Updated July 13, 2023

Difference Between Corporate Finance vs Project Finance

In the world of finance, Corporate Finance and Project Finance are two important financing concepts that help fulfill a business entity’s funding requirement. Both the financing models rely on a mix of debt and equity as the source of funds. However, there are few subtle differences between the two models – (i) purpose of financing and (ii) security offered against financing. This article will explain the differences between Corporate Finance vs Project Finance in more detail to help you understand these concepts better.

What is Corporate Finance?

In the case of corporate finance, the management consolidates the cash flows of all projects and business segments under one single head. In this way, the corporate finance model is able to meet its basic objective of ensuring optimal utilization of available capital and maximizing shareholders’ value. In this type of model, the rewards and the associated risks of all projects and segments are distributed across the entire firm. Consequently, the success or failure of these projects affects the company’s overall performance and its balance sheet is directly influenced as the overall company assets are held as security. Thus, in case of payment default, the lenders have a legal claim on all the assets of the company. On the other hand, a benefit of this model is that the projects under stress can draw support from the positive cash flows of other successful projects within the company. As such, companies planning large expansion can use this model as it permits the flow of equity from the cash flows of existing successful projects.

What is Project Finance?

Projects are usually high-risk, capital intensive, and time-consuming in nature. Hence, the project finance model requires special skills and techniques, given the nature of project work. In this type of model, capital is infused into projects based on its forecasted cash flow, which along with the project assets, are held as security for the borrowed capital. In the project finance model, the risks and rewards associated with each project are ring-fenced, which means that in the event of a default, the lender’s claim will be limited only to the assets of the specific project and additional security (if any). In such a case, the lender has no claim on the assets of the parent company. Thus, the risks and rewards of one project don’t spill over to other projects except to the extent of the investment in the project. So, the project finance model ensures that a company’s balance sheet is not impacted at all or the impact is minimal.

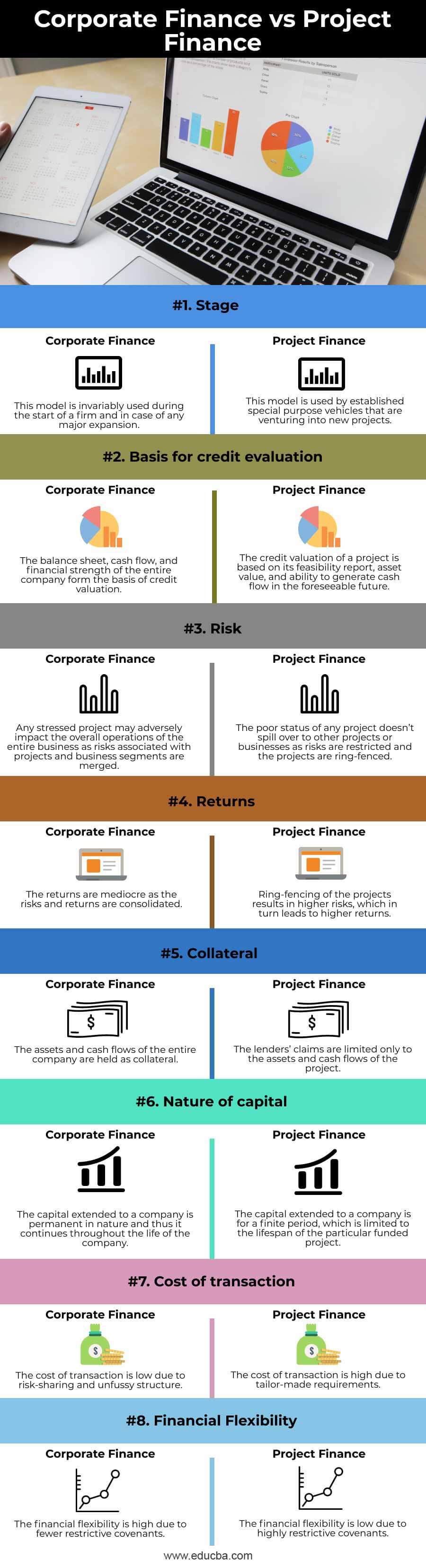

Head To Head Comparison Between Corporate Finance vs Project Finance (Infographics)

Below is the top Comparison between Corporate Finance vs Project Finance:

Key Differences Between Corporate Finance vs Project Finance

Some of the key differences between corporate finance vs project finance are as follows:

- In corporate finance, the lenders have the authority to lay claim upon all the parent company’s assets. Basically, if a company announces its bankruptcy, then the lenders can seize the borrower company’s assets and auction to recover their debts. On the other hand, the project in project finance is ring-fenced from the sponsoring company. Basically, a special purpose vehicle is created for the project-related transactions, and the lenders’ claims are only limited to the cash flows of the special purpose vehicle.

- In corporate finance, the amount of debt and cost of borrowing is determined based on the entire company’s assets, enterprise value, and risks. On the other hand, in project finance, the debt capacity of a company is determined based upon the specific project’s ability to generate adequate cash flow to cover the debt obligations comfortably.

Corporate Finance vs Project Finance Comparison Table

Below is the 8 topmost comparison between Corporate Finance vs Project Finance:

| Head | Corporate Finance | Project Finance |

| Stage | This model is invariably used during the start of a firm and in case of any major expansion. | This model is used by established special purpose vehicles that are venturing into new projects. |

| Basis for credit evaluation | The balance sheet, cash flow, and financial strength of the entire company form the basis of credit valuation. | The credit valuation of a project is based on its feasibility report, asset value, and ability to generate cash flow in the foreseeable future. |

| Risk | Any stressed project may adversely impact the overall operations of the entire business as risks associated with projects and business segments are merged. | The poor status of any project doesn’t spill over to other projects or businesses as risks are restricted, and the projects are ring-fenced. |

| Returns | The returns are mediocre as the risks, and returns are consolidated. | Ring-fencing of the projects results in higher risks, which in turn leads to higher returns. |

| Collateral | The assets and cash flows of the entire company are held as collateral. | The lenders’ claims are limited only to the assets and cash flows of the project. |

| Nature of Capital | The capital extended to a company is permanent in nature, and thus it continues throughout the life of the company. | The capital extended to a company is for a finite period, which is limited to the lifespan of the particular funded project. |

| Cost of transaction | The cost of transaction is low due to risk-sharing and unfussy structure. | The cost of transaction is high due to tailor-made requirements. |

| Financial flexibility | The financial flexibility is high due to fewer restrictive covenants. | The financial flexibility is low due to highly restrictive covenants. |

Conclusion

So, based on the abovementioned information, it may be concluded that the Corporate Finance model is more suitable for smaller businesses, entities with organic expansion plans, businesses having projects with similar risk profiles, or businesses seeking operational and financial flexibility. On the other hand, the Project Finance model is better suited for high-risk projects, entities with inorganic expansion plans, businesses having projects with different risk profiles.

Recommended Articles

This has been a guide to the top difference between Corporate Finance vs Project Finance. Here we also discuss the Corporate Finance vs Project Finance key differences with infographics and a comparison table. You may also have a look at the following articles to learn more.