Updated July 11, 2023

What is Cash Flow From Investing Activities?

The term “cash flow from investing activities” represents the section of the cash flow statement that records the amount of money invested, the purposes of the investments, and the returns generated from them during a specified period.

Some common examples of investing activities include purchasing long-term assets (also known as CapEx), mergers & acquisitions, and investment in marketable securities.

Explanation

Investing activities are an essential indicator of a company’s growth strategy. Investors and analysts usually check the sources and uses of funds from the investing section of a company’s cash flow statement to evaluate its growth (CapEx and M&A) strategy and investment in other marketable instruments. Investment in CapEx indicates that the company intends to grow in the future. This section provides an overview of the investment made in long-term assets that have the potential to generate value in the future.

Formula

The c.f. from investing activities derives as the summation of three broad activities – sale/ (purchase) of long-term assets, sale/ (purchase) of marketable securities, and sale/ (purchase) of other businesses. Here, sale results in cash inflow, and purchase result in cash outflow. Mathematically, the formula can represent as,

Examples of Cash Flow from Investing Activities

Different examples are mentioned below:

Example #1

Let us take the example of ADS Inc. to explain the computation. The following information is available about investing activities during the year 2019:

- Purchase of marketable securities worth $25.0 million

- Proceeds from maturity of marketable securities worth $42.5 million

- Payment of $12.5 million made for the acquisition of new PP&E (plant, property, and equipment)

Determine the company’s investing activities for the year 2019.

Solution:

C.F from Investing Activities for 2019 calculates as,

Cash Flow from Investing Activities = – Purchase of Marketable Securities + Proceeds from Maturity of Marketable Securities – Payment for Acquisition of New PP&E

- Cash Flow from Investing Activities = -$25.0 million + $42.5 million – $12.5 million

- Cash Flow from Investing Activities = $5.0 million

Therefore, ADS Inc.’s C.F. from investing activities for the year 2019 stood at $5 million.

Example #2

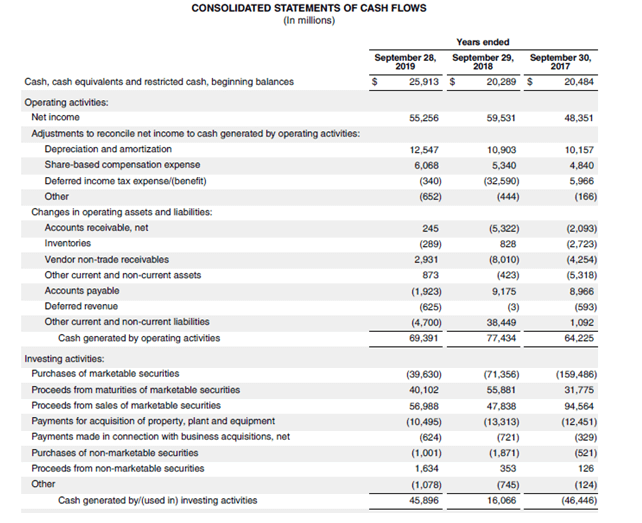

Let us take the example of Apple Inc., wherein the following information is available regarding investing activities for the year 2019:

- Purchase of marketable securities worth $39.63 billion

- Proceeds from maturity of marketable securities worth $40.10 billion

- Proceeds from the sale of marketable securities worth $56.99 billion

- A payment of $10.50 billion was made for the acquisition of PP&E

- Payment of $0.62 billion made for the acquisition of new business

- Purchase of non-marketable securities worth $1.00 billion

- Proceeds from non-marketable securities worth $1.63 billion

- Another investing cash outflow of $1.08 billion

Determine Apple Inc.’s C.F. from investing activities for the year 2019.

Solution:

C.F from Investing Activities for 2019 calculates as,

C.F from Investing Activities = – Purchase of Marketable Securities + Proceeds from Maturity of Marketable Securities + Proceeds from Sale of Marketable Securities – Payment for Acquisition of New PP&E – Payment for Acquisition of New Business – Purchase of Non-Marketable Securities + Proceeds from Non-Marketable Securities – Other Cash Outflow

- Cash Flow from Investing Activities = -$39.63 billion + $40.10 billion + $56.99 billion – $10.50 billion – $0.62 billion – $1.00 billion + $1.63 billion – $1.08 billion

- Cash Flow from Investing Activities = $45.89 billion

Therefore, Apple Inc.’s C.F. from investing activities for the year 2019 stood at $45.89 billion.

Link: https://s2.q4cdn.com/470004039/files/doc_financials/2019/ar/_10-K-2019-(As-Filed).pdf

What’s Included in Cash Flow from Investing Activities?

The items included in this section may vary from company to company. However, some of the common items included under C.F from investing activities are as follows:

- Payments for purchase of PP&E/ CapEx (cash outflow)

- Proceeds from the sale of PP&E (cash inflow)

- Payments for acquisition of other businesses (cash outflow)

- Proceeds from the sale of other companies (cash inflow)

- Payments for the purchase of marketable securities (cash outflow)

- Proceeds from the sale of marketable securities (cash inflow)

Importance

The C.F. from investing activities is an important section in the cash flow statement of a company as it shows how much of the money generated from operations is used for investment and under which head. The section is more critical in evaluating companies operating in capital-intensive industries that predominantly require enormous investments in fixed assets. Typically, suppose a business reports regular cash outflows to purchase fixed assets. In that case, it is a strong indication that the company is currently in the growth phase and firmly believes that it will be able to generate a positive return on its investments.

Advantages

Some of the significant advantages are as follows:

- It helps assess the company’s investment strategy’s cash negative/ positive position. It indicates any need for additional funding or if excess cash can be used in other activities, such as debt repayment.

- Any discrepancy in sources and uses of funds for any significant investment can be decrypted.

Conclusion

It is one of the three sections of the cash flow statement that captures the cash movement in and out of the company due to various investing activities during a given period. Investors and analysts prefer to look into this section of the cash flow statement as it provides an overview of the overall investment strategy of the business.

Recommended Articles

This is a guide to Cash Flow From Investing Activities. Here we also discuss the definition and examples along with its advantages. You may also have a look at the following articles to learn more –