What is Cash Surrender Value?

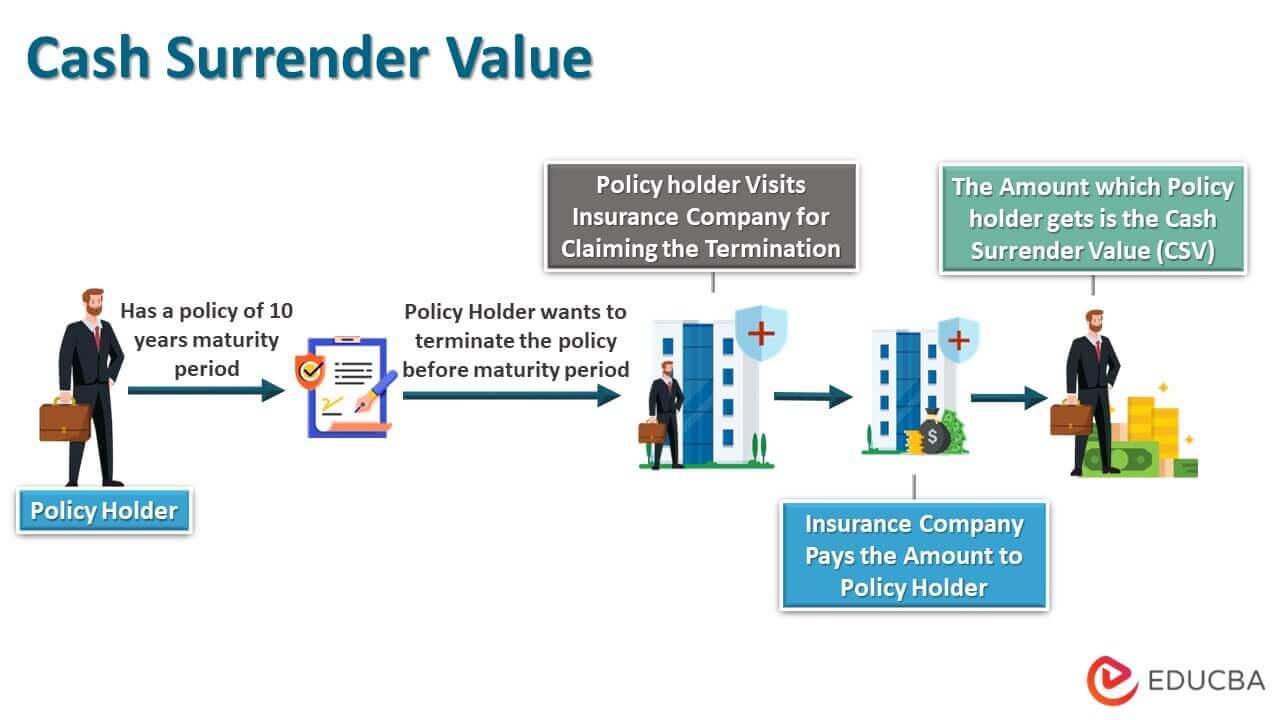

The term “cash surrender value” (CSV) refers to the sum of money an annuity contract owner or a policyholder is entitled to when they voluntarily terminate their insurance policy ahead of its scheduled maturity.

In other words, the CSV refers to the savings component of the permanent life insurance policies(especially whole life insurance policies) that the insurance companies need to pay in case of policy termination before maturity.

Explanation

The CSV is part of the permanent life insurance policy’s cash value that will be available to the owner of the policy when the policy is surrendered before maturity. The amount of money to be received as CSV varies depending on the age of the policy. In most cases, CSV could be significantly less than the policy’s actual cash value if the withdrawal happens before a pre-determined tenure.

Features of Cash Surrender Value

Some of the main features of CSV are as follows:

- It represents the value of the cash one can get from an insurance policy at any time.

- The value depends on the policy’s age and grows with time. For instance, if the policy is surrendered in the very initial years, then the amount available may be significantly less than the paid-up premium because the initial premiums are usually not used for investment but for covering the various costs, such as up-front or front-end fees.

- If a policy is surrendered before a set time, then surrender charges are deducted from the CSV. But if the cancellation is made after that time, the surrender charge deduction is not imposed on the withdrawal.

- If the policy is surrendered in full in exchange for cash value, then the insurance policy is rendered null and void. In partial withdrawal, the CSV decreases the policy’s death benefit.

How Does Cash Surrender Value Work?

Let us look at how CSV works in a life insurance policy. When policyholders pay the premiums for an insurance policy, especially whole life or permanent life insurance for mums, a particular portion of the premium payment is used to cover the death benefit, and the remaining portion is used for investment purposes. Now, the portion that the insurance company invests on behalf of the policyholder goes into the accumulation of cash surrender value. Additionally, a small portion of the premium is used to cover the various administrative costs, such as fees for investment management.

How to Calculate Cash Surrender Value?

Step 1: Determine how long the policy has been in force, denoted by n.

Step 2: Next, determine the periodic premiums’ size, denoted by P.

Step 3: Next, ascertain the rate of return offered on the premium, which is usually linked to the performance of the market. It is denoted by r.

Step 4: Next, determine the total accumulated investment value based on the age of the policy (step 1), premium payment (step 2), and rate of return (step 3), as shown below.

Step 5: Next, check whether or not the withdrawal is subject to any surrender charges. If yes, determine the surrender charges, usually expressed as % of unpaid premiums.

Step 6: Finally, the CSV can be derived as accumulated investment value minus surrender charges.

Example of Cash Surrender Value

Examples of Cash Surrender Value are:

Example #1

Let us take the example of David, who took an insurance policy 10 years back. The policy is for a period of 30 years with a yearly premium of $5,000 and a death cover of $500,000. If the policy is surrendered before the completion of 15 years, a surrender charge of 1% of unpaid premiums will be chargeable. Determine the cash surrender value if David decides to surrender the policy today, given that the rate of return on the premium is 4%.

- Given the age of the policy, n = 10 years

- Premium payment, P = $5,000

- Rate of return, r = 4%

- Policy tenure = 30 years

- Surrender charge rate = 1%

Accumulated Investment Value is calculated as,

Accumulated Investment Value = P * [(1+r)n -1] / r

- Accumulated Investment Value = $5,000 * [(1+4%)10 -1] / 4%

- Accumulated Investment Value = $60,030.54

Surrender Charges are calculated as,

Surrender Charges = Surrender Charge Rate * (Policy Tenure – n) * P

- Surrender Charges = 1% * (30 – 10) * $5,000

- Surrender Charges = $1,000.00

CSV can be calculated as,

Cash Surrender Value = Accumulated Investment Value – Surrender Charges

- Cash Surrender Value = $60,030.54 – $1,000.00

- Cash Surrender Value = $59,030.54

Therefore, the CSV, in this case, will be $59,030.54 ~ $59,030.

Importance of Cash Surrender Value

The importance of CSV comes from the fact that it represents the sum of money that will be available from an insurance policy in case of an emergency. Also, the policyholder can otherwise use CSV as collateral for the loan. Overall, it is an essential parameter for the policyholder from a liquidity point of view.

Advantages

Some of the significant advantages of CSV are as follows:

- It serves as extra liquidity support during times of emergency.

- The CSV captures how the investment portion of the insurance has grown during the policy’s tenure.

- The policyholder can also use the CSV as collateral for a loan.

Conclusion

So, it can be seen that cash surrender value is a very interesting parameter for the policyholders as it can potentially support their short-term liquidity needs. However, the value varies as per the policy terms and age of the policy.

Recommended Articles

This is a guide to Cash Surrender Value. Here we also discuss the introduction, how cash surrender value works, and advantages and examples. You may also have a look at the following articles to learn more –