Updated July 4, 2023

What is Cash Flow?

Cash flow is the incoming and outgoing of money or monetary equivalents from the funds of a business. It includes the money coming in from sales, investments, and other sources, as well as the money going out to expenses for operating costs, capital expenditures, debt repayments, and other liabilities.

Positive cash flow means more money is coming in than going out, while negative flow means more money is going out than coming in. Accounting and finance track the inflow and outflow of money and measure the liquidity and solvency of a company or individual.

Key Highlights

- Cash flow is the record of incoming and outgoing cash or cash equivalents from the accounts of a business.

- It is of three types: Operating, Investing, and Financing.

- We calculate it by adding three of its kinds or subtracting the capital outflow from the inflow.

- Fund flow, instead, is the record of how a business utilizes the available funds.

How Does Cash Flow Work?

Here is how the flow of cash typically works in a business:

1. Cash Inflow: It starts with cash inflow, which includes all the money that comes into a business.

For example, a business earns $50,000 in revenue from sales in a given month.

2. Cash Outflow: Cash outflow refers to all the money that goes out of the business, such as expenses, salaries, and loan repayments.

For example, the same business spends $30,000 on expenses and $5,000 on salaries in the same month.

3. Financial Statement: Businesses create a cash flow statement to track cash inflows and outflows. This document summarizes the cash inflows and outflows for a specific period of time, such as a month, quarter, or year.

For example, the business creates a cash flow statement for the month of June, which shows a cash inflow of $50,000 and a cash outflow of $35,000.

4. Positive Cash Flow: It is when the cash inflow of a business is greater than the cash outflow. It means that the business has more money coming in than going out, which is a healthy financial situation.

In this case, if the business had cash inflows of $60,000 and a cash outflow of $35,000 in July, it would have a positive cash flow of $25,000.

5. Negative Cash Flow: It occurs when the cash outflow is greater than the cash inflow. It means that the business is spending more money than it is earning, which can lead to financial problems.

For instance, If the business had cash inflows of $40,000 and a cash outflow of $50,000 in August, it would have a negative Cash flow of $10,000.

6. Management: To manage the flow of capital, businesses use strategies such as reducing expenses, increasing revenue, or obtaining loans. They may also create projections to predict future cash inflows and outflows.

For example, if the business anticipates a decrease in revenue in September, it may reduce expenses or obtain a loan to maintain a positive flow of cash.

Types of Cash Flows

Operating:

- They result from a business’s day-to-day operations, such as sales and expenses.

- They are critical to a business’s growth and include inflows from cash sales, receivable collections, and interest from investments.

- Operating cash outflows include payment of salaries, rent, utilities, and inventory.

Investing:

- They result from a business’s investments in assets, such as property, plant, and equipment, and its investments in other companies.

- Investing cash inflows include proceeds from the sale of long-term assets or investments, as well as returns on investments.

- Investing cash outflows include purchases of long-term assets or investments.

Financing:

- They result from a business’s financing activities, such as borrowing money or issuing stock.

- Financing cash inflows include proceeds from the issuance of debt or equity and the repayment of debt.

- Financing cash outflows include payments of principal and interest on debt, as well as payments of dividends to shareholders.

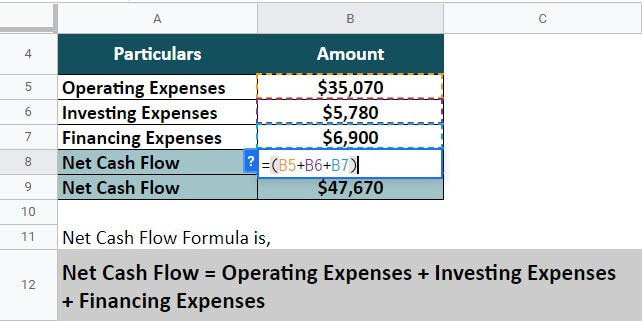

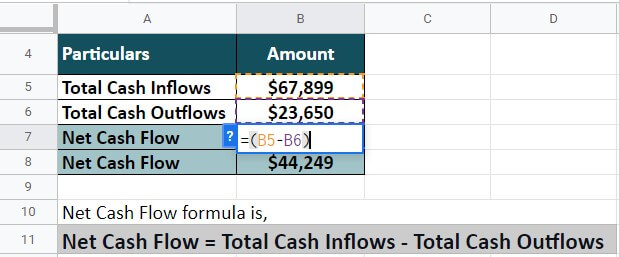

Cash Flow Formula

And

- Operations cash is the incoming and outgoing cash from a business’s day-to-day operations.

- Cash from Investments is the incoming and outgoing cash from the business’s investing activities.

- Cash Flow from Financing is the incoming and outgoing cash from the business’s financing activities.

- Total Cash Inflows is the total cash that flows into the business in the given time

- Total Cash Outflow is the total cash that flows out from the business in the given time

Examples of Cash Flow

#1. Restaurant

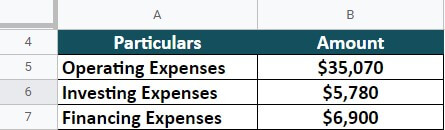

A restaurant’s operating expenses in 2022 were $35,070. The owner does an investing expenditure of $5,780, and his financing costs add up to $6,900. Calculate the net cash flows.

Given,

Solution,

The Net Cash Flows of the company sum up to $47,670.

#2. Car Manufacturing Company

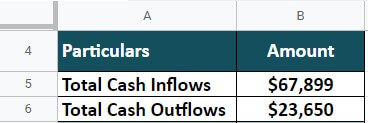

The total cash inflows amount of a car-manufacturing company in the year 2022 was $67,899. Their cash outflows of the same year summed up to $23,650. Calculate their net cash flows for 2022.

Given,

Solution,

Therefore, the net cash flows of the company are $44,249.

Cash Flow Statement

A company’s cash flow statement is the overall record of its income and expenditure that tracks and manages its financial resources. It records a company’s operational, investing, and financing activities over a financial period. It can be negative or positive. However, free cash flow denotes the money a company has left with itself after fulfilling all its expenses.

For example,

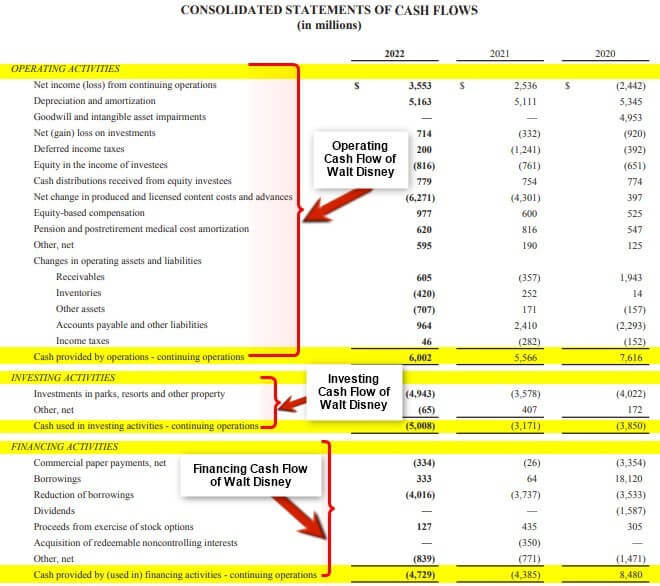

Here is the cash flow statement of Walt Disney from its 2022 Annual Report.

(Image Source: Walt Disney Annual Report 2022)

It is a comprehensive record of Walt Disney’s operating, investing, and financing activities over 2022. It shows the capital flow at both the beginning and the end of the year. The report also tracks the amounts the business paid as interest and taxes.

This Financial Statement Records a Company’s Cash Inflows and Cash Outflows.

| Cash Inflow | Cash Outflow |

| Sales of goods and services: It is the total amount of money a company brings in for goods it sells and services it renders. | Payments for goods and services: It is the total amount of money that a company pays to its suppliers for goods and services purchased. |

| Borrowing from banks or other lenders: This number reflects any cash borrowed from banks or other financial institutions. | Interest payments and Taxes: It is the amount of money a company pays to the organizations/ banks from where it has borrowed money and to the government at different levels in the form of taxes. |

| Investments from venture capital firms: If your company has received investments from venture capitalists, those amounts count here. | Employee wages and benefits: A company pays this money to the employees as wages and benefits. |

| Profits from investments: This amount is the profit a company makes from any investments. | Depreciation: This amount is the loss that a company faces with the reduction in the value of its assets over time. |

Cash Flow Analysis

Cash flow analysis is a financial tool that tracks the inflow and outflow of cash in a business over a period of time. It helps businesses determine their ability to generate cash and pay off debts.

Here is an example of how it works:

ABC Company wants to determine its cash flow for the first quarter of the year. To do this, they create a cash flow statement that summarizes all the cash inflows and outflows for the period.

Cash Inflows for Q1:

| List Item | Amount |

| Revenue from sales | $500,000 |

| Interest income | $5,000 |

| Loan from the bank | $50,000 |

| Total cash inflows | $555,000 |

Cash Outflows for Q1:

| List Item | Amount |

| Salaries and wages | $150,000 |

| Rent | $20,000 |

| Utilities | $5,000 |

| Office supplies | $10,000 |

| Loan repayment | $20,000 |

| Taxes | $15,000 |

| Total cash outflows | $220,000 |

Net Cash Flows for Q1:

$555,000 (cash inflows) – $220,000 (cash outflows) = $335,000

As per this analysis, ABC Company has a positive net flow of cash of $335,000 for Q1. It means that they have generated more cash than they have spent during this period.

By tracking its cash inflows and outflows, ABC Company can better manage its finances and make informed decisions about investments, expansion, and other financial activities.

Free Cash Flows

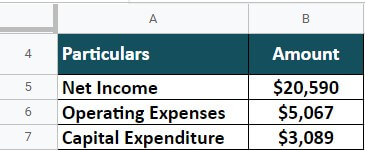

It is the amount of money left with a company after the payments of operating expenses and capital expenditures. Businesses calculate it by subtracting their operating expenses and capital expenditure from their net income.

Example:

A company earns $20,590, pays $5,067 for operating expenses, and $3,089 as capital expenditure in 2022. Calculate the free cash flows of the company.

Given,

Solution:

Therefore, the free cash flows of the company are $12,434.

Differences between Cash and Fund Flow Statements

| Cash Flow Statement | Fund Flow Statement |

| It is a detailed and comprehensive record of a company’s cash inflow and outflow. | It tracks the utilization of the available funds. |

| It is a part of the company’s financial statement. | It is not a part of the financial statement. |

| It tracks the incoming and outgoing cash for a particular accounting period. | It tracks the long-term financial health of a business over several accounting periods. |

| Businesses use it for cash budgeting. | Businesses use it for capital budgeting. |

Frequently Asked Questions (FAQs)

What is a good cash flow ratio?

According to analysts and financial professionals, a value of more than 1 is a good cash flow ratio. It denotes that a business has extra money left with it after all its payments and liabilities over a certain period of time.

Does cash flow mean profit?

No, it is different from profit. It is the money or monetary equivalents coming in and going out from a business over a given period. However, profit is the money a business has left with itself after paying all its expenses through its operations.

What are cash flows in NPV?

Cash flow in NPV or Net Present Value is the incoming or outgoing cash from a business through the expenses related to investments and projects.

Recommended Articles

This was an EDUCBA guide to Cash Flows. For more detailed knowledge, please refer to EDUCBA’s Recommended Articles.