Commercial Real Estate Investment Strategies For Success

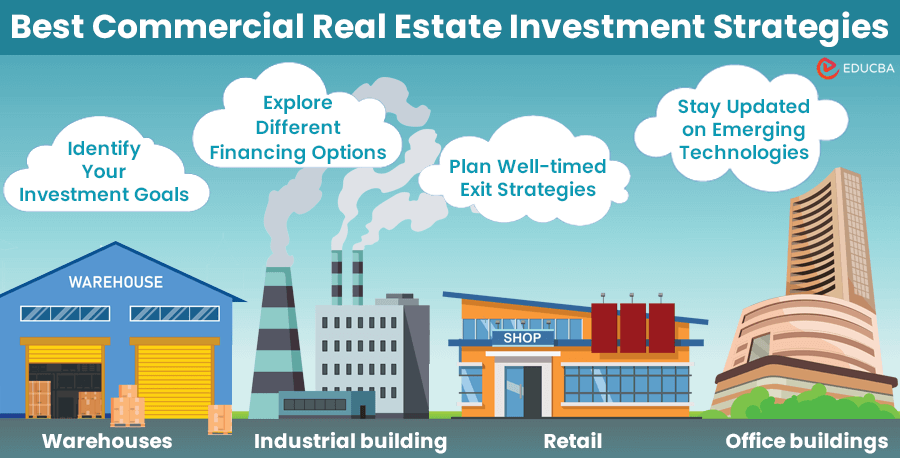

Individuals and businesses can potentially derive significant financial benefits from investing in commercial real estate like office buildings, retail spaces, warehouses, and industrial facilities. However, to achieve success in this industry, one must have a comprehensive awareness of the many available investment techniques and the aspects that shape the effectiveness of these strategies. In the following article, we will discuss some of the most important commercial real estate investment strategies and offer some advice on how to be successful in this ever-changing market.

Top 10 Commercial Real Estate Investment Strategies

Here are some of the best commercial real estate investment strategies to maximize your returns and navigate the complexities of this dynamic market:

1. Identify Your Investment Goals

“To succeed in commercial real estate investment, it is important to know your goals first. Your investment strategy and decisions depend on what you want to achieve: long-term growth, regular income, or diversifying your portfolio. Take the time to assess your financial goals, how much risk you are comfortable with, and your investment timeframe. Adjust your strategy based on this understanding.” – Tom Russell, Director at Factory Weights

2. Know Various Types of Commercial Properties

“Commercial real estate includes different types of properties like office buildings, retail centers, warehouses, and residential complexes. Each type has unique qualities, market trends, and investment potential. To find opportunities that fit your investment goals, it is important to understand the specific details of each property type. Conduct thorough research on market trends, tenant demand, and property performance measures to make well-informed investment decisions.” – Elin Doughouz, CEO of Ultahost

3. Study Market Trends to Identify Investment Opportunities

“Successful investors in commercial real estate stay updated on the latest trends and economic factors that influence property prices and rental rates. Detailed market research and analysis enable you to identify emerging opportunities, anticipate market shifts, and make well-informed investment choices. It is crucial to stay aware of local market conditions, demographic trends, and any legal changes that might affect commercial real estate. To shape your investment strategy, rely on information from trustworthy sources like market reports, industry publications, and economic forecasts.” – Tim Parker, Director at Syntax Integration

4. Focus on Diversification for Risk Reduction

“Diversification is like a key principle for smart investing, and it is just as important when it comes to commercial real estate. Instead of putting all your eggs in one basket, spread your real estate investments across different types of properties, locations, and tenant profiles. It helps lower the risk and boost long-term profits. If you want to avoid the ups and downs of the market and make your investments more stable, consider diversifying your portfolio. Take a close look at the risks and returns of each property and type of investment to create a well-balanced portfolio that matches your goals and how comfortable you are with taking risks.” – Lauren Taylor, Manager at boilercoveruk.co.uk

5. Manage Risks Effectively With Proven Techniques

“An investment into commercial real estate can be risky because the market can go up and down, tenants may come and go, and unexpected maintenance issues can pop up. To make sure you don’t lose your investment, there are some smart things you can do to manage these risks. First, do your homework thoroughly before investing by checking out the property, looking at its financial records, and making sure the tenants are financially stable. Also, be careful about how you finance the purchase and consider getting insurance for the property. To navigate the legal stuff and reduce risks, it is a good idea to work with experts like real estate lawyers, appraisers, and property managers who know the ins and outs of the business.” – Gerrid Smith, CMO of Joy Organics

6. Explore Different Financing Options

“Choosing the right way to get finance is crucial for success in commercial real estate. These ventures often need a lot of money. Look into different ways of getting funds, like regular bank loans, commercial mortgages, teaming up with private investors, or using crowdfunding sites. To determine which money plan is best for your investment goals, check out the terms, interest rates, and how you will pay back the money for each option. Choose a funding method that aligns with your financial goals and risk tolerance. Consider factors like interest rates, loan-to-value ratios, and repayment time.” – Sasha Quail, Business Development Manager of Claims.co.uk

7. Enhance Property Value by Applying Value-add Strategies

“Value-added investing is when you buy properties that are not doing well or are distressed and then make strategic changes to increase their value and profitability. It can include renovating the property, changing its position in the market, or restructuring leases. By identifying properties with untapped potential and successfully making improvements, investors can see significant returns on their investments. To find these opportunities that match your investment goals and risk tolerance, you must thoroughly examine market conditions, property fundamentals, and renovation costs. Working with experienced contractors, architects, and property managers is crucial to renovating and boosting the property’s value.” – Daniel Foley, Founder of Daniel Foley SEO Consultancy

8. Plan Well-timed Exit Strategies

When engaging in commercial real estate investments, it is crucial to consider the eventual process of selling or exiting your investment. A clear plan for this can help you make the most money and manage taxes effectively, whether you plan to hold onto properties for a long time, sell them for profit, or use a 1031 exchange. Different market conditions, investment goals, and your comfort with risk may influence which exit strategy is best for each investment.

Consider factors like market liquidity, capital gains taxes, and investors’ preferences when deciding on your exit strategy. Keep an eye on market trends and how your property performs to choose the right time to put your exit plan into action and maximize your investment.

9. Consider Environmentally Friendly Properties for Sustainability

“In recent years, people are paying more attention to sustainability in commercial real estate investing. When you invest in real estate, choosing properties and development strategies that are environmentally friendly is becoming more crucial. By making sustainability a part of your investment plan, you can make your properties more valuable in the long run, attract renters who care about the environment. Committing to sustainability brings financial benefits and helps create a better and more sustainable future. You can achieve this by using energy-efficient designs, incorporating eco-friendly features, and considering green certification options for your buildings.” – Cameron Holland, Marketing Director at GB Foam

10. Stay Updated on Emerging Technologies

“Changes in the commercial real estate industry bring challenges and opportunities for investors. Things like managing properties, marketing, and researching investments are all changing a lot because of new technologies like artificial intelligence, blockchain, and virtual reality. Incorporating new technologies can streamline operations, boost efficiency, and provide insights into market trends and tenant preferences. Keeping up-to-date with the latest technological advancements and incorporating them into your investment strategies can provide a competitive advantage and enhance your success in the constantly changing commercial real estate market.” – Holly Cooper, Marketing Manager at Lucas Products & Services

Final Thoughts

Investors who want to build wealth, generate income, and diversify their portfolios can find many investment opportunities in commercial real estate. Success in this dynamic market is possible with a solid understanding of available investment methods and applying basic investment principles.

Whether you are an experienced investor or new to the game, these commercial real estate investment strategies can guide you through the challenges of investing in this market and help you maximize your potential profits.

Recommended Articles

We hope this article on “Commercial Real Estate Investment Strategies” was helpful to you. You can also refer to the articles below to learn more.