What is Compound Protocol?

The Compound Protocol is a decentralized finance (DeFi) platform on the Ethereum blockchain where participants can give and take cryptocurrencies as loans without any middle management.

On the compound protocol platform, users (lenders) can supply assets or invest money (cryptocurrency) to earn interest. On the other hand, users (borrowers) can also borrow loans against collateral and pay interest on the amount borrowed. Compound protocol has a governance token called COMP. When users lend or borrow money, they get these COMP tokens. Furthermore, these token-holders participate in the protocol’s governance, including adjustments to interest rates and adding support for new assets.

In this article, let us explore the integration of Bitcoin and Compound DeFi Protocol, a leading application of decentralized finance, and how it simplifies access to DeFi for Bitcoin holders. However, if you are considering investing, check out Quantum AI, an educational company, to learn more about it.

Now, let us understand about decentralized finance and Bitcoin in the following sections.

Table of Contents

- What is Compound Protocol?

- Overview of Decentralized Finance

- Overview of Bitcoin

- Bridging the Gap between Bitcoin and Compound Protocol

- Yield Farming with Bitcoin and Compound Protocol

- Future Developments and Challenges

Overview of Decentralized Finance

Decentralized Finance, or DeFi, facilitates online financial services such as lending, borrowing, and trading without needing any traditional intermediaries like banks, government, or financial institutions.

DeFi uses blockchain and smart contracts technology. Here, users can interact with DeFi platforms directly from their digital wallets for transactions, and thus, it makes financial transactions more robust, transparent, and secure. This DeFi system provides users with greater accessibility, transparency, and control over their finances. For these reasons, it is emerging as a transformative force in the cryptocurrency space.

Overview of Bitcoin

Bitcoin is a type of cryptocurrency that follows a decentralized nature and blockchain technology. In general terms, Bitcoin is a virtual (digital) currency commonly used for peer-to-peer payment systems (transactions) without the involvement of any third parties. In these peer-to-peer transactions, all participants have equal power to share data, which has become a unique asset in the crypto world.

How Wrapped Bitcoin Bridges the Gap between Bitcoin and Compound Protocol?

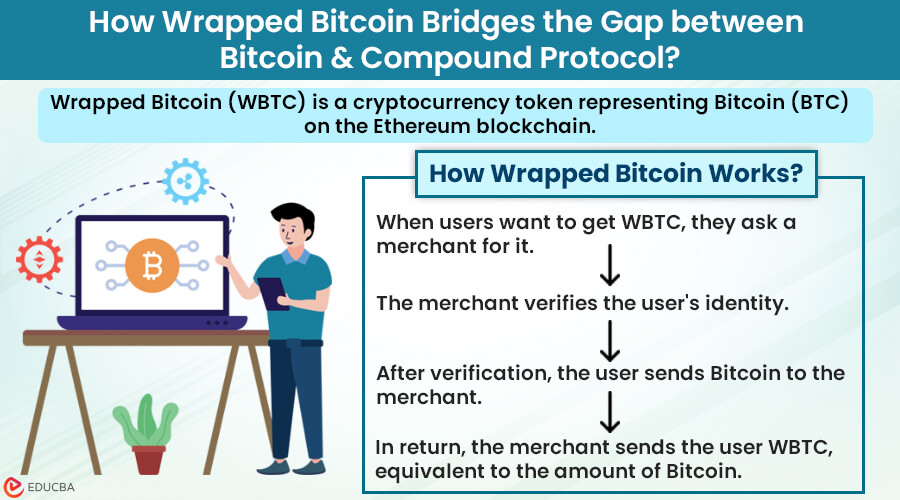

Bitcoin generally does not support smart contracts, and also the primary method of using Bitcoin in a financial transaction is through centralized entities, such as centralized exchanges (CEXs). Therefore, wrapped crypto, such as Wrapped Bitcoin (WBTC), bridges the gap between Bitcoin and Compound (decentralized finance).

Wrapped Bitcoin (WBTC) is a cryptocurrency token representing Bitcoin (BTC) on the Ethereum blockchain. It also works best with the DeFi platforms like Compound. WBTC offers greater liquidity to the Ethereum ecosystem, and users can use Bitcoin easily in decentralized exchanges (DEXs) and other financial applications.

How Wrapped Bitcoin Works?

- When users want to get WBTC, they ask a merchant for it.

- The merchant verifies the user’s identity.

- Once the merchant verifies, the user sends Bitcoin to the merchant.

- In return, the merchant sends the user WBTC, equivalent to the amount of Bitcoin.

Yield Farming with Bitcoin and Compound Protocol

One of the primary decentralized finance activities is yield farming. It is a process where Bitcoin holders or users earn rewards by providing liquidity to DeFi protocols.

Here is how it works:

- Users deposit their cryptocurrency assets into liquidity pools (User-provided reserves for decentralized finance trading).

- This pool helps with trading on decentralized exchanges or lending platforms in the DeFi ecosystem.

- In return for providing liquidity, users receive rewards in the form of additional tokens.

Thus, yield farming allows users to earn passive income through rewards. However, it’s essential for participants to carefully evaluate the potential risks and rewards of yield farming before engaging in these activities.

Future Developments and Challenges

The future of Bitcoin in decentralized finance looks promising. New projects that use innovative ideas to integrate Bitcoin into DeFi are emerging. One such network project is Layer 2 Solutions, which has successfully reduced transaction costs and delay issues. In addition, cross-chain solutions may also enable Bitcoin to interact with DeFi protocols on other blockchains.

However, there are significant regulatory concerns in the DeFi space. Increased attention (scrutiny) or involvement from authorities could affect the decentralized nature of these platforms. This may introduce rules for users and developers to follow. Hence, it is important to address these regulatory challenges for the continued growth of DeFi and Bitcoin integration.

Final Thoughts

In conclusion, integrating Bitcoin with DeFi through Compound Protocol will open new opportunities for Bitcoin holders to participate in the decentralized finance ecosystem. In addition, Wrapped Bitcoin (WBTC) serves as a bridge between Bitcoin and Ethereum-based DeFi protocols, allowing users to earn yield by engaging in various DeFi activities.

Also, as the decentralized finance space evolves, users must stay informed about the latest developments, risks, and best practices. While the potential for high returns is attractive, it is equally important to consider risks and conduct thorough research before participating in activities involving DeFi with Bitcoin.

Recommended Articles

We hope this article on “Compound Protocol” was informative. To learn more, refer to the article below.