Updated July 18, 2023

Difference Between Cash Flow vs Net Income

Cash flow can be defined as the cash movement i.e. either inflow of the cash and cash equivalents held by a business in the form of revenue, capital funding related transactionsor outflow in the form of expenses incurred, debt servicing transactions undertaken during an accounting period.

Whereas

Net income, also known as net profit/ loss(bottom line item of the income statement) is the amount of net profits/ lossearned by an organization calculated as sum total of all revenue generated reduced by the cost of goods sold, selling and administrative expenses, amortization, depreciation, the interest cost, any other extraordinary item, taxes and any other expenses incurred.

Cash Flow

Cash flow is an important statement forming part of financial statements, which provides gross data for all cash inflows and outflows of an organisation which they either receives and pays for the ongoing business operations, for other investment sourcesor for financing transactions during a particular period. Financial statement of the company provides an investor and analysts with the helicopter view of all the transactions undertaken by the organisation. Among all financial statements, cash flow statement presents cash movement and is considered as most instinctive part of F/s. Cash Flow statement provides categorizes all transactions in three major classification –

- Cash Flow from Operating Activity: It is the most important part of cashflow statement which presents cash flows related with all operating activities of a business. While presenting using indirect method, it starts with the net income of the business, makes adjustments for non-cash transactions like depreciation. After adjusting for non-cash transactions, it adds/ subtracts cash flow from related with various operating activities like cashflows related debtors, sales, vendors, purchases etc.These includes transactions like buying and selling of materials, inventory, etc, payment of expenses like salaries, wages etc. Positive cash flow from operating activities indicates good operating efficiency whereas a negative cashflow represents company poor operating performance.

- Cash Flow from Investing Activity: This part represents cash flow from investment activities like cash expenditure on purchase or sale of assets like plant, property, equipment, furniture etc. in this cash flow investors take a look at the capital expenditure of the company. When the capital expenditure of the company increases the reduction in cash flow is observed and as a result, it symbolises that the organisation is making investments for future operations. Growing companies usually have high CAPEX cashflows.

- Cash Flow from Financing Activity: This part of cashflow statement represents cash transactions in relation with capital funding i.e. business financing. It checks the flow of cash between the organisation and its shareholders (owners), debenture holders, and other financing organizations like banks. Cash flow from financing activity is useful for the investors and analyst in order to ascertain return (dividend, share buy-back) generating capacity for their individual investment. It helps banks to analyse risk of defaults and debt servicing capacity of organization.

Net Income

Net Income is the amount of surplus revenue generated by an organization after recording/ paying off all expenses incurred during an accounting period. This figure is calculated in company’s Profit and Loss A/c as a difference of total earned revenue (received in cash or not) and expenses incurred(cost of goods sold, operating expenses, non-operating expenses, interest expenses, tax expenses and any other expenses) whether paid in cash or not. It is important for each stakeholder to gather and understand amount of net profit generated by entity. With the help of net income, net earning per share can be determined. It is also termed as bottom line as it is the last line item of the income statement

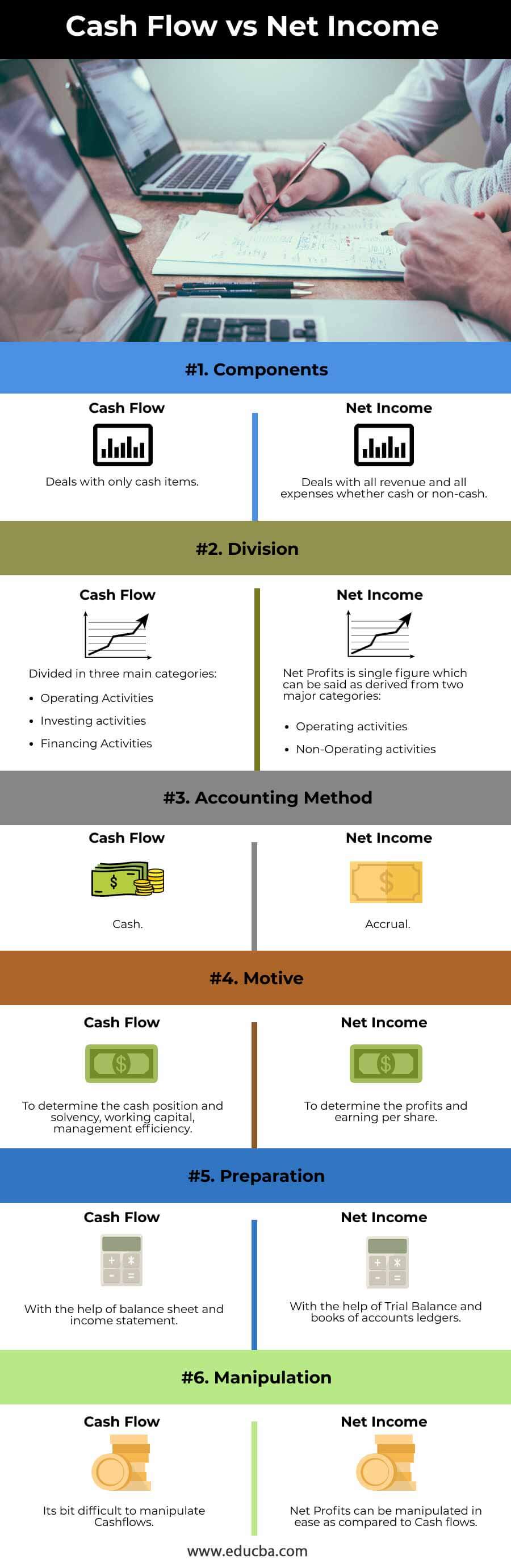

Head To Head Comparison Between Cash Flow vs Net Income (Infographics)

Below are the top 6 differences between cash flow vs net income:

Key Differences Between Cash Flow vs Net Income

The key differences between the cash flow vs net income are as follows:

Net profit and cash flow are an important financial metric of an organisation and are always confusing for the people who are new in finance and accounting. Net profit and cash flow are not the same tools and it is important to understand the differences between the two in order to make and process key financial decisions. Being an investor interpreting the difference between cash flow and net profit makes it easier to ascertain whether company is a good investment or not on the basis of its ability to remain solvent at the time of Crysis.

Difference in between cash flow and net profits get generated as a result of accrual method of accounting. In cash method of accounting, both cash flow profit and net profits are same. There are time gaps between sales and actual payments but accrual concept of accounting requires an entity to provide for all incurred expenses and record all accrued income. This is the main reason for difference between cash flow and net income figures. This situation is neutralised if the cash is paid by the customer during the coming period but if the payments are not received for larger gaps there is a huge difference between cash flow and net income. If the situation is not changed annual reports will show low cash flow and net income. Generally, fast-growing companies present low income because they invest huge amount in expansion and growth. After some time high operating cash flows makes steady net income growth but in some cases, it may even show a downfall trend also. Cash flow is always a better measuring tool for the organisation’s financial health.

- Cash flow is the sum of money that flows in and out of a business due to various business activities, while net income is the income generated as a result of surplus revenue over cost (vise versa).

- Cash flow manipulation is a bit difficult as per US GAAP as cash balance needs to get tallied with bank/ physical cash while net profit can be manipulated by increasing revenue or decreasing revenue/ costs.

- Cash flow is used to determine the company’s cash generation capacity, its enigmas concerning liquidity and to appraise the income generated by the accrual system of accounting. While net income is used to determine the profitability of the organisation for a given period and to ascertain the earnings for the shareholders.

- Cash flow statement projects the sources of cash and where it is utilized. Whereas, net projects result of various business operations considering both cash/ non cash transactions

- Cash flow is classified in three activities- operating, investing and financing on the other hand net profit comprises of mainly two major headings: – operating activity and non-operating activity.

- Cash flow does not consider non-cash transactions in its calculation while net profits considers both cash/ non-cash transactions.

Cash Flow vs Net Income Comparison Table

Let us look at the comparison table of cash flow vs net income.

| Basis | Cash Flow | Net Income |

| Components | Deals with only cash items | Deals with all revenue and all expenses whether cash or non-cash |

| Division | Divided in three main categories:

|

Net Profits is single figure which can be said as derived from two major categories:

|

| Accounting Method | Cash | Accrual |

| Motive | To determine the cash position and solvency, working capital, management efficiency | To determine the profits and earning per share |

| Preparation | With the help of balance sheet and income statement. | With the help of Trial Balance and books of accounts ledgers |

| Manipulation | Its bit difficult to manipulate Cashflows | Net Profits can be manipulated in ease as compared to Cash flows |

Conclusion

Both cash flows and net profits are important components of financial statement and serves different purposes. While the cash flows depict cash movements under different categories, net profits shows results of business operations. It is important for an organization to have adequate net profits as per the desired rate of return along with which it should also hold strong cash position. Weak cashflows may lead to liquidity crunch situation which in turn may affect business profitability. Therefore, both cashflows and net profits are interdependent and important for stakeholders.

Recommended Articles

This is a guide to Cash Flow vs Net Income. Here we also discuss the Cash Flow vs Net Income key differences with infographics and comparison table. You may also have a look at the following articles to learn more –