What are Cash Receipts?

In simple terms, a cash receipt is the official document of receipt of cash from external sources like receipts from debtors, receipts from a bank, and receipts as loans from third parties, etc., and to formalize the transaction, cash receipts are generated. They can serve as proof of the amount receivable.

Explanation

A business organization has to perform many functions like inventory management, investors, debtors, etc. For all the management, cash is primarily used in business. Hence it is necessary to make a record of cash to verify and present the true picture of the business. Cash transactions in the business occur in the form of receipts and payments. Examples of cash receipts are receipts from debtors, banks, etc. Against every cash receipt, the business organization generates a formal document called a ‘cash receipt’ to record the transaction. Cash is important for every business, so the chances of teaming & leading and other frauds increase. Hence maintenance of records in the form of cash receipts is very important and necessary. The pro forma for cash receipts varies from organization to organization. Some prefer detailed records, while others prefer summary receipts.

Characteristics of Cash Receipt

The following are characteristics of Cash Receipt:

- Presented as Proof: Cash receipt is the proof of cash received, whether it is from cash sales, receipts from debtors, loan receipts, etc.

- Legally Enforceable document: Cash receipt is the formal document; Therefore, when the law demands, it can present itself as proof. Hence it is a legally enforceable document.

- Issued for Maintenance of records: We generate cash receipts to maintain records and prevent deflection and other cash-related misappropriations.

- Helps in detecting misappropriation: If an issue of cash receipt is the organization’s trend, then any misappropriation of cash can be easily traced with the records.

How to Write Cash Receipt?

The following content is to be written in cash receipts:

- The date of the receipt and the name of the receiver’s organization of cash should be there on the receipt.

- We pre-print a unique serial number onto a cash receipt voucher.

- The cash receipt must include the payer’s name and the payer’s business organization.

- The purpose of receiving the cash, i.e., whether cash is received against a loan or sales, etc., with details to be written to keep track of various records.

- Cash receipt also contains the receiver’s signature to know that the authorized person is receiving the cash.

- The cash receipt voucher should include the mode of payment, whether it is cash, cheque, or online transfer.

You could also use templates or Invoice Simple’s receipt maker to make this process easier.

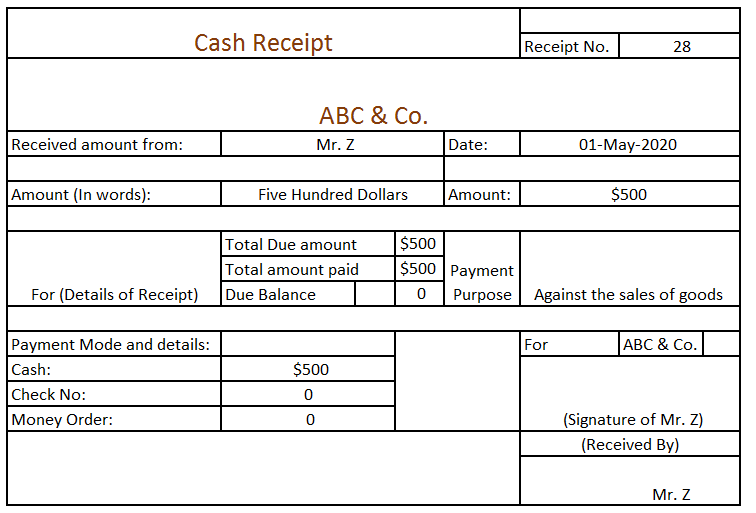

Example of Cash Receipt

ABC & Co. sold goods to Mr. Z amounting to $ 500 on 01.04.2020. Mr. Z didn’t pay the bill immediately and promised to pay the bill after one month. ABC & Co. recorded the sales as sales made to Mr. Z and Mr. Z as debtors. After one month, the collection agent of ABC & Co. went to the premises of Mr. Z to collect the debt against the bill in cash. The agent presented the bill to the authorized person of Mr. Z’s organization. After verifying the bill, Mr. Z’s authorized person cleared the payment, issued the cash payment receipt, and signed it and got signed by the agent of ABC & Co. The agent of ABC & Co. also issued the cash receipt voucher as proof of clearance of debt as below:

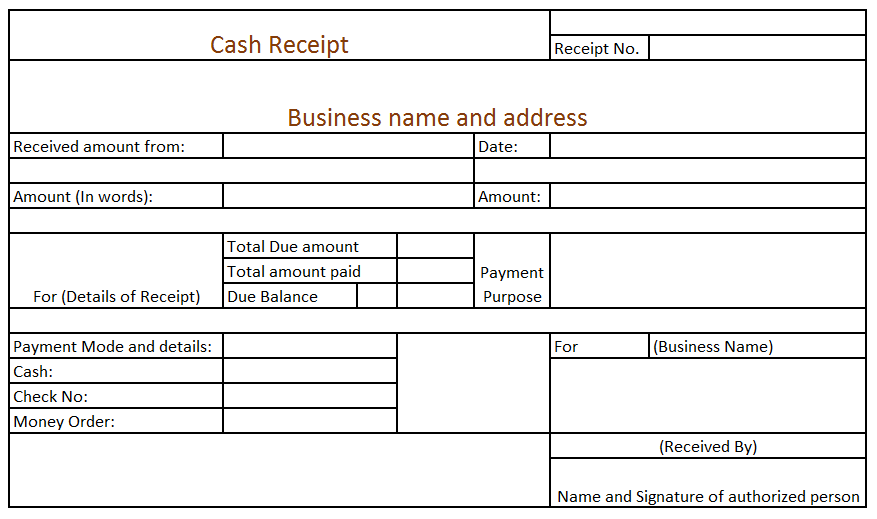

Cash Receipt Format

The cash receipts format is given below:

Advantages of Cash Receipts

- A cash Receipt voucher is a legally enforceable document.

- It helps in keeping records of cash received and cash paid.

- With the issuance of cash receipts and payment vouchers and deflection can be traced.

- The cash receipt voucher contains the details of the payer so that in case of any discrepancies payer can be easily traced.

- Issuing a cash receipt voucher forces the issuer to maintain the records correctly, reducing the chances of misappropriation.

- Every organization maintains the cash receipt as one of the primary documents.

- The contents of the cash receipt are unambiguous, which helps track the records and determine the remaining balance receivable or payable by the organization.

- The records can prove to be a cash verification at any point in time.

Disadvantages of Cash Receipts

- The cash receipt does not show the non-cash transactions like depreciation, interest accrued, etc.

- It does not reflect the mutual settlements of debtors and creditors; hence sometimes becomes unable to trace.

- The cash receipt does not contain the name of the authorized person, so there are chances of manipulating the receiver and misappropriating cash.

- It does not contain the records of discounts given or received.

- It does not differentiate between revenue and capital receipts.

Conclusion

Cash receipt is the document issued on receipt by the receiver organization. Cash receipt voucher contains the serial number pre-printed to prevent the misappropriation of cash. The cash receipt voucher contains the details of the payer. The cash receipt voucher can be presented as legal proof and accepted in court. However, it does not indicate the difference between revenue and capital expenditure. It also does not contain records of non-cash transactions. The cash position can be traced easily with the records of cash vouchers, whether receipts or payments. A specific format of cash receipts differs from organization to organization. The more clear and unambiguous the format, the easier it becomes to track and trace.

Recommended Articles

This is a guide to Cash Receipts. Here we discuss the definition and how to write a cash receipt. Along with advantages and disadvantages. You may also have a look at the following articles to learn more –