Updated July 17, 2023

Definition of Contango

Contango is a circumstance where the futures price of a particular commodity is higher than its current price. It happens when there is the hope of a boost in the price of the commodity and it is represented by the upward slowing forward curve.

It is a common market procedure where long-term securities are marketed higher in comparison with the short-term securities.

Why is It Called Contango?

The term contango is called so because of the corruption during the 19th century in England. The corruption is to continue, continuation, or, contingent. The contango was used to be a fee paid by buyers when they wished to delay the settlement of trade they had agreed for. The interest rate was decided by the seller.

The main reason behind the concept of contango used to be speculation. It would become an extra cost for the buyer on holding up the commodities as well as there was a fear of depreciation also, so they preferred not to pay on the settlement day. Instead, they paid contango fees on the settlement day so they could wait for a little longer without having to hold up commodities, and it continued until the price of the commodity increased. But later on, this practice started waning as there were many options reintroduced during the year 1958. The futures trading options include a distinguished lot size as well as fixed settlement dates.

Example

The situation of Contango can be cited as:

FT>ST

Where,

- FT stands for the futures price

- ST stands for the spot price

This means the futures price of the commodity in the contango is higher than the spot price. This can be explained wider with an example

Assume Mr. X as a portfolio manager and he gets into a futures agreement of oil at the time when the price of oil in the futures is mentioned at 60$ during the month of February 2017. And the spot price was mentioned at 58$. Accordingly, there is a bonus of 2$ in futures trade as the market was in contango i.e., the futures price was higher than the existing price. When it is almost the end of the month, Mr. X decided to roll over his contract to May 2018. At that time the price of the oil was trading at 60$ and its futures price was trading at 61.50$ so there is a bonus of 1.50$ which is lower than the past bonus due to which Mr. X the portfolio manager will undergo a loss on the roll return can be explained with a numerical stated below:

- Roll Return = (60$ – 61.50$)/60$

- Roll Return = (-2.5℅)

So, when the market is in contango there is a negative roll return.

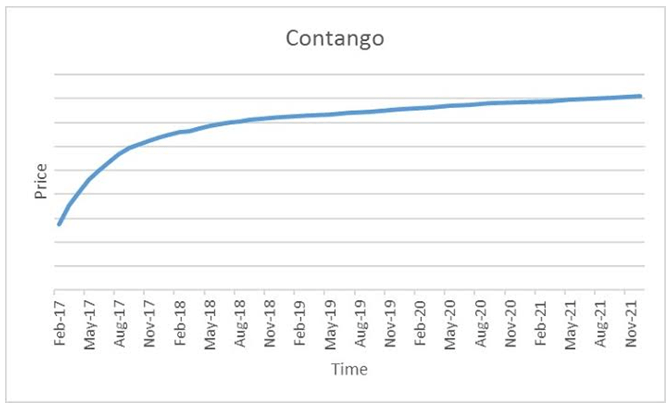

Let us have a look as to how a contango situation would look like graphically.

As you can see from the graph above, the situation of contango is more when the period to the expiry of a futures contract is more. This is due to the effect of speculation by traders.

Why Does It Occur?

Contango occurs due to the people’s intention of paying a premium instead of holding up a commodity which can also cost them carry over prices. Further, there is a chance of depreciation of the commodity so they prefer contango fees to postpone the settlement day. On the other hand, it is favorable for the producer or the commodity holders as they are getting a high rate of interest in their products which is more than expected so they have no problem in getting a postponement of payment as long as they are being paid by contango fees.

This is a speculative process as there is a chance of rising in the price of a commodity. People invest in and pay contango fees only because they can see their profit in future trading. The opposite of contango is backwardation.

Contango in the Stock Market

Contango proves to be very helpful in the stock market as the futures prices can be predicted with the help of it. This helps the hedgers in deciding the best price for their commodities. It not only assists the investor in trading without holding up the goods by postponing the settlement date but also useful for the hedgers in the stock market as they are getting a higher rate of return than expected. The contango is been used in the stock market for years.

- In the London stock exchange during the 19-century people used to pay contango fees to sellers as late fees or postponement fees to postpone the settlement date. The rate of interest was decided by the seller.

- After the year 1958, the contango was common in some exchanges like the Bombay Stock Exchange (BSE). The trading of futures was based on the interpreted size as well as the fixed settlement dates.

Conclusion

Contango is seemed to be very helpful for investors in making bets for the future more accurately. It also helps the market in determining whether the price of their underlying commodities will grow or shows a downfall in the future which makes them confident in determining the price of the commodity. The opposite of it is backwardation which assists the old investor willing to grow future price to the level of the spot price. It also directs the negative rolling return because the future prices are higher than the spot price.

Recommended Articles

This is a guide to Contango. Here we also discuss the definition and contango in the stock market along with an example. You may also have a look at the following articles to learn more –