Updated July 21, 2023

Definition of Combined Ratio

The combined ratio (CR) is defined as a ratio that is an indicator of the performance of the insurance company. The combined ratio is a ratio between the expenses plus the losses and the premium earned by the insurance company.

Explanation

An insurance company when taking its insurance assignment makes sure that the loss ratio and the expense ratio are good or not. The CR is nothing but the combination of both the loss ratio as well as the expense ratio. It is a comparison that is essential to make the investors understand the financial position of the insurance company. The premium earned is divided by the losses and the expenses to find out whether the company is capable of bearing the losses and the expenses with that premium money or not. This premium money is submitted by the policyholders and they have the right to understand the combined ratio which may affect their investment decision. The combined ratio is calculated in the percentage term. Suppose an insurance company’s combined ratio is more than 100% then this means that the insurance company is having more losses and expenses in comparison with the premium earned by it. In a rare case, scenario breakeven occurs to this ratio.

Formula

Example of Combined Ratio (With Excel Template)

Let’s take an example to understand the calculation of Combined Ratio in a better manner.

Example #1

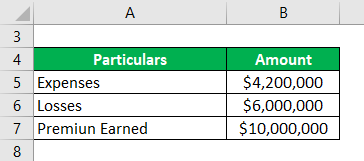

An insurance company’s total premium earned for the year is $ 100 lacs, the expenses including the underwriting expenses come out to $42 lacs and the losses are recorded to $60 lacs. What will be the combined ratio in this case?

Solution:

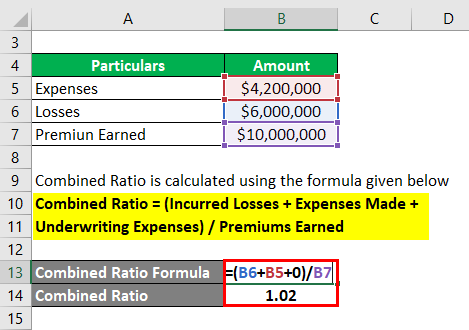

Combined Ratio is calculated using the formula given below

Combined Ratio = (Incurred Losses + Expenses Made + Underwriting Expenses) / Premiums Earned

- Combined Ratio = ($6,000,000 + $4,200,000 + $0) / $10,000,000

- Combined Ratio = 1.02

Here the combined ratio is 102% that means the expenses and the losses are more than the premium money earned by the insurance company. Therefore it is not an ideal situation for the insurance company.

Difference Between Combined Ratio and Loss Ratio

- The loss ratio is a ratio which is calculated to find out the loss incurred by the insurance company in comparison to the premium money received. Whereas the combined ratio is a ratio which finds out the total loss incurred along with the expenses made by the insurance company in comparison with the insurance premium received.

- For the sake of complete information regarding the financial position of the insurance company the combined ratio can really help whereas the loss ratio cannot be the ratio which we can rely upon.

- The combined ratio is also beneficial for the insurance company in decision making whereas the loss ratio serves a very limited purposes.

- The exact financial condition can be found out with the help of the combined ratio whereas the loss ratio only tells us about the losses.

- The loss ratio can help a policy holder understand his cost if he is asking for a insurance policy whereas the combined ratio can depict the financial condition of the insurance company.

Benefits

- The CR is a mixer of both loss ratio as well as the expense ratio. Therefore it can help in decision making.

- The CR helps the policy holder to understand the insurance company’s financial condition and also that the policy holder should invest or not.

- The CR is considered as one of the best methods of calculating the efficiency of the company because only the income earned from premium is used in the ratio calculation and the other incomes are ignored to find out the combined ratio.

- The indicator of the ratio is a percentage and this should be below 100% which depicts that the company is making profits against its losses and expenses.

- The CR also helps the policy holder known that whether their premium money is utilized effectively or not.

- In CR the policy holder will be able to get a clear picture of the insurance company.

- In CR both the aspects can be seen clearly that is the expense ratio as well as the loss ratio because these all form part of the insurance policy.

Limitations

- The CR portrays the financial condition of the insurance company but the combined ratio does not include the income from investments which is also a big part of the income of the insurance company.

- The core business of the insurance company is associated with other incomes as well therefore if in the calculation of the CR the other income from the company is not allocated then it is not a correct calculation and therefore the ratio is not reliable.

- In case of calculation of the CR it has been seen that the percentage which is a deciding element will always be less than 100% since the entire income of the insurance company is not there.

- Due to the structure of the CR formula the policy holder will always think that the financial condition of the insurance company is very good which can also be a false conception.

- The management can easily manipulate the combined ratio which is generally presented in the insurance company

- The policy holder can be at a loss if it does not consider the entire financial statement before investing in this insurance company.

Conclusion

The combined ratio is a ratio which depicts the financial condition of the insurance company. It is a ratio which is a combination of both the loss ratio as well as the expense ratio. The losses and the expenses both are considered in this calculation but the biggest limitation is that the ratio does not invite the other incomes of the insurance company to be the part of the ratio calculation. The management of the insurance company can manipulate the policy holder by always showing the ratio as less than the 100%. Therefore the policy holders should be aware of the financial condition by not completely relying upon the ratio but by understanding the complete financial statements released by the insurance company.

Recommended Articles

This is a guide to Combined Ratio. Here we discuss how to calculate combined ratio along with practical examples. we also provide a downloadable excel template. You may also look at the following articles to learn more –