Updated July 18, 2023

Difference Between Cash Flow vs Fund Flow

Cash flow is recognized in cash flow statement of the company which is among the main financial statements of the company that indicates the actual amount of cash inflow or outflow of the organization due to the operational activity of a company and it involves cash flows generated from the operating activities, the investing activities and the financing activities whereas the Fund flow statement does not portray the cash position of the company but it helps accountant to report any changes in working capital or assets and liabilities of the company during a given period of time.

Cash flows indicate the changes in cash and cash equivalent position of the company from one period to another period. Cash flow statement (one of the major financial statement) is prepared by the company which records Cash flows (Cash inflows or outflows). It shows the actual amount of cash generated by the company from its operational, investing or financing activities. Cash inflow includes cash revenue generated from the sale of goods or services, Interest income from investing activities, amount received on the issue of shares or raising of loans, etc. Cash outflows include payroll expenses, purchases made in cash, repayment of loans, distribution of dividend,s etc.

On the other hand, Fund flow only indicates the movement of cash or indicates the changes in working capital or assets and liabilities of the company from one period to another period. It also identifies the activities which are not regular in nature.

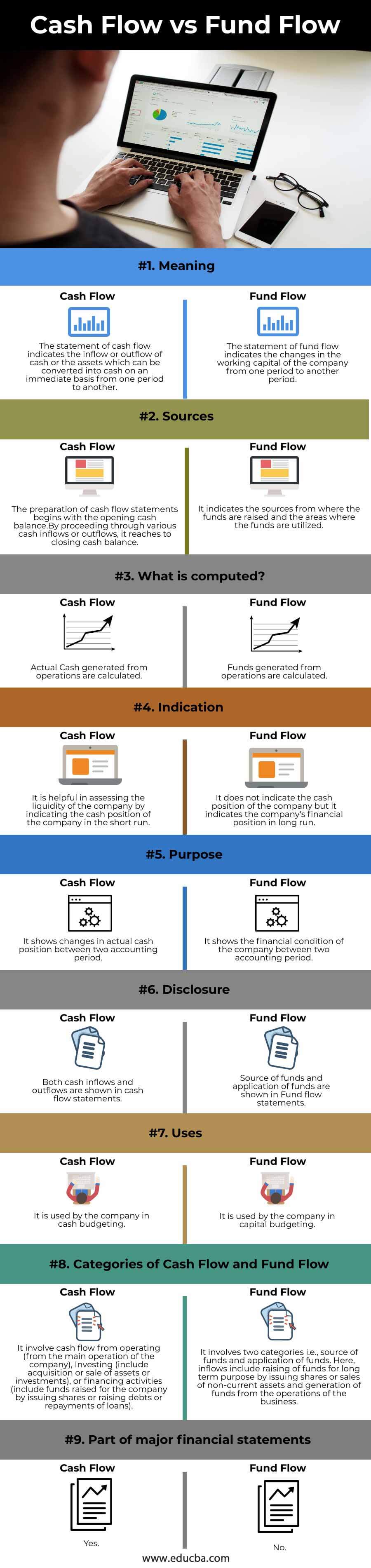

Head To Head Comparison Between Cash Flow vs Fund Flow (Infographics)

Below are the top 10 differences between cash flow vs fund flow:

Key Differences Between Cash Flow vs Fund Flow

The key differences between the cash flow and fund flow are as follows:

- The cash flow statement indicates the actual cash position of the business which is not shown by the fund flow statement. To know about the liquidity of the company, one should refer cash flow statement instead of a fund flow statement

- The fund flow statement indicates how efficiently the firm is utilizing its working capital but the cash flow statement only indicates the reasons for changes in cash balance.

- The cash flow statement shows opening cash balance, closing cash balance, and causes of changes in cash balances during the accounting period whereas the fund flow statements indicates sources from where the funds are raised and areas where the funds are deployed.

- The concept of a fund flow statement is broader than a cash flow statement (as it is based on only one component of working capital i.e., cash).

- A fund flow statement is used by the governments, creditors or analyst to analyze the financial condition of the business whereas by reviewing the cash flow statement they can look into the liquidity position of the company.

- Changes in the current assets and the current liabilities indicated through a schedule of the changes in the working capital while preparing fund flow statement but in the statement of cash flow, it is included in cash flow statements itself ad, not in any schedule.

- The future course of actions can be decided and controlled by the management with the help of fund flow statements but this is not possible by looking into the cash flow statement of the company.

Cash Flow vs Fund Flow Comparison Table

Let us look at the comparison table of cash flow vs fund flow.

|

Basis of Comparison |

Cash Flow |

Fund Flow |

| Meaning | The statement of cash flow indicates the inflow or outflow of cash or the assets which can be converted into cash on an immediate basis from one period to another. | The statement of fund flow indicates the changes in the working capital of the company from one period to another period. |

| Sources | The preparation of cash flow statements begins with the opening cash balance.By proceeding through various cash inflows or outflows, it reaches to closing cash balance. | It indicates the sources from where the funds are raised and the areas where the funds are utilized. |

| What is computed? | Actual Cash generated from operations are calculated. | Funds generated from operations are calculated. |

| Indication | It is helpful in assessing the liquidity of the company by indicating the cash position of the company in the short run. | It does not indicate the cash position of the company but it indicates the company’s financial position in long run. |

| Purpose | It shows changes in actual cash position between two accounting period. | It shows the financial condition of the company between two accounting period. |

| Disclosure | Both cash inflows and outflows are shown in cash flow statements. | Source of funds and application of funds are shown in Fund flow statements. |

| Basis of Accounting used in the preparation of Cash Flow and Fund Flow Statements | Cash basis | Accrual basis |

| Uses | It is used by the company in cash budgeting | It is used by the company in capital budgeting. |

| Categories of Cash Flow and Fund Flow | It involve cash flow from operating (from the main operation of the company), Investing (include acquisition or sale of assets or investments), or financing activities (include funds raised for the company by issuing shares or raising debts or repayments of loans). | It involves two categories i.e., source of funds and application of funds. Here, inflows include raising of funds for long term purpose by issuing shares or sales of non-current assets and generation of funds from the operations of the business. |

| Part of major financial statements | Yes | No |

Conclusion

Thus cash flow statement indicates the actual position of cash in the company and the fund flow statement indicates the result of the operations performed by the company during the period. By preparing the statement of cash flow, the company can analyze its liquidity position and can arrange finance if it is running short in cash or can invest the money (for getting more return) if it has excess funds. Interested parties can analyze the financial position of the business by reviewing Fund flow statements. It shows the sources from where the funds are obtained or the places where those funds are used.

The cash flow statement should be reviewed by interested parties with other financial statements to ascertain actual gain or loss to the company as it only depicts the cash position. Fund Flow statements should also be reviewed along with the balance sheet to judge the position of the business in a better manner.

Recommended Articles

This is a guide to Cash Flow vs Fund Flow. Here we also discuss the Cash Flow vs Fund Flow key differences with infographics and comparison table. You may also have a look at the following articles to learn more –