Updated July 20, 2023

Introduction of Components of Financial Statements

Components of financial statements are nothing but a balance sheet (which presents the financial position of the organization as of a specified date), income statement (which presents the performance of the organization over a specific period), cash flow statement (which presents the cash flows that arose to the organization at a specific date from operating, investing and financing activities during the period) and notes accompany the above three.

Explanation

- The components of financial statements are the reports which are prepared by the management of the organization or entity to present the financial performance and financial position at a specific date.

- These are audited by accounting firms (Chartered Public Accountants in the USA, Chartered Accountants in India, etc.) so as to give assurance over the reliability of the financial statements.

- The three components of financial statements are as follows:

- Balance Sheet

- Income Statement

- Cash flow Statement

- The components of financial statements are analyzed by various stakeholders (i.e. employees, inventors, finance providers, management, shareholders, etc.) of the organization. Each stakeholder has a different perspective of analysis.

- The components help to calculate the ratios (for example current ratio, inventory turnover ratio, quick ratio, interest expense to earnings ratio, etc.). Each of these has the potential to give important insights about the organization

Components of Financial Statement

The components are explained below:

1. Balance Sheet

- This presents the financial position of the entity. The financial position means the quantification of the assets, liabilities, and equity of the owners on a specific date.

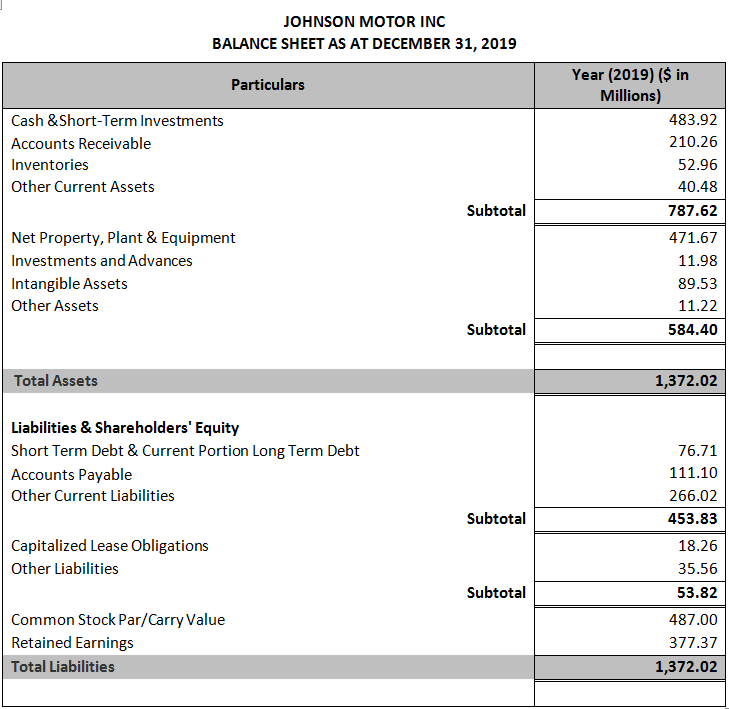

- As an example, we have the following balance sheet (excel file attached separately):

- The formula for the balance sheet is as Assets = Liabilities + Owners Equity

- “Assets less liabilities” is the book value or worth of the entity.

- On the asset side, the receivables should not be on the higher side as compared to total assets. Higher inventories reflect lower sales of the organization.

- Using the balance sheet, the most useful ratios are debt to assets ratio, debt to equity ratio, receivables turnover ratio, quick ratio, current ratio, etc.

- However, the liabilities do not include contingent liabilities (i.e. those liabilities which may arise in the future when a specific event occurs).

- The balance sheet shows how the total assets are funded (i.e. own money or earned money or borrowed money or all of these).

- If you observe, the assets are listed in the order of liquidity. Cash & cash equivalents are the most liquid assets. Account receivables show the amount of money to be receivable from customers. Inventories specify the raw material, work-in-process, and finished stock held by the entity.

- On the other side, liabilities are listed in the order in which they would be paid by the organization. Short-term debt & a current portion of long-term debt are to be paid within one year from the closing of books. Accounts payables are the obligations of the organization to pay. Other liabilities may include provisions, taxes payable, etc.

- Shareholders’ equity (also called common stock and retained earnings) is the amount of money belonging to the owners of the entity.

2. Income Statement

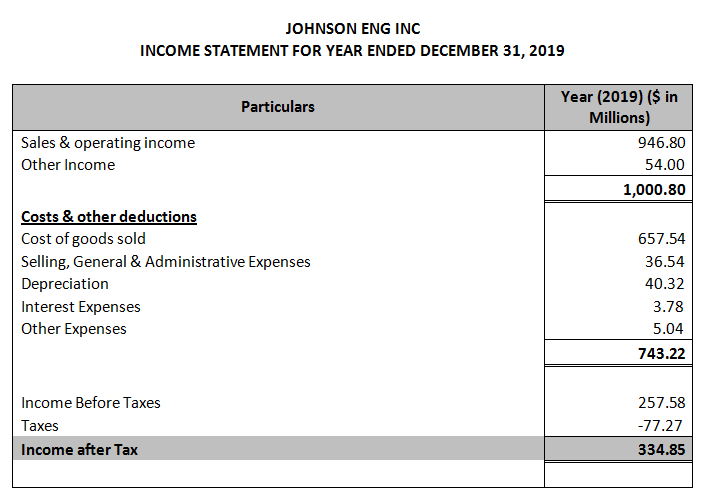

- The income statement (also known as the profit & loss statement) presents the financial performance of the organization over a period of time. On a gross basis, the statement depicts a picture of direct expense, indirect expense, and capital (through depreciation) expense over the period.

- The statement starts with revenue from the core operating activities of the organization. Other income includes revenue from non-operating (i.e. non-primary sources of revenue) activities such as interest income, dividend income, rental income, discounts, rebates, etc.

- The cost of goods sold reflects the cost incurred to earn revenue. The difference between revenue and cost of goods sold is the gross profit of the organization. This is a basic profit an organization should survive in the long term.

- Selling, general and administrative expenses show the selling costs incurred by the entity which may include salaries of sales personnel, warehousing expenses, storage expenses, etc.

- Depreciation expense is the apportioned capital expense for the period. An entity applies a rate of depreciation over the cost of property, plant, and equipment, to arrive at the charge for the year. This charge reflects the usage of fixed assets by the entity. Amortisation reflects the usage of intangible assets of the entity.

- Interest paid includes the cost of borrowing and other bank charges. Other expenses include miscellaneous expenses such as printing & stationery, legal and professional expense, store expenses, electricity, transportation, etc.

- All the expenses are deducted from the revenue to arrive at the bottom line i.e. net income before taxes. Taxes are corporate taxes levied by the federal government. Income after taxes belongs to the owners of the entity.

- Income statements show the operating efficiency of the organization year on year. The important ratios used for analyzing the efficiency of the entity are gross margin nation, net margin ration, operating margin ratio, interest coverage ratio, etc.

- As an example, we can see the following:

3. Cash Flow Statement

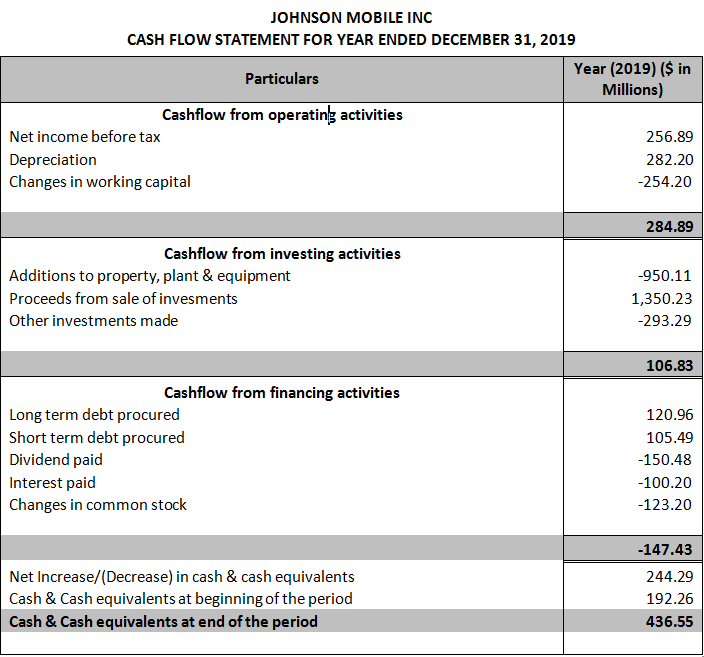

Let`s have a look at the following cash flow statement:

- Cash flow shows the sources from where the organization generates its cash & where it expands. The net cash movement from all activities is then added to the beginning cash & cash equivalents to arrive at the closing cash & cash equivalents. It shows the financing backing of the organization.

- The statement is broadly divided into three sources to earn cash i.e. operating activities, investing activities, and financing activities.

- Operating activities show the cash earned by the organization through the core activities. The Income statement is prepared as per the accrual basis of accounting. So as to arrive at cash profit we make certain adjustments to the net income as per the income statement. Like depreciation, there is no cash outflow incurred for depreciation and hence, it is to be added back. Changes in working capital reflect the net of payments to trade payables, receipts from trade receivables, movement in inventory, and current assets and liabilities. Cash flow operating activities should be more than that from other activities.

- The investing activities show how the organization procures the property, plant, and equipment. This area shows the cash flow from the purchase and sale of assets of the entity. Also, any income earned from deposits with banks, and rental income is reflected in this area.

- The financing activities present the movement in the capital structure of the entity. This area has the effect of long-term and short-term borrowings’ repayments and procurements, payment of dividends and interest on obligations, and movement in the equity holding of the entity.

- The ending cash and cash equivalents should match with the cash & cash equivalents reflected in the balance sheet of the entity for the said period.

Financial statements give clarity about the fundamentals of the organization. The balance sheet specifies how the assets are funded. The income statement depicts the earning growth and performance when compared with previous years. The cash flow statement shows where the money is coming from & where is it spent.

Recommended Articles

This is a guide to Components of Financial Statements. Here we also discuss the components of financial statements which include, the balance sheet, income statement, and cash flow statement. You may also have a look at the following articles to learn more –