Updated July 25, 2023

Definition of Common Size Income Statement

In “common size income statement” each of the line items in the income statement of the subject company is presented as a percentage of the total sales.

It is to be noted that it is just a type of presentation technique that forms part of the vertical analysis of financial statements that is predominantly used by financial managers to assess the performance of a company such as,

- It can be used to compare the performance of companies with a varying scale of operations because this technique eliminates the base effect by expressing the figures in terms of percentages.

- It can be used to assess the trend in the performance of a company across time periods.

- It also enables the establishment of the relationship between each of the cost accounts in the income statement and the total sales, and how each cost impacts the overall profitability of a company.

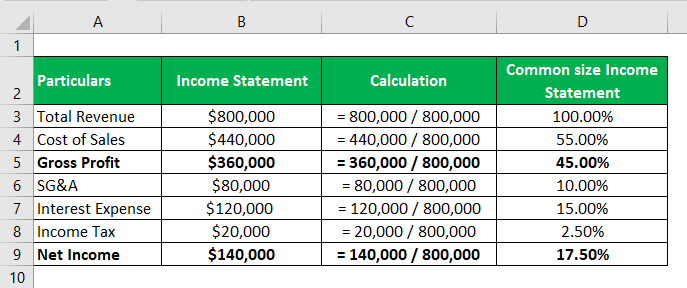

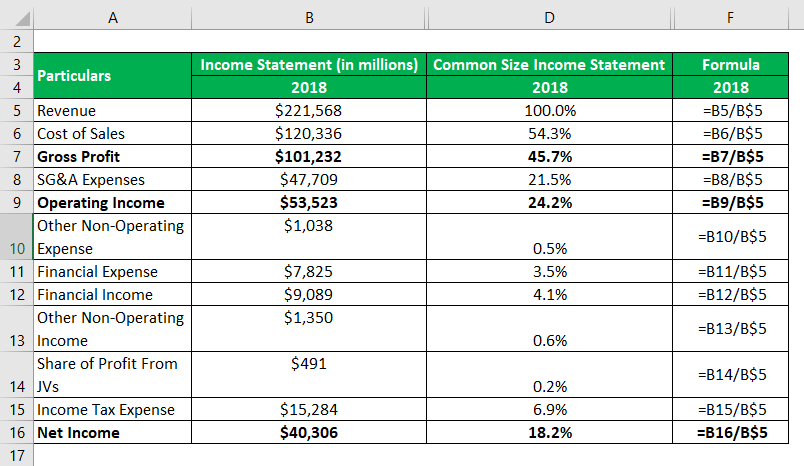

Formula

There is no such formula for deriving a common size income statement, rather it is a method wherein a separate column is created and all the line items in the income statement are divided by the total sales and placed in the corresponding adjacent separate cell. It is presented in terms of percentage. The below table provides a brief illustration.

Examples of Common Size Income Statement (With Excel Template)

Let’s take an example to understand the calculation in a better manner.

Example #1

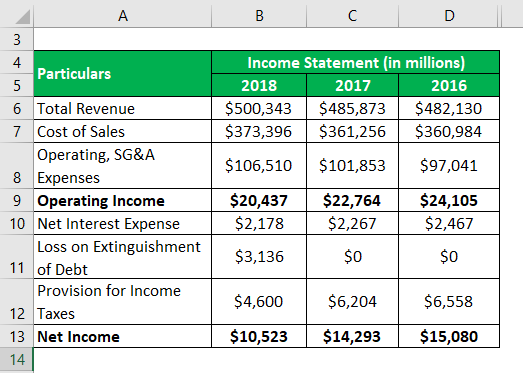

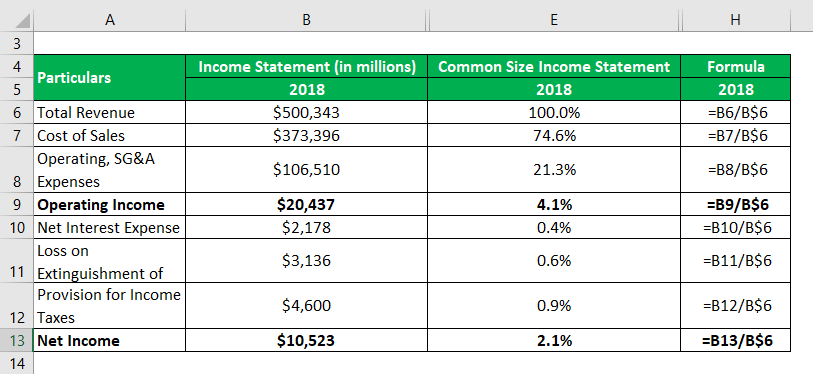

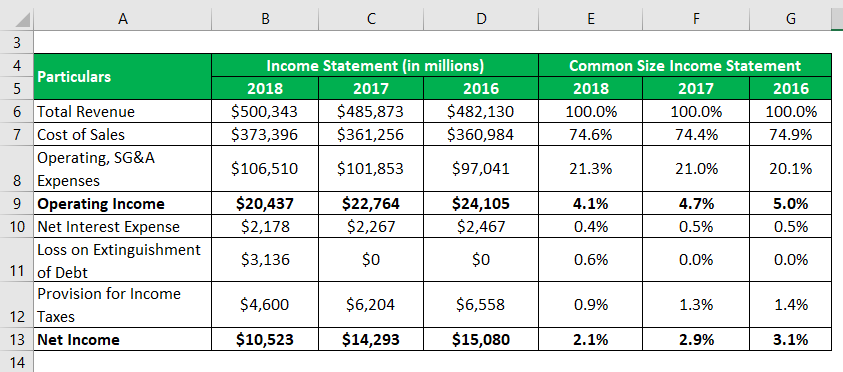

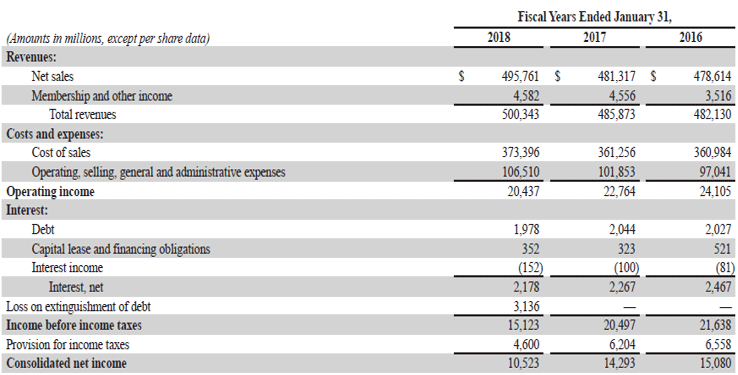

Let us take the example of Walmart Inc.’s annual report for the year 2018 to illustrate the computation of a common size income statement. Also, comment on the trend witnessed in some of the major cost components during the last three years.

Solution:

Common Size Income Statement is calculated as

similarly, calculate for the years 2017 and 2016.

In the above table, it can be seen that the operating income margin has been declining gradually over the last three financial years primarily due to an increase in operating and SG&A expenses. On the other hand, the decline in net income in 2017 is in line with that of operating income, while in 2018 the decline was primarily fueled by the one-time loss on extinguishment of debt. As an analyst, you can further investigate the reason behind the declining trend provided you have more information.

Source: Walmart Annual Reports (Investor Relations)

Example #2

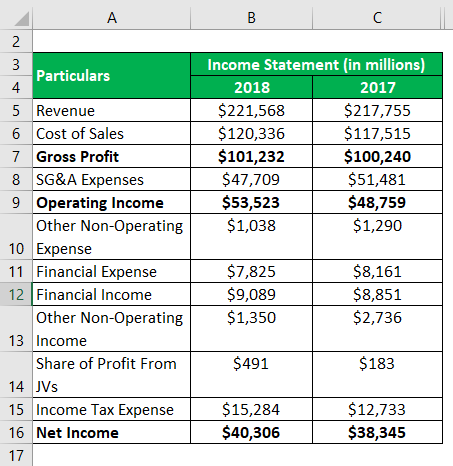

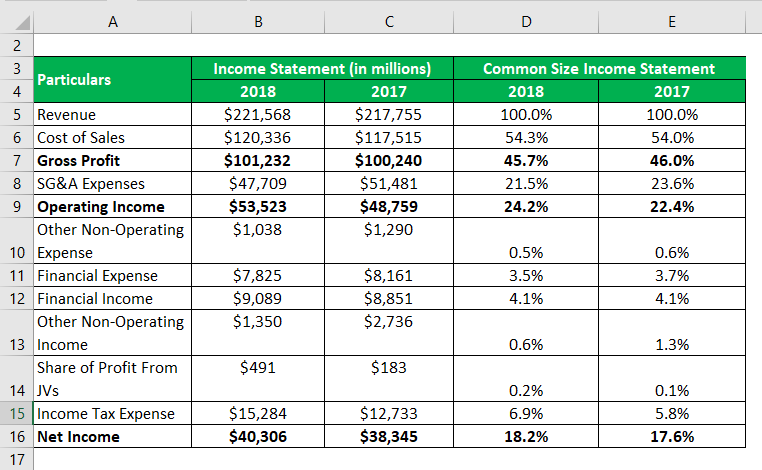

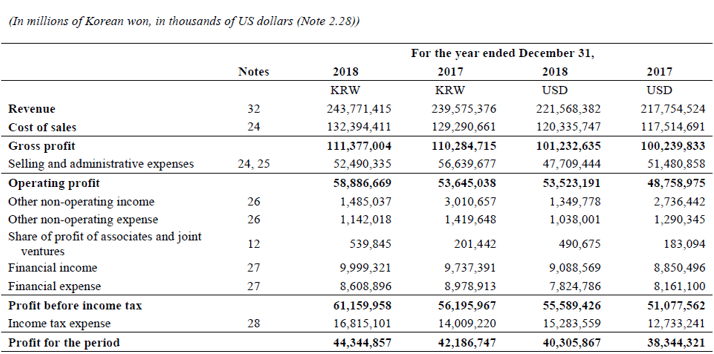

Let us take the example of Samsung’s annual report for the year 2018 to illustrate the computation of a common size income statement.

Solution:

Common Size Income Statement is calculated as

similarly, calculate for the years 2017.

Source Link: Samsung Inc. Balance Sheet

Advantages

Some of the major advantages are:

- It can facilitate comprehending the impact of all line items of the income statement on the company’s profitability as it expresses them in terms of the percentage of total sales.

- It helps in assessing the trend in each line item of the income statement w.r.t. across time periods. Any unusual variation can be easily identified through this technique.

- It can be used to compare the financial performances of different entities irrespective of the scale of operation as it is expressed in terms of percentage.

Disadvantages

Some of the major disadvantages are:

- Some of the experts find common size income statements to be useless as there is no approved standard benchmark for the proportion of each item.

- A comparative study based on a common size income statement will be misleading if there is a lack of consistency in its method of preparation.

Limitations

Some of the major limitations are:

- It does not facilitate the decision-making process due to the lack of any approved standard benchmark.

- One can’t write-off the risk of window dressing of financial statements as the actual figures are not required since the analysis is limited to percentage.

- At times it also fails to identify the qualitative elements during the evaluation of the performance of a company.

- It can be misleading for a business that is impacted by seasonal fluctuations.

Conclusion

So, it can be concluded that the method of drawing a common size income statement helps in making the task of performance comparison much easier. It helps the analyst to identify the cost items that primarily drive the variation in profit year over year. Further, it also facilitates peer comparison and trend analysis across time periods.

Recommended Articles

This is a guide to Common Size Income Statement. Here we discuss how to calculate along with practical examples. We also provide a downloadable excel template. You may also look at the following articles to learn more –