Updated July 25, 2023

Definition of Contribution Margin Income Statement

Contribution margin income statement refers to the income statement which is used for the purpose of calculation of the contribution margin of the company where the contribution margin is derived by the way of subtracting the variable expenses incurred by the company for the period from the total sales of the company and when the fixed expenses are further subtracted from the contribution margin then the resultant figure is the operating income of the company.

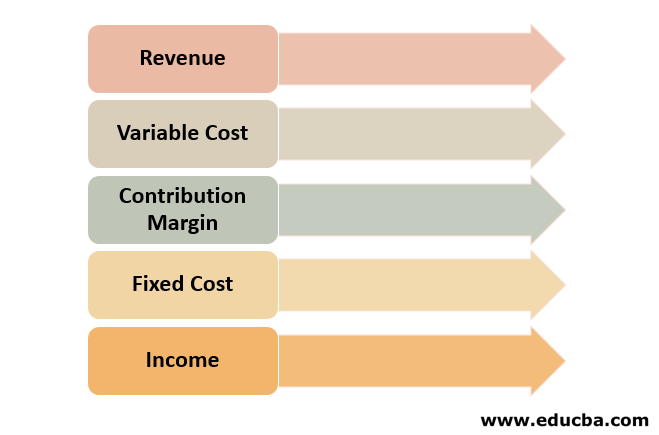

Components of Contribution Margin Income Statement

Following are the different components that are generally present in the Contribution margin income statement:

- Revenue: Revenue is the total sales made by the company during the period by way of selling the goods or by providing the services to the customers of the company. Revenue is calculated by multiplying the number of units sold by the per-unit rate of the goods sold.

- Variable Cost: Variable cost refers to all those costs incurred by the company which changes with the change in the level of output of the company i.e., it increases with the increase in the level of output and decreases with the decrease in the level of output.

- Contribution Margin: The contribution margin is derived by subtracting the total variable cost of the company during the period from the total sales made during the period.

- Fixed Cost: Fixed cost refers to all those costs incurred by the company which do not change with the change in the level of output of the company i.e., they remain constant irrespective of the level of output of the company.

- Income: Income is derived by subtracting the total value of the fixed cost of the company during the period from the Contribution Margin.

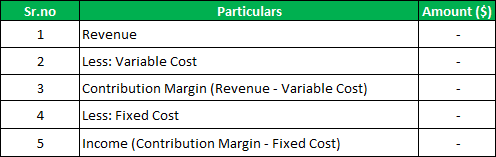

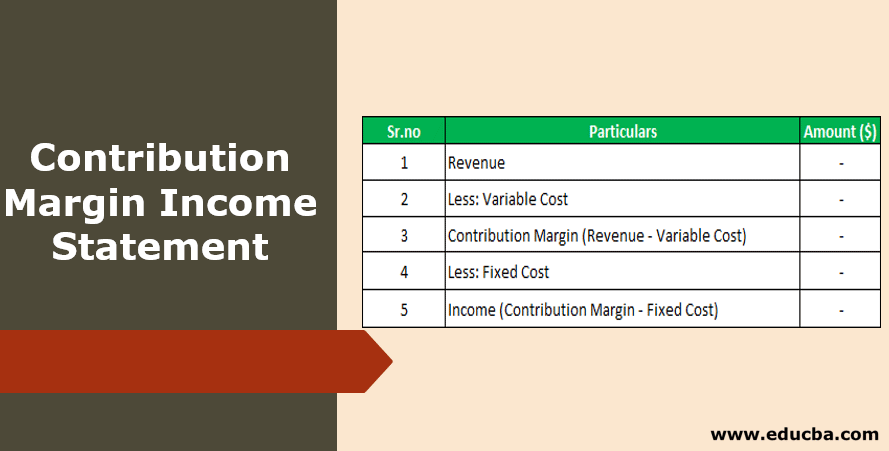

Format of Contribution Margin Income Statement

Below is the general format of the contribution margin income statement

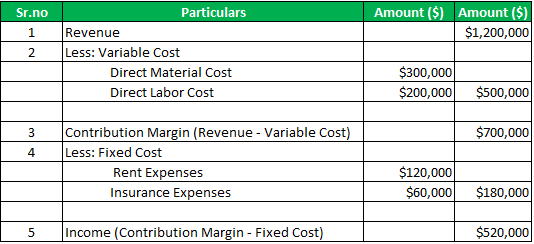

Example of Contribution Margin Income Statement

For example, there is a company A Ltd which is manufacturing and selling the different products in the market. For the financial year 2019, the total sales of the company were $ 1,200,000, direct material costs were $ 300,000 and direct labor costs were $200,000. During the same period, the fixed expenses paid by the company include rent expenses worth $120,000 and insurance expenses worth $60,000. Calculate the Contribution Margin and the Income of the company during the period using the contribution margin income statement.

Solution:

Calculation of the Contribution Margin and the Income of the company

Contribution margin income statement:

Thus the Contribution Margin for the period is $700,000 and the Income of the company for the period is $520,000

Advantages

The various different advantages related to the contribution margin income statement are as follows:

- It is simple and easy to use the statement as it involves simple calculations where in order to derive contribution, variable cost is deducted from the sales, and in order to derive the profits, fixed cost is further subtracted from the derived contribution margin.

- It helps in a better analysis of the performance of the company, as it bifurcates the expenses in the variable and the fixed expenses and also calculates the contribution margin of the company that helps in a break-even analysis of the company.

- It places the different data of the company in the set format and in an organized way. Due to this management of the company can understand the effect of changes in production as well as the sales volumes on the profit of the company.

Disadvantages/ Limitations

The various disadvantages related to the contribution margin income statement are as follows:

- It can be accessed only by the internal persons of the company and cannot be shared with the outside stakeholders of the company because such a format is not recognized by any of the concerned authorities and the same is used only for internal purposes.

- The focus of the contribution margin income statement is only on the expenses of the company.

Important Points

The various different important points related to this are as follows:

- In the case of the traditional income statement, the product costs of the company separated from the period cost but in the case of the contribution margin income statement variable cost is separated from the fixed cost and both are separately presented. Thus it is the cost behavior statement where the arrangement of the expenses corresponds to the nature of expenses involved.

- It helps in a better analysis of the performance of the company, as it bifurcates the expenses in the variable and the fixed expenses and also calculates the contribution margin of the company that helps in a break-even analysis of the company.

Conclusion

Thus it is one of the important tools for the management and the internal audience of the company in the planning and the decision-making process. In the case of this income statement, variable cost is separated from the fixed cost and both are separately presented which helps in the better analysis of the performance of the company and understanding the effect of changes in production as well as the sales volumes on the profit of the company.

However, it cannot be shared by the company with the outside stakeholders of the company because such format is not recognized by any of the concerned authorities and the same is used only for internal purposes.

Recommended Articles

This has been a Guide to Contribution Margin Income Statement. Here we discuss components, the format of contribution margin income statement along with an example, advantages, and disadvantages. You can learn more from the following articles –