Understanding CIBIL Score for Education Loan

As a student, it is important to understand a CIBIL score, especially when applying for an education loan. Loan lenders (banks) consider your CIBIL score when approving student loan applications. A CIBIL score is a three-digit numeric ranging from 300 to 900. Students must have a CIBIL score above 700 to qualify for an education loan.

This score determines your creditworthiness and your ability to repay the loan. Thus, a high score means you can repay loans in due time.

Moreover, in 2000, Credit Information Bureau (India) Limited (CIBIL) partnered with TransUnion (US-based), now known as TransUnion CIBIL. TransUnion CIBIL is India’s leading credit bureau that calculates and generates your credit score.

This article will explain the basics of the CIBIL score for education loans, tips for improving your score, and the minimum CIBIL score you need to be eligible for a hassle-free education loan.

Why is CIBIL Score Required for Education Loan?

Education is a must for every student for better careers and futures, but it has become expensive to pursue a higher degree. Thus, students pursuing higher studies in their country or abroad need education loans. The CIBIL score required for education loans should at least meet the minimum criteria and thus play an important role in approving education loans.

Also, lenders need to measure the risk of granting a loan to the applicant and whether they would replay the amount in time. Normally, lenders consider the CIBIL score of applicants before approving a credit application.

How Can Students Check and Build a CIBIL Score?

Students can check their CIBIL scores for free on various online platforms. If any student does not have a credit history and wants to apply for an education loan in the future, they can apply for a secured credit card. Students can use this credit card to get a loan against a fixed deposit or from wherever they already have a savings or current account.

With no or low CIBIL score, the chances of getting an education loan are close to nil. However, if you are new to credit or have a low CIBIL score, the bank shall decide your loan’s terms and conditions based on your co-borrower’s credit score.

Minimum CIBIL Score Required for Education Loan

- A CIBIL score for students must be above 700, which increases their chances of getting loans from potential banks and Non-Banking Financial Companies (NBFCs). It is also considered the minimum score for approval of education loans for some banks.

- Some public sector banks may consider loan approval with a score below 750.

- However, for most students who do not have a credit history or a low CIBIL score, it might be difficult for lenders to grant a loan.

- Usually, private sector banks may reject a loan application with a low CIBIL score.

Hence, lenders often ask for a guarantor or a co-applicant (co-borrower) to analyze the creditworthiness of applicants. Getting a loan can be easier if the co-applicant has a good credit score and valid documents.

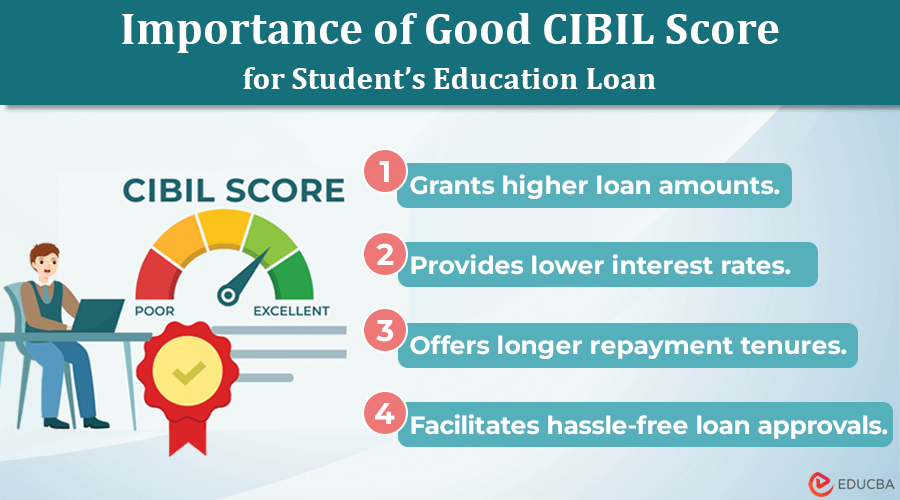

Therefore, students should maintain a good CIBIL score. It helps them easily avail of loans at low-interest rates, with higher amounts, hassle-free approvals, relaxed longer repayment tenure, and concessions on fees.

Tips to Improve CIBIL Score for Education Loan

As a student, you can follow these important tips to make sure that you enhance your CIBIL score gradually but effectively:

- Create your credit history by applying for credit cards and taking short-term personal loans.

- Always pay off your loan EMIs and credit card dues on time.

- Do not apply for multiple credit products simultaneously or at a shorter duration.

- Try to minimize your expenditure from the assigned monthly credit limit.

- Check your CIBIL report regularly for errors, and if there are errors, resolve them as soon as possible.

- Always opt for longer repayment tenure to lower your EMI amount to pay them on time.

Final Thoughts

If your CIBIL score is low, try to improve your score to reach at least 700. Remember increasing the score is not an overnight process, it needs continuous efforts. In this case, if you plan to apply for an education loan, then ensure your parent’s CIBIL score is healthy. Generally, banks and NBFCs consider parents’ credit scores while evaluating the loan application.

Being a student with no credit score is still reasonable and is not always considered a disadvantage. However, students shall be more aware of their CIBIL score and try improving it using useful measures.

Recommended Articles

We hope this article on “CIBIL Score for Education Loan” was informative and helpful to you. For more information, refer to our articles below.