPO

The formula to calculate DPO is as below:

DPO = (Average Account Payable / Cost of Goods Sold) * No of Days

- DPO = (((2000+4000)/2) / 50000) * 365

- DPO = 21.9

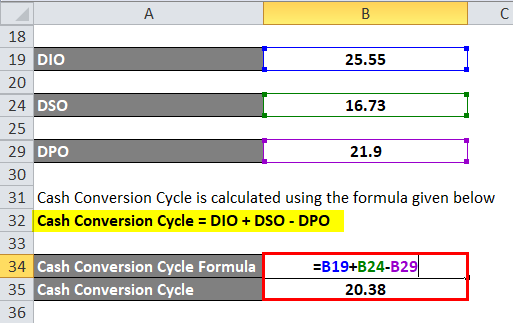

The formula to calculate Cash Conversion Cycle is as below:

Cash Conversion Cycle = DIO + DSO – DPO

- Cash Conversion Cycle = 25.55 + 16.73 – 21.9

- Cash Conversion Cycle = 20.38

Cash Conversion Cycle Formula – Example #2

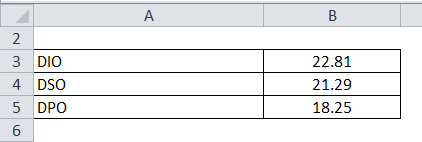

Amazon has the below detail, and we will calculate the cash conversion cycle

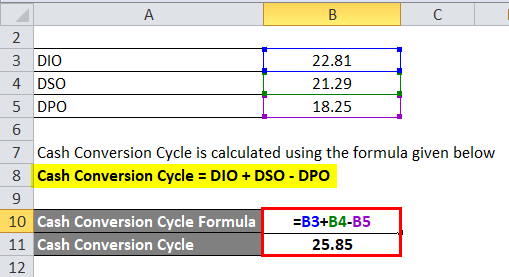

The formula to calculate Cash Conversion Cycle is as below:

Cash Conversion Cycle = DIO + DSO – DPO

- Cash Conversion Cycle = 22.81 + 21.29 – 18.25

- Cash Conversion Cycle = 25.85

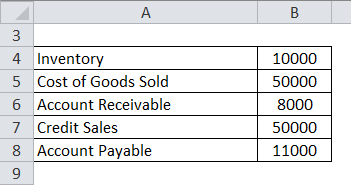

Cash Conversion Cycle Formula – Example #3

Company ABC has the following information available regarding their expenses and income. We have to calculate the cash conversion cycle from below available information.

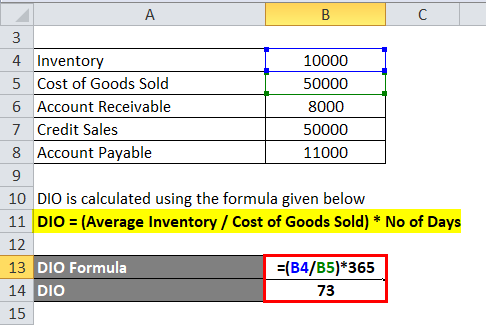

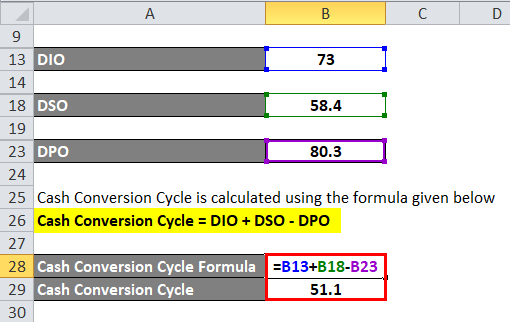

The formula to calculate DIO is as below:

DIO = (Average Inventory / Cost of Goods Sold) * No of Days

- DIO = (10000 / 50000) * 365

- DIO = 73

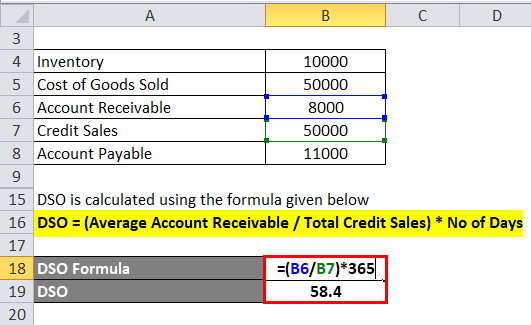

The formula to calculate DSO is as below:

DSO = (Average Account Receivable / Total Credit Sales) * No of Days

- DSO = (8000 / 50000) * 365

- DSO = 58.4

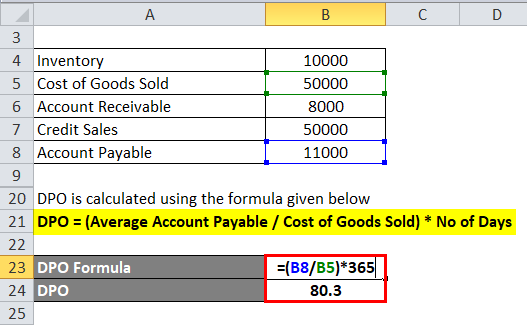

The formula to calculate DPO is as below:

DPO = (Average Account Payable / Cost of Goods Sold) * No of Days

- DPO = (11000 / 50000) * 365

- DPO = 80.3

The formula to calculate Cash Conversion Cycle is as below:

Cash Conversion Cycle = DIO + DSO – DPO

- Cash Conversion Cycle = 73 + 58.4 -80.3

- Cash Conversion Cycle = 51.1

You can download this Cash Conversion Cycle Formula Excel Template here – Cash Conversion Cycle Formula Excel Template

Explanation

The cash conversion cycle is associated with the inventory of the company. Cash conversion cycle help management to make a proper decision using available resources. Cash conversion cycle help in various ways to create a wealth of company in the long run. Every company wants steady cash conversion for better performance of the company and continuous growth over a period and creates wealth for their existing and new shareholder.

CCC involves calculating the time required for converting inventory and raw material into the final product or output. CCC calculation includes DIO, which means days of inventory outstanding with the company, and it’s associated with the cost of goods sold and average inventory during the year. And secondly, the cash conversion cycle also includes DSO, which indicates how many days the other company takes to pay for a credit sale. Last but not least, DPO indicates days payable outstanding.

DIO and DSO are associated with company cash inflow and outflow. Hence, only DPO is the only negative figure in the cash conversion cycle formula. On the other hand, in the cash conversion cycle formula, only one figure is negative, and it’s associated with the payable of the company.

A company’s cash conversion cycle broadly takes into account different terms and figures from the financial statement of a company. These include accounts payable, accounts receivable, cost of goods sold, and opening and closing inventory.

- Revenue and cost of goods sold from an income statement

- Inventory at the beginning and end of the time period from a trading account.

- Account receivable at the beginning of the period and end of the time period from the balance sheet on the asset side

- Account payable at the beginning and the end of the period from the liability side from the balance sheet.

- The number of days in the period

The first thing on the available inventory level represents how long it will take for the business to sell its inventory to the final customer. This amount is calculated using the day’s inventory outstanding (DIO). A less value of DIO is preferred as it indicates that the company is making sales in a higher amount. A higher DIO indicates a lesser turnover, so DIO should be less.

Days sales outstanding are calculated based on the cost of goods sold (COGS), which represents the cost of goods or acquiring or manufacturing the product the company sells during the year. The second stage focuses on the current sales and represents the duration of the time. It also considers the amount of the inventory and goods it purchased and represents the time horizon when the company is required to payoffs those credits.

Relevance and Uses

Cash conversion cycle attempts to measure the time it takes a company to convert its inventory and other resources inputs into cash. The cash conversion cycle is used to know the liquidity issues and excess inventory. This can indicate proof sales or, even worse, a product nobody wants.

Uses of the cash conversion formula explain below.

- The cash conversion cycle is a metric that expresses the length of time in days that it takes for the company to convert its investment in inventory and others.

- It is used for evaluating the company’s performance and management decision-making ability and use of resources properly.

- Cash conversion cycle helps the company to know its inventory turnover over a period of time.

- It also helps to improve the efficiency of the company’s operation.

- It helps to compare the performance of two different companies.

Calculator

You can use the following Cash Conversion Cycle Calculator

| DIO | |

| DSO | |

| DPO | |

| Cash Conversion Cycle Formula | |

| Cash Conversion Cycle Formula = | DIO + DSO - DPO | |

| 0 + 0 - 0 = | 0 |

Recommended Articles

This has been a guide to the Cash Conversion Cycle formula. Here we discuss how to calculate Cash Conversion Cycle along with practical examples. We also provide the Cash Conversion Cycle calculator with a downloadable Excel template. You may also look at the following articles to learn more –