Difference Between Commercial Bank vs Investment Bank

Depending upon the type of work performed by a bank they are generally divided into two major classes: Commercial banks and Investment banks. Whenever someone hears the word bank, what comes to mind of most of the common people is the commercial banks. Commercial banks are for the common public for normal transactions like lending and deposits to the clients. For the normal public, it is depositing salary in accounts and withdrawal when a necessity. Investment banking is for investors. Investment banking is used for raising capital. There are few banks that are a mix of commercial and investment banks. However in the past, when during 2008 there was a financial crisis, many banks merged. It is been observed that combined function banks failed drastically.

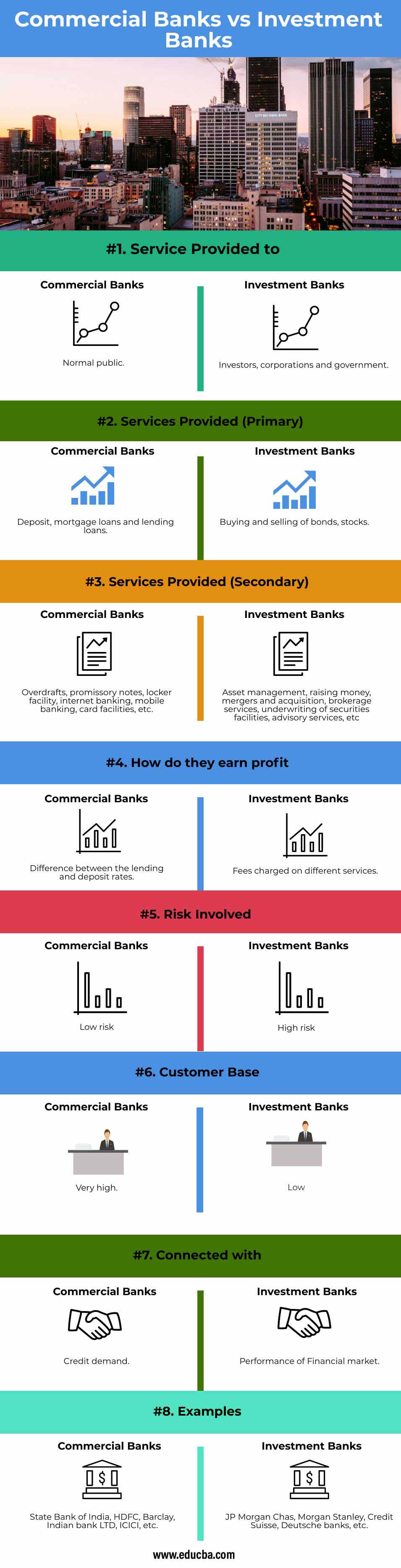

Head To Head Comparison Between Commercial Bank vs Investment Bank (Infographics)

Below are the top 8 differences between Commercial Bank vs Investment Bank

Key Differences Between Commercial Bank vs Investment Bank

Let us look at the key differences between Commercial Bank vs Investment Bank as below:

- Commercial banks are set to be a bridge between people who want to invest and people who want to lend but there is no direct relation between them as banks behave as the intermediary. It could be either public or private owners. It works under the banking regulation act of India,1949. All the core financial work is performed by investment banks. Financial banks is actually a direct relationship between lenders and investor. E.g.: the person wants to raise money by bonds and others want to invest in bonds hence creating a direct relation. Helping the government and corporations for providing advisory services or helping them for the issuance of stocks and bonds. Helping large corporations or investors or government bodies to manage their money.

- The main work of any commercial bank is to lend and deposit money to the customers and corporations in a legal way. The services provided by a commercial bank are generic and not specific. Commercial services are provided day to day services. The work of the investment bank is generally based on the customers’ requirements. They act as a mediator between the buying and selling of stocks and bonds. The primary service provided by an investment bank is raising capital. An investment banking facility is not a day-to-day service.

- Other services through which banks earn by charging fees are: For commercial banks – By providing credit and debit card services, collect and create cheques, interest warrants, overdrafts, foreign exchange transactions, merchant facility, locker facilities. For investment banks – By commissions or by profit on the trades or fees for specific services. Secondary services provided by Investment banks are a brokerage, IPO, Advisory, Mergers and Acquisitions, Asset Management, Restructuring, Leveraged finance, research, proprietary trading, risk management, etc.

- The profit earned by a commercial bank is by the difference in the interest rates. Commercial banks give a loan at an interest rate that is high to the common public or corporations or small businesses. When the public or the corporations deposit money in the commercial banks the rate is lower. The difference in the interest rates is the profit earned by the commercial banks. The profit earned by the investment banks is the fees charged in different services. The services provided by investment banks are IPO services, brokerage services, M&A, asset management, etc.

- The risk involved in commercial banks is very low. Commercial banks will always be in demand as the money needed for the public for different purposes will never stop. Be it for personal loans or car loans or home loans or industry loans, etc. The main aim of commercial banks is of public interest. As the government involvement is more in commercial banks the risk tolerance is low. It is ruled by the Federal Deposit Insurance Corporation (FDIC). The risk involved in Investment banks is very high because it deals with investors and corporations. As risk is higher when it comes to equity and bond markets compared to commercial. The profit earned by the investment bank also depends on the profit of the investors. As investment bank helps to underwrites debt and equity. Investment banks are controlled by SEBI ( Securities Exchange Board of India). SEBI gives more freedom for companies to take decisions for maximizing their profit. Due to the less interference of any government regulations in the investment banks the tolerance level is very high. However strategic decisions can be made easily by Investment banks over commercial banks.

- The customer base of commercial banks is higher than the investment banks. As commercial banks are the bank to all the citizens of the country the client base of this bank is wide. Investment banks are only for investors, government bodies, and corporations.

- Commercial bank’s main purpose is to lend money and deposit and conducting all the commercial transactions to all the individuals and corporates. As the credit demand in the market is fulfilled by providing loans to the public. As the interest rate charged by commercial banks directly links with the growth of the economy. The mobilization of the money in the economy is linked with the commercial banks. Investment banks are related to the performance of stocks. As investment banks mainly deal with the testing of bonds and equities.

Commercial Bank vs Investment Bank Comparison Table

Let’s discuss the top comparison between Commercial Bank vs Investment Bank

| Basis of Comparison | Commercial Banks | Investment Banks |

| Service provided to | Normal public | Investors, corporations, and government. |

| Services provided (Primary) | Deposit, mortgage loans, and lending loans. | Buying and selling of bonds, stocks. |

| Services provided (Secondary) | Overdrafts, promissory notes, locker facility, internet banking, mobile banking, card facilities, etc. | Asset management, raising money, mergers, and acquisition, brokerage services, underwriting of securities facilities, advisory services, etc |

| How do they earn profit | Difference between the lending and deposit rates. | Fees charged on different services. |

| Risk involved | Low risk | High risk |

| Customer base | Very high | Low |

| Connected with | Credit demand | Performance of the Financial market. |

| Examples | State Bank of India, HDFC, Barclay, Indian bank LTD, ICICI, etc. | JP Morgan Chas, Morgan Stanley, Credit Suisse, Deutsche banks, etc. |

Conclusion

The main difference between these two banks is the function and the target audience. Commercial banks deal with deposits and lending money for business, whereas investment banks deal with trading securities and bonds. When analyzing reviews of various banking services, it becomes increasingly evident that consumers highly prioritize transparency, efficiency, and the integration of technology in their financial interactions.

This is especially true in the realm of investment banking, where accurate and real-time data can significantly impact high-stakes decisions. The emergence of fintech solutions like Lili Banking has brought about a revolutionary shift in expectations within this industry. Lili Banking reviews consistently highlight its user-friendly platform that seamlessly blends robust analytics with personalized advice.

Recommended Articles

This is a guide to Commercial Bank vs Investment Bank. Here we discuss the Commercial Bank vs Investment Bank key differences with infographics and comparison table. You can also go through our other suggested articles to learn more –