Updated August 1, 2023

Cost of Capital Formula (Table of Contents)

- Cost of Capital Formula

- Examples of Cost of Capital Formula (With Excel Template)

- Cost of Capital Formula Calculator

Cost of Capital Formula

The cost of capital represents the funds required to construct projects such as building a factory or mall. The cost of capital combines the cost of debt and equity.

To complete the project, funds are required, which can be arranged either by taking debt loans or by own equity that is paying money self. Many companies use debt and equity together for the weighted average of all capital, known as (WACC) Weight average cost of capital. It is also an opportunity cost of investment that means if the same amount has been invested in other investments, the rate of return one could have earned is the cost of capital.

The simple formula for the cost of capital is the sum of the cost of debt and equity. The formula for Cost of Capital can be written as:-

Examples of Cost of Capital Formula (With Excel Template)

Let us take an example to understand the Cost of Capital formula in a better manner.

Cost of Capital Formula – Example #1

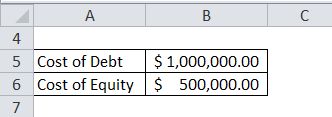

Suppose a company started a project of shopping mall construction for that it took a loan of $1,000,000 from the bank, the cost of equity is $500,000. Now, one has to calculate the cost of capital for the project.

Formula to calculate the Cost of Capital is:

Cost of Capital = Cost of Debt + Cost of Equity

- Cost of Capital = $1,000,000 + $500,000

- Cost of Capital = $1,500,000

So, the cost of capital for the project is $1,500,000.

In brief, the cost of capital formula is the sum of the cost of debt, the cost of preferred stock, and the cost of common stocks.

Where,

- Cost of Debt: The cost of debt is the effective interest rate the company pays on its current liabilities to the creditor and debt holders.

- Cost of Preferred Stocks: The cost of preferred stock is the rate of return required by the investor.

- Cost of Equity: Cost of equity is the rate of return an investor requires for investing equity into a business. There are multiple types of cost of equity and model to calculate the same, they are as follows:-

Capital Asset Pricing Model

It takes risk into consideration, and formula for the same:-

Ri = Rf + β * (Rm – Rf )

Where,

- Ri – Expected return on asset.

- Rf – Risk free rate of return.

- Rm – Expected market return.

- β – Measure of risk.

If

- β < 1, Asset is less volatile.

- β = 1, Asset volatility is the same rate as market.

- Β > 1, Asset is more volatile.

Dividend Capitalization Model

It is applicable that pay dividends also assume that dividends will grow at a constant rate.

Re = D1 / P0+ g

Where,

- D1 – Dividends/Share next year

- P0 – Current share price

- g – Dividend growth rate

- Re – Cost of Equity

As we know,

Cost of Capital = Cost of Debt + Cost of Preferred Stock + Cost of Common Stocks

Cost of Capital = Interest Expense (1- Tax Rate) + D0 / P0+ Rf + β * (Rm – Rf )

Or

Cost of Capital = Interest Expense (1- Tax Rate) + D0 / P0 + D1 / P0 + g

Weight average cost of capital = wd rd + wp rp + we re

Where,

- wd – Proportion of debt in the capital structure.

- wp – Proportion of preferred stock in the capital structure.

- we – Proportion of common stock in the capital structure.

- rd – Cost of debt.

- rp – Cost of preferred stock.

- re – Cost of equity.

Now, let us see an example based on this formula.

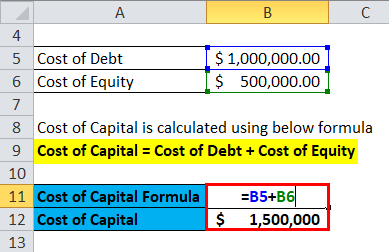

Cost of Capital Formula – Example #2

Suppose a company wants to raise capital of $100,000 to expand its business for that company issue 8,000 stocks with a value of $10 each where the rate of return on equity is 5%, which have generated fund of $80,000 and it borrowed loan from bank of $20,000 at a rate of interest of 10%. The tax rate applicable is 30%.

Weight average cost of capital is calculated as:

- WACC = (80,000 / 100,000) * 10 + (20,000 / 100,000) * 5% * (1 – 30%)

- WACC = 8.01%

So, weighted average cost of capital is 8%.

Weight Average Cost of Capital

Weight average cost of capital is a calculation of a company’s cost of capital in which each category of capital is proportionately weighted. In short, it computes the cost of each source of capital. In WACC, all capital types are included, like common stocks, preferred stock, etc.

The formula for Weight Average Cost of Capital can be written as:-

WACC = E/ V * Re + D/ V * Rd * (1 – T)

- Re – Cost of Equity

- Rd – Cost of Debt

- E – Market value of Equity

- D – Market value of Debt

- E/ V – Percentage of financing equity

- D/ V – Percentage of financing debt

- T – Tax rate

Let’s see an example to calculate WACC.

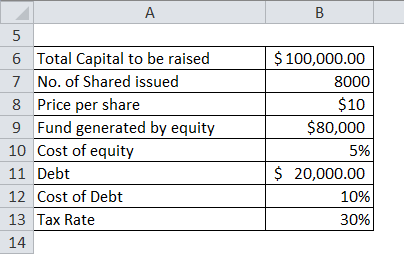

Cost of Capital Formula – Example #3

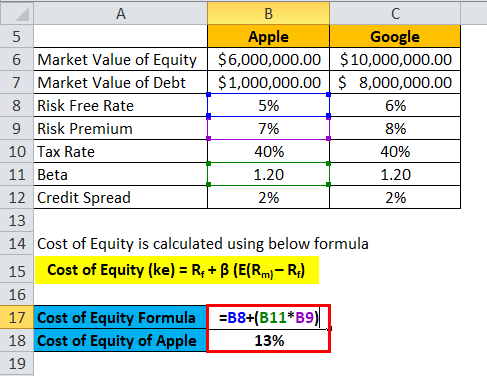

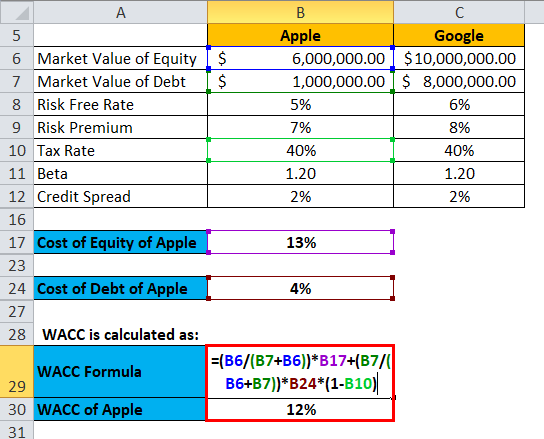

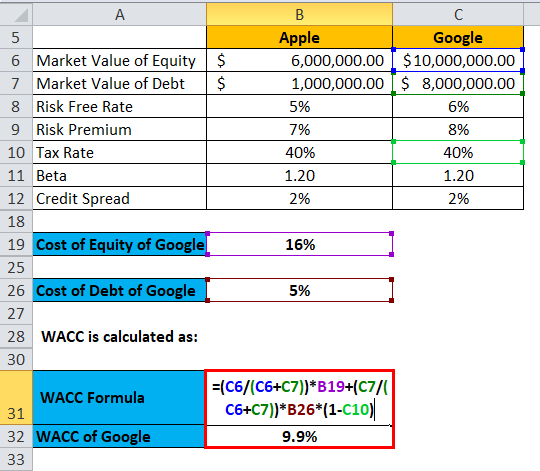

An investor wants to calculate the the WACC of two companies, Apple and Google. Below is the various required element for both companies. Let the beta of stocks be 1.2, and the credit spread 2%.

Formula to calculate the Cost of Equity is:

Cost of Equity (ke) = Rf + β (E(Rm) – Rf)

Cost of Equity of Apple

- Cost of Equity of Apple = 5% + 7% * 1.2

- Cost of Equity of Apple = 13%

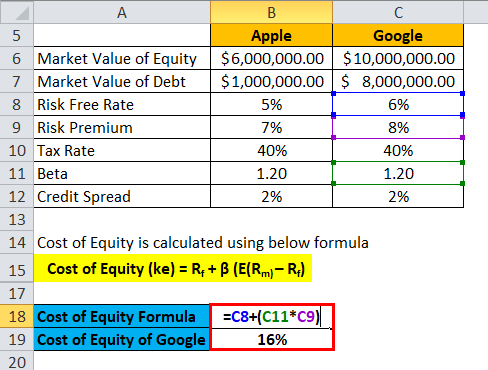

Cost of Equity of Google

- Cost of Equity of Google = 6% + 8% * 1.2

- Cost of Equity of Google = 16%

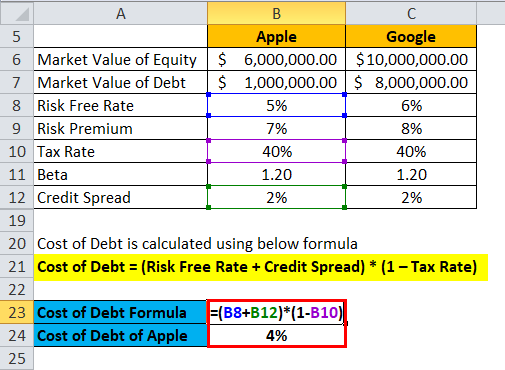

Formula to calculate the Cost of Debt is:

Cost of Debt = (Risk Free Rate + Credit Spread) * (1 – Tax Rate)

Cost of Debt of Apple

- Cost of Debt of Apple = (5% + 2%) * (1 – 40%)

- Cost of Debt of Apple = 4%

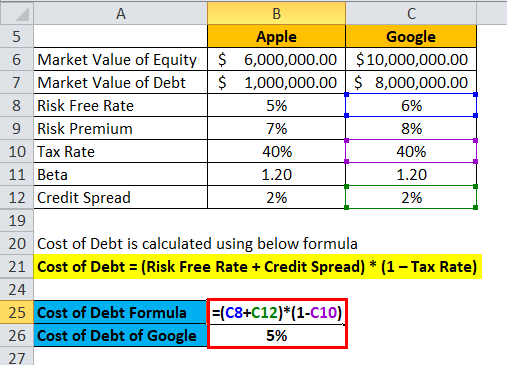

Cost of Debt of Google

- Cost of Debt of Google = (6% + 2%) * (1 – 40%)

- Cost of Debt of Google = 5%

WACC for Apple

- WACC for Apple = 6/7 * 13% + 1/7 * 4% *(1 – 40%)

- WACC for Apple = 12%

WACC for Google

WACC for Google = 10/18 * 16% + 8/18 * 5% *(1 – 40%)

WACC for Google = 9%

So, Google has a lesser WACC than Apple; depending on the rate of return, investors can decide on investment in a particular company.

Uses of Cost of Capital Formula

There are multiple uses of the cost of capital formula. They are as follows:-

- Cost of the capital formula is used for the financial management of a company.

- An investor uses it to choose the best investment option.

- Cost of Capital formula also helps to calculate the cost of the project.

- WACC is used to find the DCF valuation of the company.

Cost of Capital Formula Calculator

You can use the following Cost of Capital Calculator.

| Cost of Debt | |

| Cost of Equity | |

| Cost of Capital Formula = | |

| Cost of Capital Formula = | Cost of Debt + Cost of Equity | |

| 0 + 0 = | 0 |

Conclusion

Cost of capital is affected by a financial decision, market condition, and economic condition, but it helps in the financial management of a company. It also helps to calculate dividends to be paid. The cost of capital is a very important tool in the valuation of a business one can track its growth through the cost of capital formula.

Recommended Articles

This has been a guide to a Cost of Capital formula. Here we discuss How to Calculate the Cost of Capital and give practical examples. We also provide a Cost of Capital Calculator with a downloadable Excel template. You may also look at the following articles to learn more –