Updated July 25, 2023

Difference Between CFO vs Controller

CFO stands for Chief Finance Officer and is a high-ranking executive in a company, typically reporting directly to the CEO. With the skills of a CFO, he or she not only controls and manage everything related to finance in the company but are also prominent at managing the day-to-day business operations and product pricing, along with a sense of other activities such as marketing, advertising, human resources, etc.

The controller is more of a Chief Accountant, and this person reports to the CFO of a company. The controller’s duties involve managing the day-to-day finances of the business while coordinating income and expenses. Large organizations require separate roles for accounting and finance functions, as they have distinct responsibilities and cannot be effectively combined.

Who is CFO? (Chief Finance Officer)

In terms of skillsets, a CFO’s skills may be the same as a Controller, but a CFO must be certainly involved with both the business and the numbers from an early stage. In addition to developing a deep understanding of the synchronization between numbers and business operations, a CFO needs to have a pulse of the functioning of all the departments and keep the entire structure of the business well-oiled and smoothly functioning.

The CFO reviews financial reports, manages risks, and targets future growth. Some day-to-day activities of the CFO include financial analysis, forecasting, finalizing financing, fund management, planning, implementing, strategizing, and coaching the rest of the finance team.

A person suitable for the role of CFO needs to be a great financial strategist and a data-backed critical thinker.

Who is the Controller?

The controller serves as the organization’s Chief Accountant and requires strong professional experience in accounting and financial reporting. They are usually responsible for maintaining the accounting books in order, continuously evaluating past performance, and deriving lessons that could assist in the future.

The entire accounting department reports to the Controller. He or she is responsible for assigning duties to every department within accounting, and hence responsible for accounting, budgeting, compliance, generating reports, ensuring accuracy in the reports, analyzing data, and giving these reports and models to the CFO for decision making.

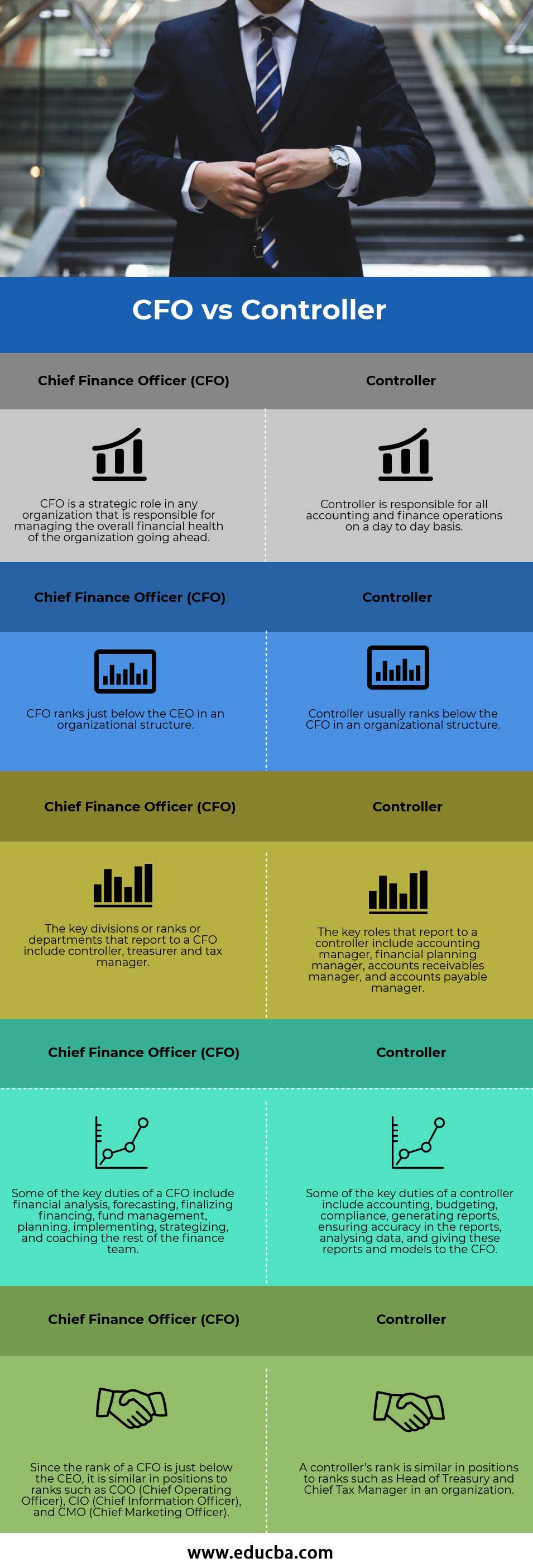

Head To Head Comparison Between CFO vs Controller (Infographics)

Below is the Top 5 Comparison between CFO vs Controller:

Key Differences Between CFO vs Controller

While some large organizations may refer to the controller as the CFO, it may not be true.

Example:

H&M India does not have any rank, such as CFO. In H&M India, “Controller – India” reports to “Country Manager / CEO – India”. However, this structure is so because H&M is a Swedish company. The senior executive team in Sweden sets its planning and decision-making for the future course of business. Hence, H&M has its CEO and CFO ranks based in Sweden, while each country will have a Country Manager (equivalent to the CEO for that country) and Controller (equivalent to CFO for that country). This is so because, despite the decision-making powers that the Country Manager and Controller of a country might have, they have to be working within the defined broader guidelines set by the Senior Management in Sweden.

The key differences between the CFO vs Controller are as follows:

- The CFO is responsible for all things finance and ranks below the CEO. The Controller reports to the Country Head or CFO and ranks 3 to 5 below the CEO.

- The CFO focuses on future financial strategies and cash flow projections for growth. The Controller manages day-to-day accounting and finance operations, including reporting, budgeting, and compliance.

- The key roles that report to a CFO include controller, treasurer, and tax manager. The key roles that report to a controller include an accounting manager, financial planning manager, accounts receivables manager, and accounts payable manager.

Comparison Table of CFO vs Controller

The table below summarizes the comparisons:

| Chief Finance Officer (CFO) | Controller |

| CFO is a strategic role in any organization responsible for managing the overall financial health of the organization. | Controller is responsible for all accounting and finance operations on a day-to-day basis. |

| CFO ranks just below the CEO in an organizational structure. | Controller usually ranks below the CFO in an organizational structure. |

| The key divisions or ranks or departments that report to a CFO include the controller, treasurer, and tax manager. | The key roles that report to a controller include an accounting manager, financial planning manager, accounts receivables manager, and accounts payable manager. |

| Some of the key duties of a CFO include financial analysis, forecasting, finalizing financing, fund management, planning, implementing, strategizing, and coaching the rest of the finance team. | Some of the key duties of a controller include accounting, budgeting, compliance, generating reports, ensuring accuracy in the reports, analyzing data, and giving these reports and models to the CFO. |

| Since the rank of a CFO is just below the CEO, it is similar in positions to ranks such as COO (Chief Operating Officer), CIO (Chief Information Officer), and CMO (Chief Marketing Officer). | A controller’s rank is similar in positions such as Head of Treasury and Chief Tax Manager. |

Conclusion

A CFO is ultimately responsible for anything to do with the finances of a company. However, since a single person cannot manage everything, there are further subdivisions within the finance department. One of the important sub-divisions is headed by the Controller, which manages the day-to-day financial operations of the business while allowing the CFO to manage the macro-level decisions for the future path of the business.

Recommended Articles

This is a guide to the top differences between CFO vs Controller. Here we discuss CFO vs Controller key differences with infographics and a comparison table. You may also have a look at the following articles to learn more –