Updated July 26, 2023

What is Cash Reserve Ratio?

In the parlance of the commercial banking system, the cash reserve ratio denotes the proportion of overall deposits that a bank must retain with the country’s central bank.

The proportion of bank deposits that must be maintained with the central bank is also determined by the central bank itself. Central banks in each region use their experience during instances of a bank run, where many depositors withdraw their deposits simultaneously, to decide on the reserve amount in some cases. The Federal Reserve is the central bank for the United States, while it is the Bank of England for the United Kingdom.

A bank is mandated to maintain the CRR to avert any funds shortage during bank runs. Inherently, the central banks use the CRR to manage economic liquidity by controlling the money supply. For example, the central bank will increase the CRR and shrink bank lending to control the money supply in the market in case of a Contractionary Monetary Policy. On the other hand, the central bank will reduce the CRR and add to the market liquidity in case of an Expansionary Monetary Policy.

Cash Reserve Ratio Formula

The formula for the cash reserve ratio is fairly simple. To calculate it, divide the cash reserve that the bank is obligated to maintain with the central bank by the overall bank deposits.

Mathematically, it is represented as:

Examples of Cash Reserve Ratio (With Excel Template)

Let’s take an example to understand the calculation of the Cash Reserve in a better manner.

Example #1

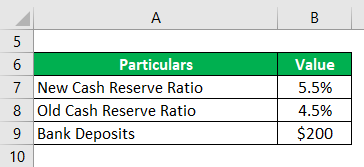

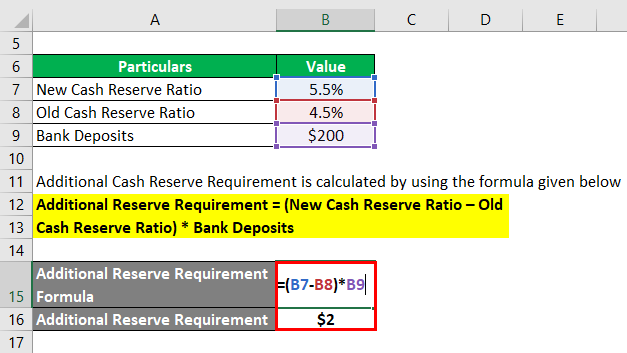

Let us take the example of an economy where the central bank has decided on a Contractionary Monetary Policy as such, it has raised the cash reserve ratio from 4.5% to 5.5% to reduce money in the market. As per the new regime, Calculate the additional reserve required by a bank with overall bank deposits of $200 million.

Solution:

Additional Cash Reserve Requirement is calculated by using the formula given below:

Additional Reserve Requirement = (New Cash Reserve Ratio – Old Cash Reserve Ratio) * Bank Deposits

- Additional Reserve Requirement = (5.5% – 4.5%) * $200 million

- Additional Reserve Requirement = $2 million

Thus, the central bank has reduced this bank’s money supply by $2 million.

Example #2

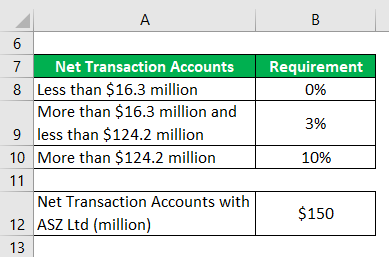

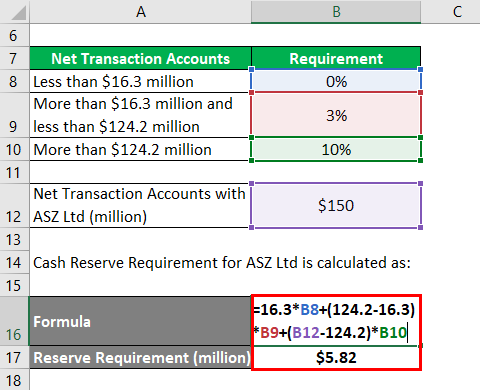

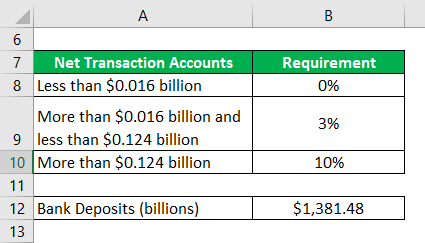

Let us take the example of bank ASZ Ltd, which is in the US. The bank has net transaction accounts of $150 million, and it wants to calculate its cash reserve requirement according to the newly chartered reserve requirement by the Federal Reserve. As per the new rule, net transaction accounts of less than $16.3 million are exempted from any requirement, net transaction accounts of more than $16.3 million and less than $124.2 million will attract a 3% reserve requirement, and net transaction accounts of more than $124.2 million will be subjected to a 10% reserve requirement. Calculate the reserve requirement of ASZ Ltd. for ASZ Ltd can be.

Solution:

Let’s do the calculation of Cash Reserve Requirement for ASZ Ltd:

- Reserve Requirement = $16.3 million * 0% + ($124.2 million – $16.3 million) * 3% + ($150 million – $124.2 million) * 10%

- Reserve Requirement = $5.82 million

Under the new regulations, ASZ Ltd must maintain a cash reserve of $5.82 million with the Federal Reserve.

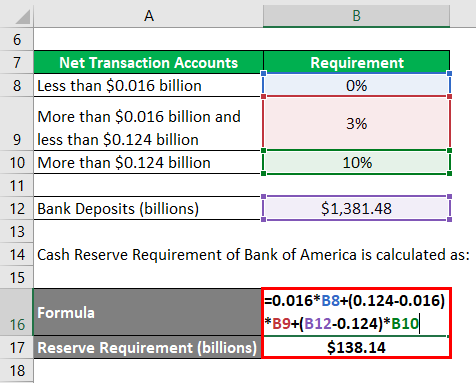

Example #3

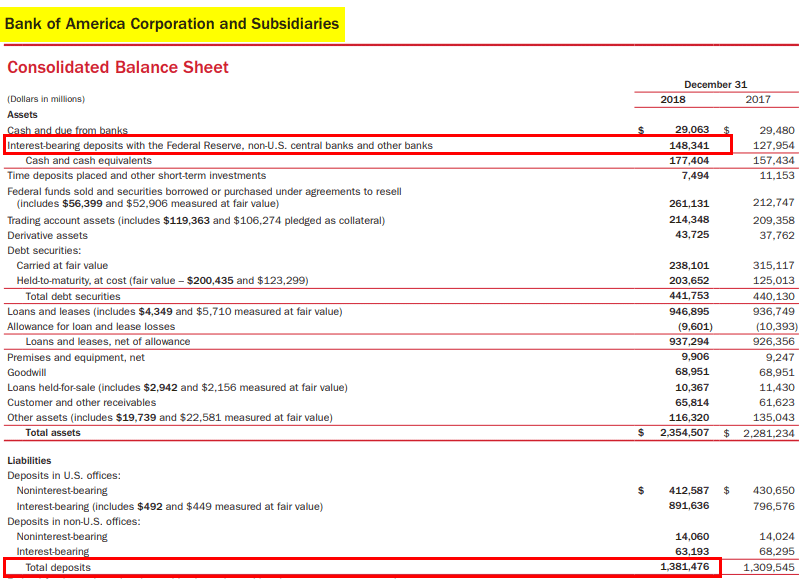

Let us take the latest annual report of Bank of America to understand the concept of cash reserve ratio in real life. According to the annual report 2018, the bank’s overall deposits stood at $ 1,381.48 billion on the balance sheet. Calculate the cash reserve requirement of Bank of America for the year 2018.

Since the bank has most of its liabilities in the US, we will consider the reserve requirement of the Federal Reserve for ease of calculation.

Solution:

Let’s do the calculation of the Cash Reserve Requirement of Bank of America:

- Reserve Requirement = $0.016 billion * 0% + ($0.124 billion – $0.016 billion) * 3% + ($1,381.48 billion – $0.124 billion) * 10%

- Reserve Requirement = $138.14 billion.

Therefore, the mandate for Bank of America in 2018 is to maintain a cash reserve of $138.14 billion, which is relatively close to the highlighted value of $148.34 billion maintained under Assets.

Advantages and Disadvantages

The advantages and disadvantages of CRR are as follows:

Advantages

- The cash reserve ratio is primarily useful in controlling the money supply in the system by fostering a smooth money supply along with credit in the economy.

- The cash reserve ratio helps develop a sustainable solvency position of the commercial banking system in an economy.

Disadvantages

- Requiring banks to hold larger deposits in the Federal Reserve leads to increased borrowing costs for banks.

- Frequent changes can result in an uncertain economic environment for commercial banks.

Conclusion

So, it can be seen that the cash reserve ratio is a means to manage the liquidity of commercial banks to maintain a sustainable and smooth banking system in an economy.

Recommended Articles

This has been a guide to Cash Reserve Ratio. Here we discuss how the cash reserve ratio can be calculated with its formula, examples, and a downloadable Excel template. You can also go through our other suggested articles to learn more –