Updated November 15, 2023

Difference Between Chapter 11 vs Chapter 13 Of The Bankruptcy Code

Chapter 11 of the bankruptcy code is a form of bankruptcy reorganization available for corporations, partnerships, or individuals. Chapter 11 of the bankruptcy is intended primarily for reorganizing firms with huge debt burdens, most often associated with large firms but also available to small firms. Although uncommon, consumers may file for Chapter 11 bankruptcy in some rare cases. In Chapter 13 of the bankruptcy proceeding, the debtor has to pay part or all of his debts from the future income over three to five years under Chapter 13 of the bankruptcy plan. For some people, the period should be five years, depending on the case. If the court approves the payment plan, the debts will be paid in part or full by the Chapter 13 trustee.

What is Chapter 11 of the Bankruptcy Code?

Chapter 11 bankruptcy allows the debtor to propose a plan for profitability post-bankruptcy, which may include cutting costs and seeking new opportunities for revenue or income while temporarily holding creditors at bay. In contrast, Chapter 7 bankruptcy (also called liquidation) involves closing the debtor business and selling liquid assets to repay creditors. While Chapter 11 has certain advantages for those who qualify, including more time to file a plan and the opportunity to reorganize, it is more time-consuming and costlier than any other form of bankruptcy.

Businesses have the following court filing requirements for Chapter 11 bankruptcy –

- Statement of operations

- Cash-flow statement

- Copy of the business entity’s most recent balance sheet

- Copy of the most recent federal income tax return

While Chapter 11 offers businesses the advantage of additional time (compared to other chapters of bankruptcy) to file a plan and renegotiate terms with creditors (180 days versus 15 days for Chapter 7), along with a time advantage, it has a few drawbacks. However, it can cost tens of thousands of dollars in legal fees, which may be untenable for a struggling small business or individuals. If the emergence from bankruptcy protection proves successful, these costs are offset by the ultimate reward of becoming profitable.

What is Chapter 13 of the Bankruptcy Code?

To qualify as a debtor under Chapter 13 of the Bankruptcy Code, the Debtor must be an individual or a wife and husband filing jointly. There are also certain debt limits pre-determined by the Government for debtors filing under Chapter 13 bankruptcy. Debt (almost major part or minor part) that needs to be paid as declared by the plan of reorganization will be wiped out or discharged. In other words, if your plan only provides for payment of up to 15% of the unsecured debt, then the remaining 85% plus any accrued interest will be wiped out or discharged upon completion of your plan. If your bankruptcy plan doesn’t provide any payment to unsecured creditors, then the entire unsecured debt is wiped out upon completion of the plan.

If a husband, a wife, or an individual filing jointly for bankruptcy has debt that exceeds certain limits predetermined by law, then Chapter 13 bankruptcy reorganization is not an option; they can file for bankruptcy but under a different chapter of the bankruptcy. These limits change every three years in April based on the cost of living and inflation since the last change. For example, until 1st April 2016, an individual or wife and husband filing jointly must owe an unsecured debt of less than $383,175 and a secured debt of $1,149,525. If an individual or wife and husband filing together debts exceed the above limits, then the only option to reorganize is under Chapter 11.

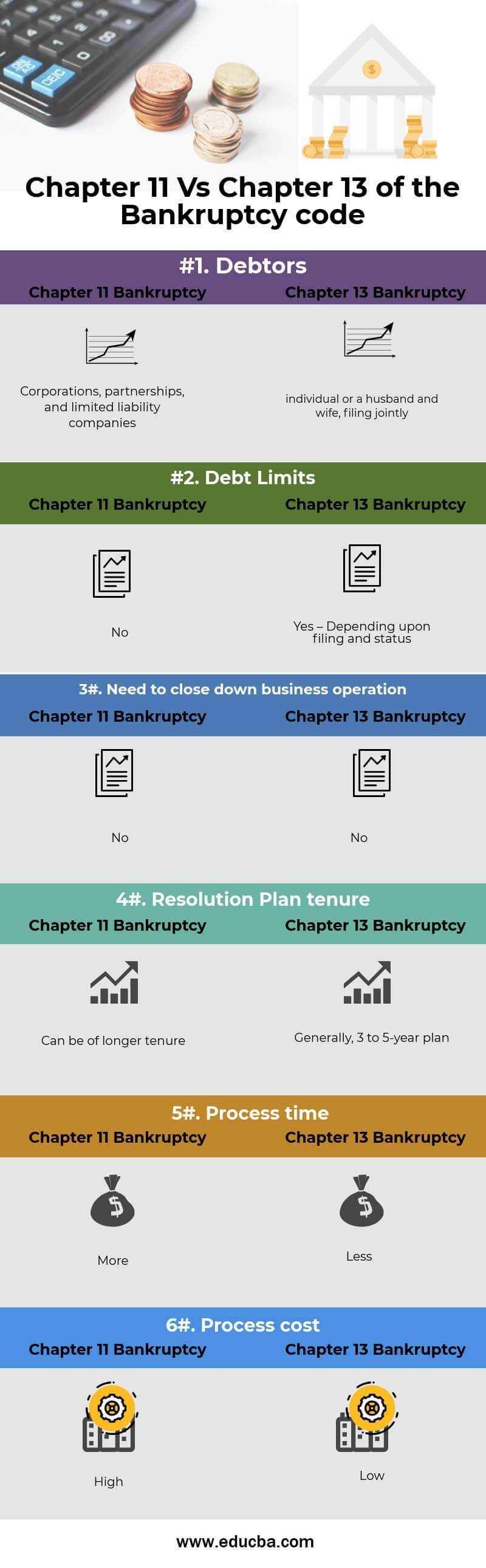

Chapter 11 vs Chapter 13 of the Bankruptcy Code (Infographics)

Below are the top 6 characteristics between Chapter 11 vs Chapter 13

Key Differences Between Chapter 11 vs Chapter 13

Both Chapter 11 vs Chapter 13 are recommended options in the business. Let us examine some of the fundamentals of Chapter 11 vs Chapter 13:

To qualify as a debtor under Chapter 13 of the Bankruptcy Code, the debtor must be an individual or a wife and husband filing jointly. Corporations, partnerships, and limited liability companies (LLCs) are not allowed to file for bankruptcy under Chapter 13 of the bankruptcy; thus, Chapter 11 of the bankruptcy code would be the only option for such entities if one of these types of companies needs to reorganize and continue its operations. Thus, chapter 11 of the bankruptcy code is a form of reorganization available for corporations, partnerships, or individuals.

If any firm files for relief under Chapter 7, the company must cease its operations once it files for a bankruptcy case. This is why Chapter 7 bankruptcy is considered a last resort, and Chapter 11 bankruptcy and Chapter 13 bankruptcy are used generally.

Chapter 13 bankruptcy is generally less expensive than Chapter 11 bankruptcy code. This is primarily because:

- the filing fee for Chapter 13 bankruptcy is less costly

- the Chapter 13 bankruptcy process requires less work and

- the maximum Chapter 13 bankruptcy plan is five years instead of a lengthier Chapter 11 bankruptcy plan.

Chapter 11 vs Chapter 13 Comparison Table

Below is the topmost Comparison between Chapter 11 vs Chapter 13

| Basis of comparison |

Chapter 11 bankruptcy |

Chapter 13 bankruptcy |

| Debtors |

Corporations, partnerships, and limited liability companies |

Individuals or a husband and wife filing jointly |

| Debt Limits |

No |

Yes – Depending upon filing and status |

| Need to close down the business operation |

No |

No |

| Resolution Plan tenure |

Can be of longer tenure |

Generally, a 3 to 5-year plan |

| Process time |

More |

Less |

| Process cost |

High |

Low |

Conclusion

Filing for bankruptcy can become easier by knowing the details of each proceeding. For example, in Chapter 13, bankruptcy is for individuals or jointly for husband or wife. Chapter 11 bankruptcy is for corporations, limited liability companies, and partnership firms; even individuals can file under Chapter 11 bankruptcy.

Chapter 11 bankruptcy and Chapter 13 bankruptcy defers ineligibility, process, cost, and tenure perspectives. Chapter 11 of the bankruptcy offers many advantages for firms and individuals not qualifying for Chapter 13 bankruptcy.

It’s best to discuss your options with a professional business bankruptcy attorney before deciding.

Recommended Articles

This has guided the top variations of Chapter 11 vs Chapter 13. Here, we also discuss Chapter 11 vs Chapter 13 key differences with infographics and a comparison table. You may also have a look at the following articles to learn more –