Updated July 7, 2023

What is a Certificate of Insurance?

A certificate of insurance is proof of an insurance policy issued by an insurance company. For example, James wants to rent an office space in New Jersey. His landlord requests property insurance. As James has renters insurance, he provides his landlord with the COI and rents the place.

The certificate of insurance lists the policy type, coverage, limits, insured’s name, and effective date. It is helpful if there is a lack of trust between two parties, such as in business transactions or when renting property. In these cases, one party may ask for sufficient insurance coverage proof before proceeding further. These certificates have one-year validity, and renewal should be before expiry.

Key Highlights

- It provides evidence that the individual/company has valid insurance, which they can provide for customer documentation.

- Businesses, customers, and others need it to confirm the coverage they require.

- Types of this certificate would include a certificate of general liability, automobile liability, and workers’ compensation insurance.

- It is crucial when one wants to renew their insurance policies, and it also safeguards the insured against insurance fraud.

Certificate of Insurance Types

Certificate of Liability Insurance:

- It is a policy that protects the insured from any losses that may arise from a third-party lawsuit

- General Liability Insurance covers the insured for liability arising from accidents or injuries to a third party, property damage, and other risks.

- Another is Professional Liability Insurance, which covers professionals who may be liable to their clients for damages, such as architects, engineers, lawyers, accountants, and doctors.

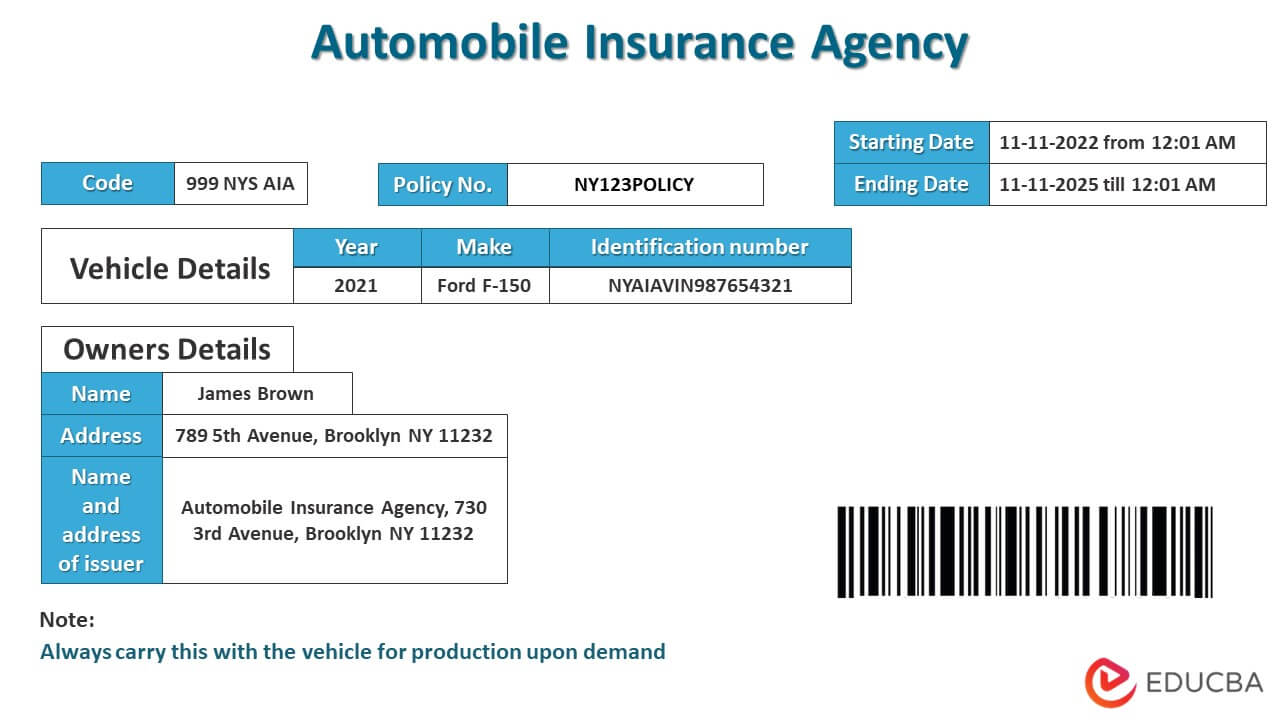

Certificate of Automobile Liability Insurance:

- It is a report to certify that the person has their vehicle insured. For instance, the Department of Motor Vehicles (DMV) issues the certificate for the State of California.

- If the insured causes an accident, the insurance pays for the other vehicle’s repairs and medical expenses incurred by the other driver or passengers.

- One must submit their certificate to the automobile department, like DMV, if they get into an accident with an uninsured driver.

Certificate of Workers Compensation Insurance:

- Its purpose is to prove that the employer has the policy to cover any injuries an employee/worker may sustain on the job. Additionally, the employee cannot sue the business with a COI.

- This document shows up on an injured employee’s insurance claim. Thus, the employer must give them the certificate within 24 hours of the injury.

- Workers’ compensation insurance covers medical expenses, income replacement, and death benefits. One can get this insurance through a private company or their state’s workers’ compensation program.

Who may Require a Certificate of Insurance?

- Firms with customers or clients requiring proof of insurance must obtain the certificate. This document provides evidence that they have the necessary coverage in place.

- Businesses must have certain types of insurance, such as workers’ compensation and liability insurance, to protect those employees.

- Landlords, event venue managers, and others sometimes require to have COI

- It is necessary for vehicle and property owners as well.

How to Obtain a Certificate Of Insurance?

- The first step will be to gather all essential information regarding the insurance and fill out a COI form with the respective insurance company.

- It could be through most companies’ customer support areas and even online.

- The company may take a few days or weeks to create the certificate to verify the data.

- Once done, the insured receives the certificate via email, mail, or the website. The insured can print it as a paper version of the certificate if it is a soft copy.

Importance of Certificate of Insurance

- It protects businesses from being liable for damages caused by employees or customers.

- It is an essential document for employees in the workplace. And it also verifies that the employee has insurance coverage in case of an accident or injury while on the job, especially in high-risk jobs like construction.

- It’s an important document when one wants to get new insurance, transfer their policy, or need to renew current policies.

- It saves the insured from insurance scams or frauds as they possess proof of insurance.

- It also offers a quick overview of the insurance plan.

Conclusion

Insurance certificates provide many benefits to businesses. It shows customers the firm’s commitment to protecting them from harm. It also makes it easier to get a new policy when there’s a change in the business structure or location. Consult with an insurance agent or broker to ensure you have the correct type of certificate for your needs. Finally, remember to keep the document safe to access it when needed.

Frequently Asked Questions(FAQs)

Q1. What is the certificate of insurance?

Answer: A certificate of insurance is a legal document to prove the existence and validity of your contract insurance for a specific period.

Q2. What is the difference between an insurance policy and a certificate?

Answer: While an insurance policy is a contract between the insured and the insurer, a certificate is simply evidence of insurance coverage.

A policy defines the amount of coverage, claim conditions, insurance premiums, and any exclusions or limitations. On the other hand, the certificate only provides basic information about the coverage, such as the coverage dates, the amount of coverage, and the insurer’s name.

Q3. What is a transport insurance certificate?

Answer: A transport insurance certificate is a document that details the policy number and the coverage contracted. It attests to establishing risk coverage on the goods/logistics operations during international transport.

Q4. When is a certificate of insurance needed from a provider?

Answer: It is typically required when contracting with another business or individual. This document provides proof that the insured has the minimum insurance required by the other party. The certificate also states the effective dates of the policy, the policy limits, and the named insured.

Recommended Articles

This is a guide to the Certificate of Insurance. It explains its meaning, types, participants, etc. Please read the following article for more details,